A sideways look at economics

Last Thursday, a group of Fathom staff got together after work to conduct an auction of Premier League footballers. While business here is going well, none of us are owners of top-tier English football clubs (yet). Rather, the money was play and the auction was for this year’s work fantasy league – an increasingly popular pastime where real-life players earn pretend managers points based on how well they play in actual games. A couple of sceptical colleagues saw the event as an excuse to bunk off work early and discuss the upcoming season. However, the evening was not without its economic insight.

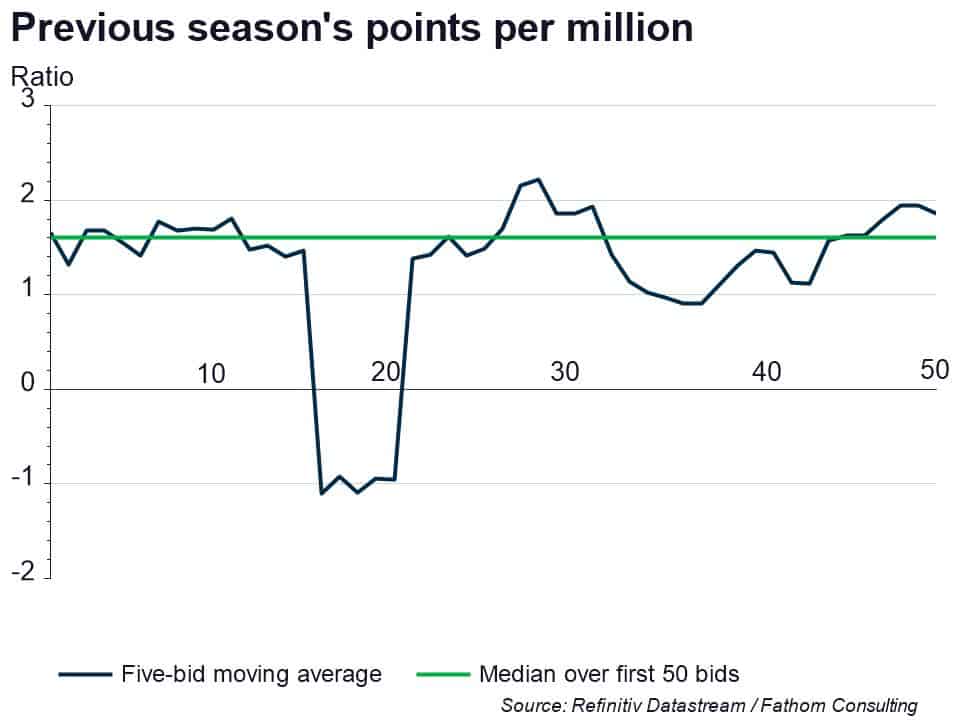

Auctions have been heavily studied by economists, including us, but the conditions Fathom’s managers were subject to are unlikely to be found at Christie’s or Sotheby’s. Each bidders’ budget was both known and identical to all others (200 million), as was their needs (a squad of fifteen players). The initial stages of bidding acted as a form of price discovery. Liverpool FC’s Brazilian goalkeeper, Alisson, sold for 32 million. With past performance seen as a good guide to future returns, the table quickly calculated that this valued his 58 points last season at around 2 points per million. This previous season’s points-to-price ratio acted as a benchmark for some time. Over the first few rounds, valuations largely fit tightly around this figure, as the chart below shows [1].

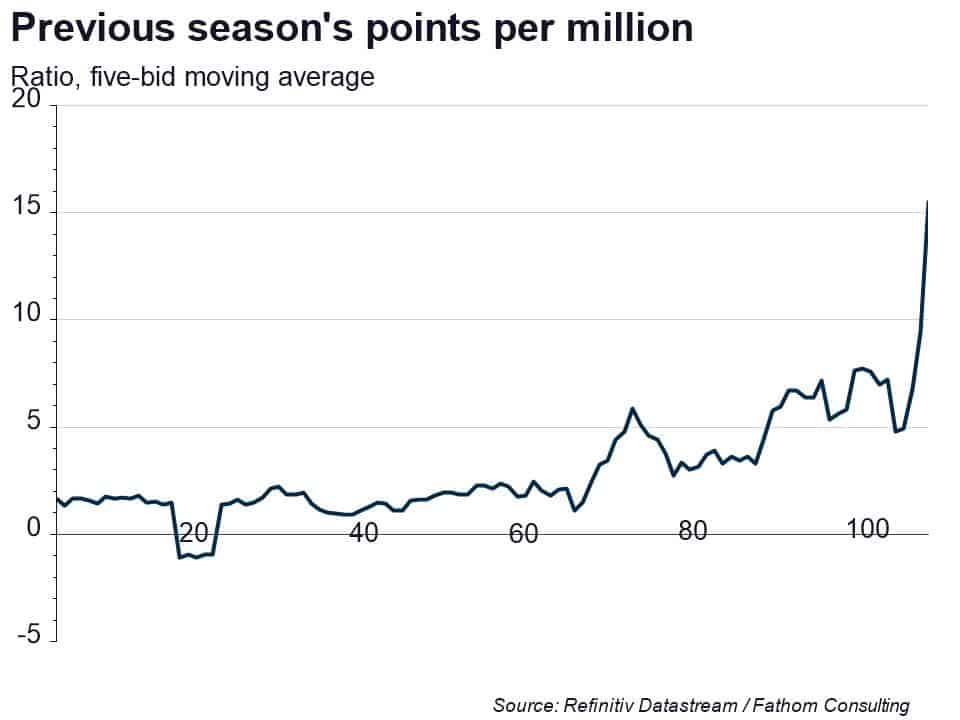

As the auction continued, it eventually became apparent that the 2x ratio was consistent with levels of bubble usually associated with a West London bottomless brunch. David Luiz (45 points last season) was snapped up for just 8 million, delivering a ratio of almost 6, smashing the previous record high. From there, good deals became easier and easier to find, culminating in the purchase of Lucas Moura (34 points in just half of a season) for the meagre sum of 1 million. Bold buyers experienced a version of ‘Winner’s curse’, a disappointment from the realisation that winning an auction means everyone else must have had a lower valuation than you. Perhaps none more so than our Technical Director, who purchased Brighton’s 35-year-old striker, Glenn Murray, for 17 million, only to later see Brighton’s big summer signing, Neal Maupay, go for 1 million. In the opening weekend, Maupay replaced Murray after 64 minutes, and went on to score.

Others have used fantasy auctions to get a better grip on economics. Previous research by Boudreau & Shunda [2] shows that the behaviour of Fathom staff was textbook. The authors found that managers participating in an auction on fantasy basketball players overbid at the beginning of the auction before underbidding thereafter. The finding confirmed previous auctions pricing research that identified a so-called declining price phenomenon [3]. The authors interpret this as managers strategically using their budget constraint to maximize their share of high-value players. In a zero-sum game, such as fantasy sports, purchasing superstars ensures none of your competition has them, encouraging managers to bid heavily on players that are expected to gobble up a disproportionately large share of points.

It’s easy to see how this sort of behaviour might be replicated in financial markets, where investors now seek winner-takes-all companies such as Facebook. WeWork, which is set to go public, appears to be positioning itself as one. Softbank is reported to have bought equity in the commercial landlord, valuing it at $47 billion, a figure -25 times its 2018 profits. The company lost $1.9 billion last year (on revenues of $1.8 billion), implying a negative price-to-earnings ratio that is close to where Amazon traded when it first went public. In Amazon’s case, early losses were no barrier to future returns and it now competes in large swathes of the consumer landscape.

While valuations move around, fundamentals should eventually dominate. In our fantasy auction, this reality check happened in one evening with a couple of bruised egos the only casualties to report. For real world investors, it may take longer, and result in greater pain, although there are also recent examples of maligned tech firms going on to confound their initial pessimists. Against that backdrop, some unprofitable companies going public still seem to be able to convince investors that they could be the next big thing, justifying their lofty valuations. This week’s market gyrations highlight how the mood music can change suddenly. It remains to be seen whether investors in WeWork end up buying the stock market equivalent of 2019 Glenn Murray, and wishing that they bought a negative yielding German bund instead, or whether WeWork turns out to be the Amazon of commercial real estate.

[1]. Fathom has never been known to blindly follow the consensus, and the negative period represents the contrarian 1 million purchase of Everton goalkeeper, Jonas Lössl, who gained -11 points last year.

[2]. James W. Boudreau & Nicholas Schunda, “Sequential auctions with budget constraints: Evidence from fantasy basketball drafts”, Journal of Behavioural and Experimental Economics, Vol. 62, pp. 8-22.

[3]. An empirical finding that auction prices decline through the day that runs counter to theory that predicts constant prices.