Headlines

- Most economies have avoided recession, despite the higher cost of living and energy price shock following COVID-19

- Higher interest rates pose a risk of slowing down the macroeconomic cycle, but the economy remains resilient for now

- US house prices, which remain resilient to higher mortgage rates, corroborate this and have even picked up in 2023 thanks to lower supply (i.e., construction) that is helping homebuilders’ stocks post strong gains

- Investment growth has also remained strong and corporate issuance has held up well, with both variables strongly procyclical and lagging in response to higher interest rates

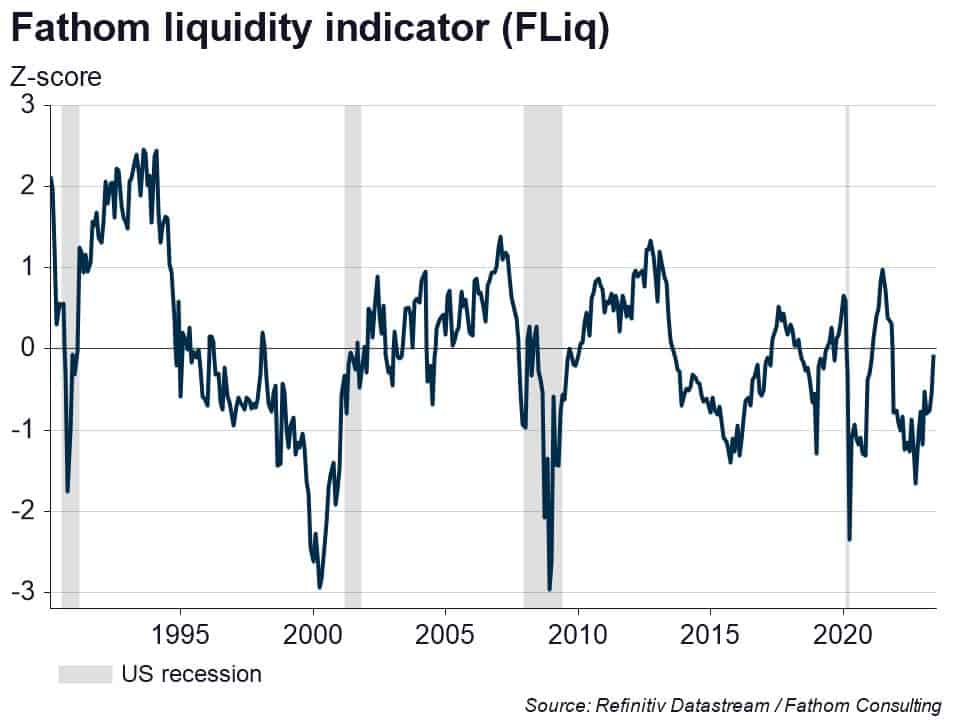

- The Fathom Liquidity Indicator (FLiq) — a broad measure of market liquidity incorporating both public (i.e., central bank) and private (i.e., investors and markets) sources of liquidity — is currently signalling a rebound and underpinning the positive performance in markets year to date

[Please click below to read the full note.]