A sideways look at economics

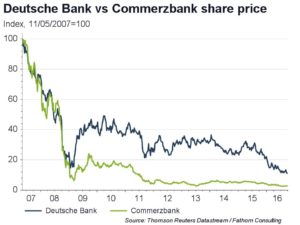

Unless you have been living under a Brexit rock for the past few weeks, you are doubtless aware of the mess in which Deutsche Bank finds itself. Between mid-2007 and late last year, the price of Deutsche Bank shares fell around 75%, as low interest rates, tougher regulation and reduced revenue hit profitability hard. The price has fallen a further 50% since then. As if to add fuel to the fire(sale), the US Department of Justice announced that the German giant, which in the words of the IMF is “the most important net contributor to systemic risks”, could face a $14 billion fine – more than 75% of the bank’s market cap – owing to miss-selling of mortgage related instruments in the US. Any amount over the $5.4 billion that Deutsche Bank has set aside would negatively affect its Common Equity Tier 1 (CET1) capital ratio.

When you consider what other banks have been fined in the past for similar violations, it is likely that its CET1 ratio will fall from its current level of 10.8% to around 9.4%. Irrespective of what the final penalty turns out to be, John Cryan will struggle to achieve the bank’s CET1 ratio target of 12.5% by the end of 2018, as Deutsche Bank faces additional investigations for money laundering in Russia as well as one for FX market rigging.

Ironically, early on Thursday Deutsche Bank analysts downgraded Commerzbank from “Buy” to “Hold”. The words “pot” and “kettle” spring to mind. The future of Germany’s second biggest bank is hardly rosy. While its larger competitor is cutting 4,000 jobs, Commerzbank is slashing around 10,000 jobs, and its share price is more than 97% below its pre-crisis level. One is tempted to suggest that the two banks might help each other by assigning “Overweight” recommendations to each other’s equity. Unfortunately the main thing the two lenders are overweight on is restructuring.

Commerzbank has hit back with a new marketing campaign, which shows a handyman removing the last letter from what seems like Deutsche Banks’s logo. The leaflet reads: “There’s one German bank that stays on your side.”