A sideways look at economics

Emerald-green grass and pristine, light-coloured outfits are the hallmarks of the Wimbledon championships, commonly known as just ‘Wimbledon’ — the world’s oldest and most prestigious tennis tournament. For most, the experience would be incomplete without indulging (at some expense) in a bowl of juicy red strawberries and clotted cream. For wealthy tennis fans seeking an investment, however, Wimbledon offers an even juicier opportunity to splash out. That opportunity is not a bond, nor a stock, nor a ticket, nor even a hill of ripe strawberries — it is a Wimbledon debenture.

What is a Wimbledon debenture? It is an ingenious way to leverage Wimbledon’s status among fans in order to finance progress and, at the same time, to return more brand value. The All-England Lawn Tennis Club, which owns the courts and organises the tournament, regularly has to undertake extensive investment, which it funds through the issuance of the Wimbledon debentures. Subscribers to an issue pay the cash in instalments, and not upfront as typically required by regular bond subscriptions. They also do not receive any coupon payments throughout the five-year duration of the debenture. Each debenture, however, guarantees a seat for the 13 days of the championship for the next five years. Technically, the Wimbledon debenture is a five-year tradeable zero-coupon debt security that comes with an in-kind dividend in the form of tickets.

Why does this unsecured securitised loan open the deep wallets of many fans? It is the aura of Wimbledon, and the desire of fans to feel like gatekeepers and co-owners of the brand. Fans-turned-investors provide cash for ongoing improvements which enhance the tournament’s prestige, like the vast outlay on the retractable roof on Centre Court.

It took two years to plan the 65-by-75-metre, hydraulically-operated structure of translucent fabric supported by steel trusses. A major challenge was the fact that moisture on the grass can affect a ball’s bounce. To ensure that on-court humidity stays at acceptable levels when the roof is closed, over 600 air distributors pump dry air into the building — in perfect silence. The cost of the roof was an eye-watering £100 million, but it was a worthwhile investment as it made weather-related cancellations a thing of the past. A fan-turned-investor must inevitably feel proud of themselves and “their” roof when the next Djokovic-Nadal Wimbledon final is not only able to go ahead in the rain, but it is also not turned into a Greek drama by Djokovic’s complaints about how the ball is bouncing on the grass (Nadal fan here…). More importantly, the roof and its perks serve to remind the world which is THE tennis tournament.

Wimbledon debentures are not only popular among fans with “pure” tennis instincts. They also draw the attention of “pure” investors. The main reason is the tradeable dividend — premium tickets, which are in sky-high demand on the open market. A subscriber to a Wimbledon debenture has the right to either (1) keep, or gift the tickets, and gain utility from the experience; (2) sell some of them until they break even or profit; (3) sell the debenture on the secondary market at a price that is higher than the cost. Of course, one can also choose any combination of the three, given that the five-year duration of the debenture allows time to figure out what works best.

It is difficult to put numbers on the investment returns from selling tickets: debenture holders are free to sell tickets through any channel, and there is no record of transactions or of how they relate to the debenture price. But there are some indicative data, if one looks at the prospectus of the Centre Court 2021-2025 issue here. Had you purchased the Centre Court 2016-2020 issue at its issue price of £50,000, you could have recouped about £70,200 purely by reselling all 65 tickets (13 tickets per year, for five years) to hospitality companies.[1] That’s a healthy profit of £20,200 with almost no real risk.[2]

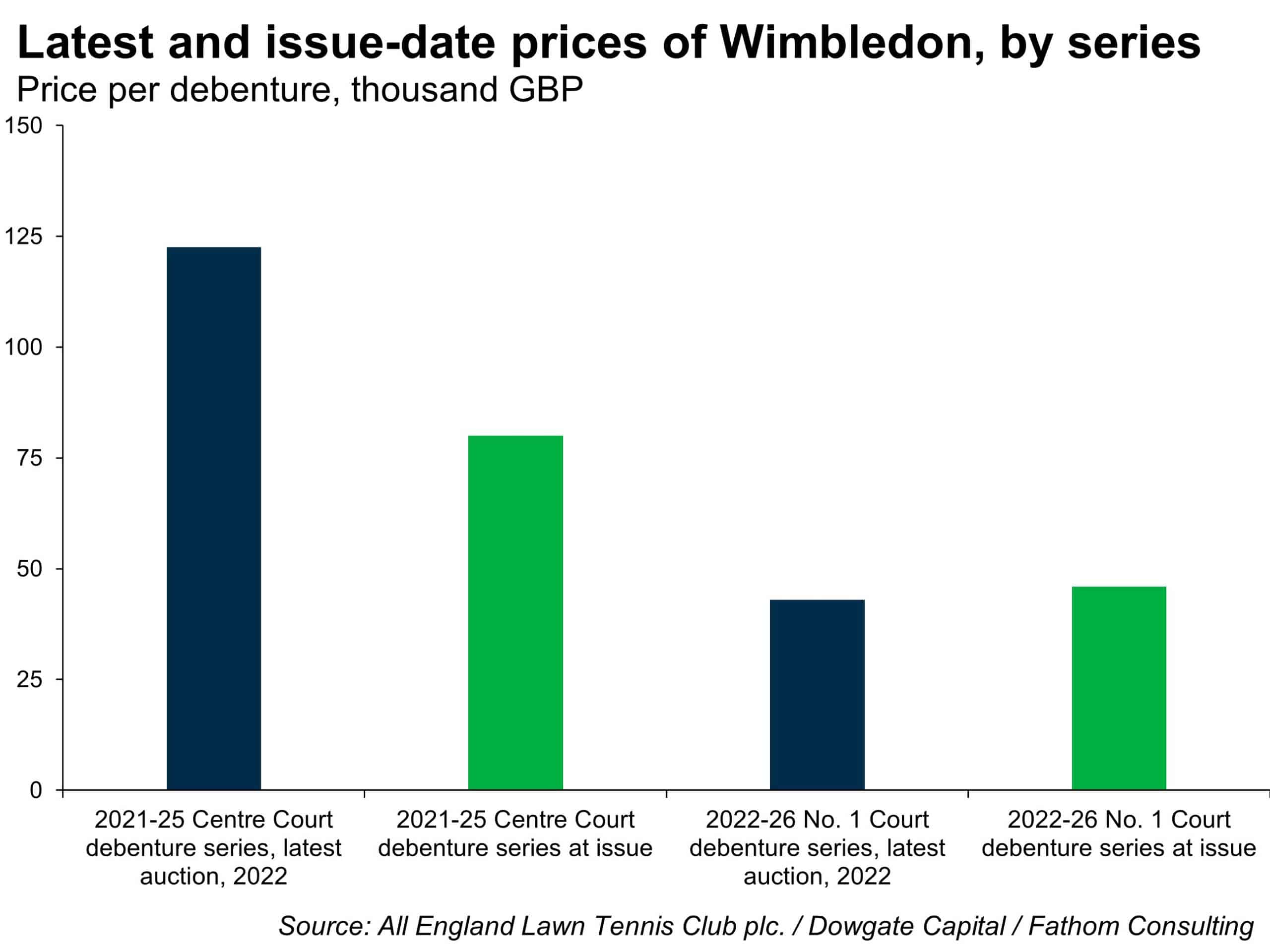

Gaining through price appreciation in the secondary market is a bit more complicated. Data on the latest market prices, taken by Wimbledon’s market maker Dowgate Capital and shown above, suggests that this could be profitable too. A crucial aspect is whether you are already in the debenture loop. If you already own a debenture, you can participate in the sale of the next debenture issue at its official issue price. When issued, the Centre Court 2021-2025 issue would have cost £80,000 at its official price, but in the latest auction (June 23, 2020) it was sold for £122,500. That represents an annualised return of 17%, made in 19 weeks — not bad at all. However, this is for the Centre Court debenture where finals are played. The debenture for No. 1 Court, which does not host finals and has long been considered the home of the true tennis fan, is traded at a discount of 2% annualised. That may be the price one has to pay for mixing love for the sport with cool-headed investment calculations. It may also help keep true tennis fans true…

Whether you are a groundskeeper watering and trimming the lawns in preparation for play, a farmer in Kent preparing to harvest strawberries, a tennis fan heading to the courts dressed in a striped blazer or a flowery dress, or a fan-turned-investor seeking investment returns, the prestigious tennis major in southwest London has something to offer. This is purely down to Wimbledon’s ingenuity in developing a self-charging brand “engine”, set in place in 1920 with the first debenture issue. The brand taps the fans in order to evolve, and then rewards them with ever-improving tennis extravaganzas and investment returns. In the process, and unfortunately for the not-so-well-off tennis fan, ticket prices remain stubbornly high. But, hey — at least we can all watch it through the public broadcaster and not on a pay-per-view platform. And it is almost certainly the revenue from debentures which makes it possible for Wimbledon to refrain from switching to the dark side of the (sports) force and selling the coverage rights to a satellite channel or a streaming service.

[1]Being the only members of the public who are allowed to re-sell tickets, debenture holders are targeted by hospitality companies. They buy and repackage tickets at prices ranging from £1000 GBP for less desirable days to £10,000 for the finals, and averaging £6000 (those prices are per person…). In effect, the prices charged by hospitality companies are 40 times the average face value of the ticket (£150). Assuming that the debenture holder gets just 15% of that open market value, we can estimate that the debenture is potentially worth £70,200 to an investor.

[2]Even during the pandemic — Wimbledon got cancelled in 2020 — debenture holders did not lose out. As The Times reported, after the 2002 SARS outbreak Wimbledon started paying a hefty insurance premium specifically to cover pandemics — which, in 2020, paid off to the tune of £100 million. Thanks to the insurance, debenture holders did not suffer a loss on the 2020 value of their debentures.