A sideways look at economics

“There are known knowns. There are things we know we know. We also know there are known unknowns. That is to say, we know there are some things we do not know. But there are also unknown unknowns. The ones we don’t know we don’t know.”

Donald Rumsfeld, 12 February 2002

At the time, Rumsfeld’s quote, made in response to a reporter’s question about evidence of weapons of mass destruction in Iraq, was seen as a gaffe or else a masterclass in not-answering-the-question (we’ve seen a few more of those lately). Since then, however, the quote has been widely used to describe aspects of the uncertain world we live in today, and its status has grown so much that Rumsfeld referenced it in the title of his 2011 autobiography. The quote seems apt today as we approach the tenth anniversary of the financial crisis, which turned conventional wisdom about how the economy operates on its head and exposed widespread risks in the financial system that had gone apparently unchecked. Now, in the UK and the US, political uncertainty is on the rise and the economic outlook appears unusually risky as a result. But what do we actually mean by risk and uncertainty?

The Chicago economist Frank Knight defined risk as being present when there is a set of different possible future outcomes, but these outcomes occur with measurable probability. Uncertainty on the other hand is a situation where the chances of each event occurring are themselves unknown.

Risks — the known unknowns — are an inherent aspect of daily life. A business considering an investment will want to form an estimate of the probabilities of various return rates, so the decision to invest can be made on the range and expectation of these returns. Economists usually assume agents to be risk-averse, meaning they prefer the sure thing to a lottery that delivers the same amount on average, and this idea underpins the existence of insurance markets where risks among a large number of people are pooled, to avoid extreme losses. At Fathom’s poker night we make our decisions to fold, check or raise depending on our assessments of the probabilities that the cards we want will come up in the flop, the turn and the river. (One thing that is certain is that this author could have used a higher degree of risk-aversion in our most recent game.)

In the real world it is rarely possible to have perfect estimates of the probabilities of future outcomes (unless you get really good at counting cards), which is why the two concepts are so often conflated. But uncertainties — the unknown unknowns — become increasingly important as the chances get harder and harder to attach accurate values to. Think of the failure of the betting markets to predict Brexit, the election of Donald Trump or the UK’s 2017 hung parliament. Taken individually, each event could be just one of those few times that the less-likely outcome prevails (the straight flush), but taken together it seems like there are errors in the way that agents are estimating probabilities (there is an unknown number of Aces in the pack). Within these events can lurk more uncertainty. After the US election we at Fathom assigned a greater than 50% chance to the ‘Trump Lite’ outcome when it comes to US–China trade, but each new tweet could be making observers more unsure about whether the outturn will actually be ‘Donald Dark’, or indeed ‘Everywhere Dark’ if Kim Jong-un has a bad day. And good luck trying to attach any kind of probabilities to the possible outcomes of Brexit negotiations.

Complete and accurate information is the preferred basis for constructing these estimates to base our decisions on, but this could also become increasingly difficult in a world of #fakenews, let alone one where a senior White House aide can defend a clearly false claim about the size of the inauguration crowd, apparently without irony, as an “alternative fact”.

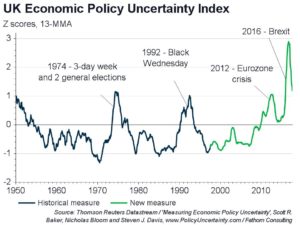

The distinction between the two concepts can be seen in the measures developed to examine uncertainty. The Economic Policy Uncertainty (EPU) Index of Baker et al. is a long-run series based on the share of newspaper articles published that month that mention ‘uncertainty’, the economy, and one or more of the terms ‘tax’, ‘policy’, ‘regulation’, ‘spending’, ‘deficit’, ‘budget’, ‘Bank of England’, ‘war’, and ‘tariff’.

Compare this to the 90-day standard deviation of the FTSE 100, used as a proxy for the realisation of market risk. When times are more risky, there is a wider range of realised outcomes, which increases the index variance, and an unknown unknown can also come out of nowhere and add to that volatility.

During the financial crisis of 2008–9 FTSE volatility increased by a lot more than the EPU, whereas the reverse was true around the time of the Brexit referendum in 2016. Our proxies for risk and uncertainty don’t necessarily move together; there’s no reason that we would expect them to, as the two concepts are independent. In fact, policy uncertainty across major developed countries increased over the financial crisis and subsequent euro sovereign debt crisis, and has remained elevated ever since. The same isn’t true of the standard deviation of stock market returns, or measures such as the VIX.

What does this mean for the economy going forward? Risk and uncertainty affect the economy in different ways. An environment in which entrepreneurs are confident in taking on a level of risk is beneficial: we would expect some inventions to turn out to be duds before an innovator hits on that one new idea that can be transformative. But uncertainty deters investment which would otherwise be productive, and makes it harder for all economic agents to make good decisions.