Headlines

- We flag three signs of a systemic banking crisis: contagion, credit losses, and official complacency

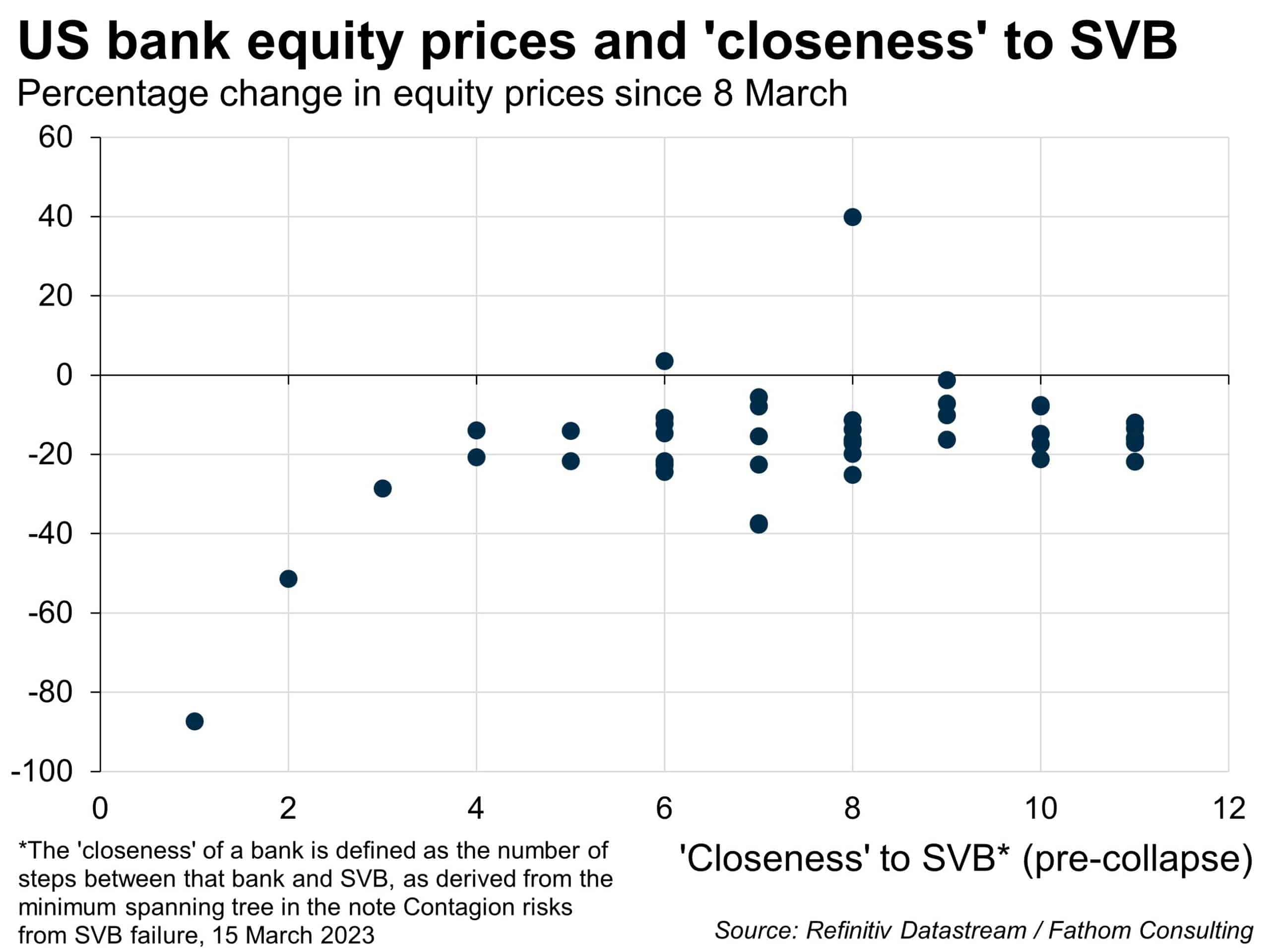

- Contagion: to date, spillovers following Silicon Valley Bank’s collapse have been relatively limited, but instability can spread more quickly than ever in the digital era

- Credit losses: we have not yet seen the full macro effects of Fed tightening — these could cause credit defaults and possibly spark a second round of concern about the banking system

- Complacency: policymakers have taken swift, decisive action to address risks but there is always scope for a policy misstep

- We see limited evidence of any of these signs flashing red

[Please click below to read the full note.]