A sideways look at economics

Who remembers the game Whac-A-Mole?

Well, for those who don’t, Whac-A-Mole is an amusement arcade game in which players use a mallet to hit toy moles, which appear at random, back into their holes. As one pops up, you try to hit it, but as you do, another one springs up somewhere else.

You’re probably wondering where I’m going with this, but actually this analogy works pretty well to describe the rise of populism and populist parties across the developed world.

Take, for example, far-right candidate Marine Le Pen’s election campaign in France, where the populist uprising gained strong momentum, but was ultimately scuppered by centrist Emmanuel Macron who eventually became President, much to the delight and relief of financial market participants. Put another way, this populist ‘mole’ was ‘whacked’ back into its hole.

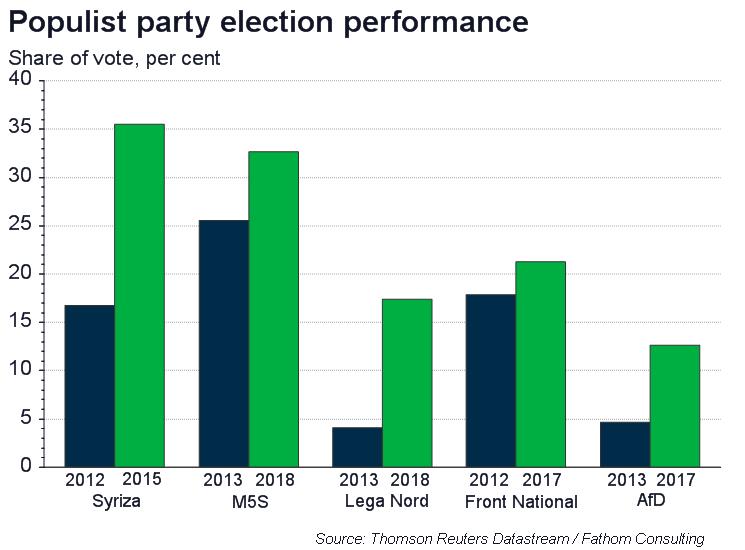

Following the defeat of Marine Le Pen, many thought European populism was on the decline, but fast forward to 2018 and Italy’s populist Five Star Movement and anti-immigrant parties have emerged as major players in the latest elections. This was the most recent of several such results in Europe and was also described as the biggest populist vote since the Brexit referendum. There has been a clear surge in the support for populist parties in Europe as the chart below shows, with Lega Nord in Italy and AfD in Germany tripling their shares of the vote in the most recent elections compared to 2013.

Moving across the Atlantic, US President Donald Trump’s decision to slap tariffs on both aluminium and steel imports seems to be a step in the direction of ‘Donald Dark’, a downside scenario for the US and global economies we first introduced back in 2016.

While you may be able to ‘Whac-a-populist-mole’ back into its hole temporarily, it will almost always pop back up somewhere else, in a different form, with different policies or ideologies or under different leadership. You may also be able to paper over the cracks, or suppress dissenting voices for some time, but they’re still lurking behind the scenes. The growing discontent with the status quo among ordinary citizens in the developed world is growing as inequality continues to widen. This trend shows no signs of slowing. While that continues, be prepared for more ‘moles’ to pop up.

However, it’s not all doom and gloom.

Just over a year ago, we first set out our ‘golden scenario’, where European leaders came together to help set the euro area down a path towards full debt-mutualisation – effectively putting the ‘economic’ into ‘economic and monetary union’. Not only would this allow the single currency to survive, but it could even thrive. A reformed Europe, with greater integration would have stronger growth prospects.

From being a distant dot on the horizon, the emergence of Emmanuel Macron, a powerful pro-European leader from the centre, has brought the prospect of the euro area addressing its internal contradictions firmly back to the forefront. Particularly if he has the full backing of Angela Merkel in Germany. Increased cooperation between nations always seems easier when the economic climate is as rosy as it is in Europe today, making now the perfect time to kick-start the reform agenda.

Will Europe remain fundamentally flawed, or is it the area’s time to shine?

Could it even become a serious counterweight to the US?

This will be the subject of much heated debate at our Monetary Policy Forum hosted by Thomson Reuters on 20 March. Our lead EU and US economists will fight it out, refereed by our distinguished guest, Paul Fisher. Full details are available on our website.

Seats must be reserved in advance: please RSVP as soon as possible to secure your place.