A sideways look at economics

‘“When the rockets go up, who cares where they come down,

That’s not my department,” said Wernher von Braun.’ [1]

These lyrics from the US mathematician and satirist Tom Lehrer’s highly amusing song may not immediately get you thinking of economics, but there are similarities between the disinterested mental shrug given by Lehrer’s von Braun and the way economists ply their trade.

Looking back to when I started my economics degree, one of the first things I remember learning was the difference between ‘positive’ and ‘normative’ approaches to economic analysis. Positivism implies describing and explaining what can be empirically measured, often referred to as ‘the facts’, without making value judgements; while a normative approach considers the desirability of what is, and whether things are right or wrong. It was quickly hammered in to us that our main focus was to be on the positivist side. Assumptions underlying models were not there to be discussed or questioned (at least not until much later), but rather learnt by rote and regurgitated come exam time. There are arguments in favour of this way of doing things: after all, in order to judge something you first need to know (and preferably understand) what it is. However, when the normative aspects of economics – which is, despite its best efforts, a social science – only become an afterthought, relegated to certain non-compulsory, graduate-level classes, then the economists you create might be misled into believing that their field of study is far more objective than is truly the case.[2]

Describing and explaining ‘what is there’ is no mean feat in the vast and overlapping web of decisions that make up economies, so to get around the risk of not seeing the wood for the trees, economics, like other disciplines, makes use of models. These models vary in their complexity: some can be summed up in a few equations, while others depend on running through long loops of code. Models are not meant to be a perfect representation of reality, but they are meant to approximate it, as their conclusions are applied to real-world problems. The assumptions you use for a model therefore, matter a great deal. With this in mind it is interesting that most economic models are implicitly underpinned by the idea of rational economic agents motivated by self-interest.[3]

Enter Homo Economicus (note the use of Latin for science-washing), otherwise known as Economic Man, the perfect exemplar of the rational self-interested individual. Mr Economicus always makes the best decision for himself (i.e., the one that maximises his utility within the given budget constraint): he never hesitates, never regrets, and unless it adds to his own utility does not care much about other people.[4] All his decisions can be quantified, they are consistent, his world is an ordered one – and perhaps it this order that makes it so compelling as a baseline for economic analysis. He does not, howev er, have many similarities with real-life people: messy, complicated, inconsistent and often caring as we are.

Despite not being especially recognisable, Economicus and his way of thinking need not be completely discounted. Indeed, he’s often a decent approximation of the aggregate outcomes in real-world markets, providing that the idiosyncracies of every individual decision-maker in that market are statistically unrelated. However, his influence is more insiduous when applied to other areas of life. One economist who made it his life’s work to paste Economicus over most facets of existence, and indeed received the Nobel Prize for these efforts, was Gary Becker (1930 – 2014). His work applied the premise of rational self-interest to a whole host of areas traditionally considered outside the economic domain, such as who we marry, how many children we have, whether we choose to commit crimes and why discrimination exists.

In his 1981 book Treatise on the family, for example, Becker defines the family as its own mini economy, where the utility maximisation of each individual drives decision-making and everyone is rewarded in accordance with their marginal efforts. Within Becker’s household as within the broader economy, activities are allocated according to comparative advantage. In this framework it follows therefore that if women take on more of the domestic chores than men, it must be because they have a comparative advantage in it, and that the total family utility is maximised in this set-up.

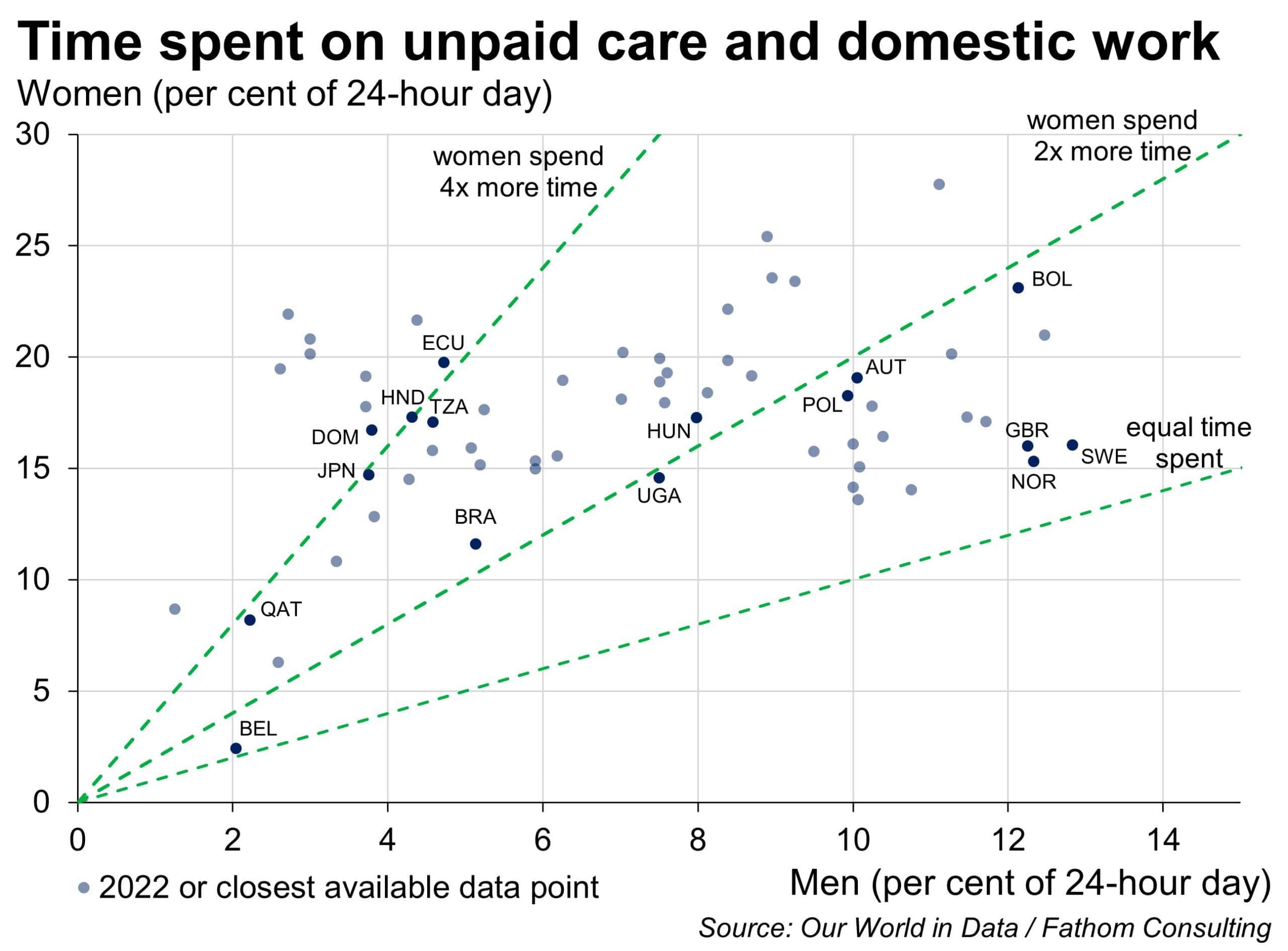

We can maybe – if we squint, and close our eyes to the number of single parent households (already on the rise when the treatise came out), and focus only on traditional family structures in western countries – find some empirical evidence of Becker’s theory at the time. That, as men were earning more than women, the opportunity cost for women to work in the home was lower than that of men, and therefore it ‘made sense’ for women to do more of the domestic work. This obviously completely ignores any alternative or complimentary explanations, such as societal norms – ‘not our department’ as the economists might say, like Lehrer’s von Braun – but, moreover, it seems far more difficult to match to the evidence today. The root of the gender pay gap, as Becker and his collaborator Mincer saw it, was that men were paid more because they were more productive, owing to their higher levels of human capital, linked in turn to their greater levels of work experience and education. Maybe this was true 50 years ago, but it’s not true now.[5] Yet women are still spending more time on unpaid care and domestic work than men.

It certainly doesn’t seem as though Becker’s theories still apply (if they ever did at all). Maybe we just need to add a bit more complexity to the model to capture these changing times – include preferences, for example?[6] Or should we be asking a more general question: whether it is perhaps misleading to try to apply rational self-interest to all human decision-making. We need to be more willing to improve the foundations of our models, keeping Homo Economicus where he is of use, but discarding him where he is not. If we want economics to be useful in addressing future challenges we cannot relegate the ‘normative’ to another department. This may mean that we as a discipline must engage more with the theories of other social sciences – theories that can perhaps not always be neatly summed up in a column of equations. And ultimately it may mean accepting that positivism was always just a way of ignoring the fact that our assumptions were normative all along.

[1] The original quote – “The rocket worked perfectly, except for landing on the wrong planet” – was allegedly made by von Braun, leading rocket scientist in Nazi Germany and later NASA, referencing the use of his V2 rockets in the bombing of London late in the Second World War. This rather blasé take on a weapon that resulted in the deaths of an estimated 9,000 civilians and 12,000 labourers and concentration camp prisoners forced to participate in the production of the weapons is an extreme example of where value-free judgements can lead us.

[2] The rise of organisations such as Rethinking Economics, a global network of students and organisers fighting for a new way of teaching and practising economics, would indicate that I’m not alone in thinking that economic teaching should be reformed.

[3] The field of behavioural economics is you might say an exception; but even here we’re looking at how actual human behaviour deviates from that of rational self-interest and why, rather than examining whether rational self-interest was a good assumption in the first place.

[4] For more on Mr Economicus and why he is highly unsuitable as a model of human behaviour I recommend reading Who cooked Adam Smith’s dinner by Katrine Marçal.

[5] The share of girls in tertiary education has exceeded that of boys since around 2000; and female labour participation, while still slightly below male participation rates, is closing the gap.

[6] Revealed preference theory, pioneered by economist Paul Samuelson in the late 1930s, is a method of analysing choices made by individuals, mostly used for comparing the influence of policies on consumer behaviour. It arose as an add-on to utility optimisation, providing a method for defining the utility functions. In short, if I am observed to choose x over y, it must be that I prefer x to y. So, for example, if women increasingly pick jobs that pay less, it must be something in these jobs that make women prefer them. For an oldie but a goodie on why revealed preferences and indeed rational self-interest is kind of bull**** see Sen’s Rational Fools.