A sideways look at economics

They say that as comedians get older, they stop making jokes about drugs, sex and hedonism, and start focusing on the price of childcare and mortgage approvals. As their fans are ageing with them, many become oblivious to the drudgery of another “kids say the funniest things” routine. It doesn’t need to be original or edgy, it’s just a relief to be out on a Saturday night without a baby monitor. (For evidence of this phenomenon, see Michael McIntyre gigs.)

Not that my career started with macroeconomic research on dubious pharmaceuticals or the like, but I’ve noticed my own focus has changed lately. With a wife in Paris and a job in London, I spend a lot of time thinking on the Eurostar. Specifically, pondering what else I could have spent my hard-earned pounds on and whether I’m managing my finances efficiently. The answer to that second question is probably not: my Eurostar trips are almost routinely booked at extortionate last-minute prices, a premium I’m willing to pay for flexibility. Placing the entire contents of an advent calendar in your mouth and then sneezing would deliver a more organised schedule than my social calendar.

During these high-speed financial reflections, I’ve been considering whether my assets are sufficiently diversified. Despite spending a large part of my time commenting on financial markets professionally, my holdings of financial market instruments do not represent a substantial part of my total financial assets. Perhaps this implies a high degree of risk aversion or a separation of personal and professional life. Perhaps it’s rooted in concern about financial market valuations. The answer to that is reserved for another Friday blog post.

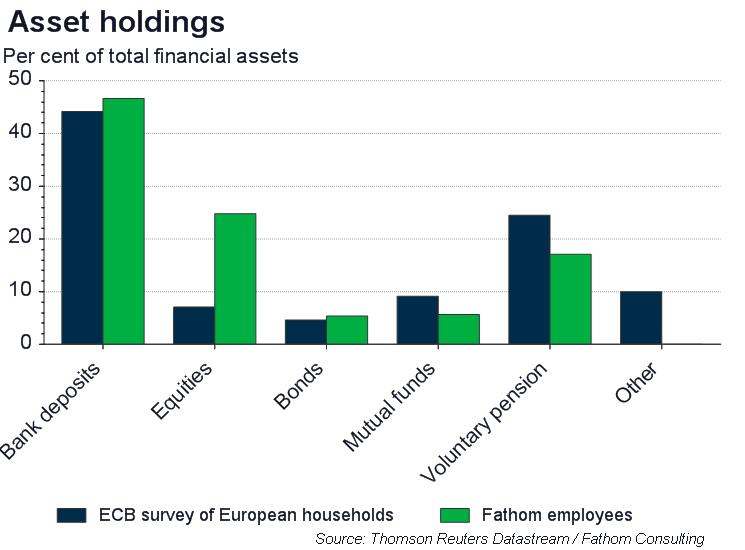

How do other financial economists compare to the wider population? The ECB produces an extensive study of household finances across 20 EU countries (the ‘ECB Household Finance and Consumption Survey’). I conducted an in-house (anonymised!) survey of Fathom’s economists, which asked broadly the same questions as the ECB’s assessment. The findings suggest that ‘Fathomites’ keep a very similar proportion of their financial assets in bank deposits to the European average, with a mean average of 46% of financial assets as opposed to 44% across the euro area. It’s what they do with the remainder that’s more interesting – my colleagues invest a lofty 25% of their financial assets in shares, as compared to 7% in the euro area. Given this week’s equity market rollercoaster ride, I kept my ears out for sobbing from the bathroom, but everyone remains reassuringly upbeat. As a company, Fathom remains concerned about equity valuations in the long run, but sees scope for further growth in the cycle before a correction.

Looking at my own portfolio against these statistics, I’m currently ‘overweight’ bank deposits. Recent years have seen low-risk financial assets such as bank deposits deliver historically low nominal yields and negative real returns. Exceptionally accommodative monetary policy in advanced economies has kept policy rates close to the zero bound, while asset purchases in quantitative easing (QE) programmes have exerted further downward pressure on low-risk returns. One of the intentions of QE was to drive investors into higher risk assets in search of a better return. Indeed, perhaps it was QE that spurred a portfolio rebalancing effect among my colleagues and encouraged these purveyors of the ‘dismal science’ to become a bit more adventurous by buying more equities.

Did highly accommodative monetary policy affect investment behaviours at a household level though? Not according to the ECB’s survey. The data in the survey were collected between 2010 and 2011 (‘wave 1’) and between 2013 and early 2015 (‘wave 2’). While this period admittedly largely predated euro area QE, it was associated with a fall in the ECB’s policy rate to historical lows and QE programmes in the US, UK and Japan. Between these two surveys, the percentage of financial assets held in low-yielding bank deposits remained roughly stable at 44%. Some of the largest changes in bank holdings were in Greece and Spain, with Greeks holding 7 percentage points less of their financial assets in banks by the time of the second survey, and Spaniards holding 10 percentage points more. Between the two waves of the survey, Greek banks came ever closer to collapse, while Spanish banks were heavily recapitalised with European funds in an improving economic environment. When placed in the context of a static euro area aggregate, both changes suggest that preservation is the strongest motivator of changes in household investment allocation.

A similar reluctance to take more risk is evident in the UK. A recent working paper from Bristol Business School (1) focused on the response of UK retail investors to QE by assessing the flows into different types of mutual funds and found very little evidence to suggest that the risk profile of British retail investors increased as a consequence of QE. So, apparently it’s hard to get households to become less risk averse with their investments, excluding my colleagues that is. A bunch of economists are less risk averse than I am. Now, I really need to have a think about that on the way home…

1. Iris Biefang-Frisancho Mariscal, ‘The impact of quantitative easing on aggregate mutual fund flows in the UK’, UWE Bristol Economic Working Paper Series 1703.