Headlines

- Two and a half years after the pandemic hit, crisis risks are elevated globally

- The UK suffered a fiscal wobble in late September, but even now that the unfunded tax cuts have been rescinded, the prime minister has resigned, and the dust has settled, the fiscal arithmetic remains less attractive for the UK and for other major economies than it has for decades

- Market pricing of government debt over the past month, combined with plausible estimates of long-run economic growth, suggest that both the US and the UK will need to move to a sustainable primary surplus — something neither has achieved for the past two decades — and Italy will need to run a larger primary surplus

- Germany and, to a degree, France, appear in marginally better shape for now

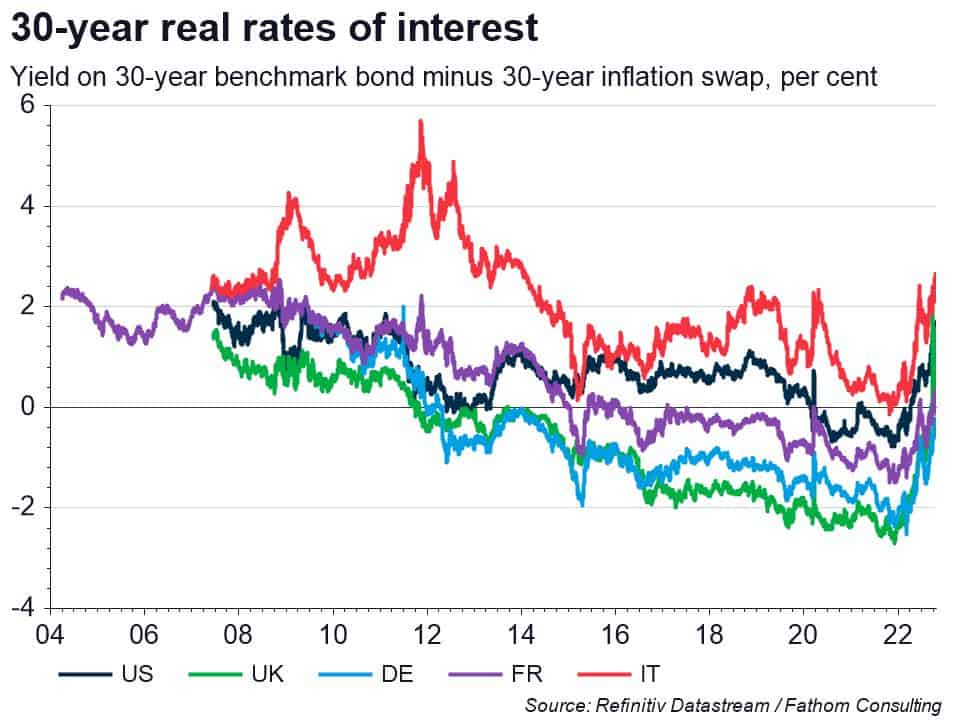

- The dramatic turnaround in index-linked government yields, which has gone beyond what can be explained by expectations of conventional monetary tightening, is hard to square with textbook models of the fall in global real risk-free rates of interest

- Those models may be wrong, or it may be that even major-economy sovereign yields were never quite as risk-free as the textbooks had imagined

- But another explanation relates to QE and the idea of fiscal dominance — central banks announcing a partial reversal of QE signals that the era when monetary policy was set to suit the government’s fiscal needs is over, thanks to rising inflation, so markets are now taking a renewed interest in the fiscal position

[Please click below to read the full note.]