Headlines

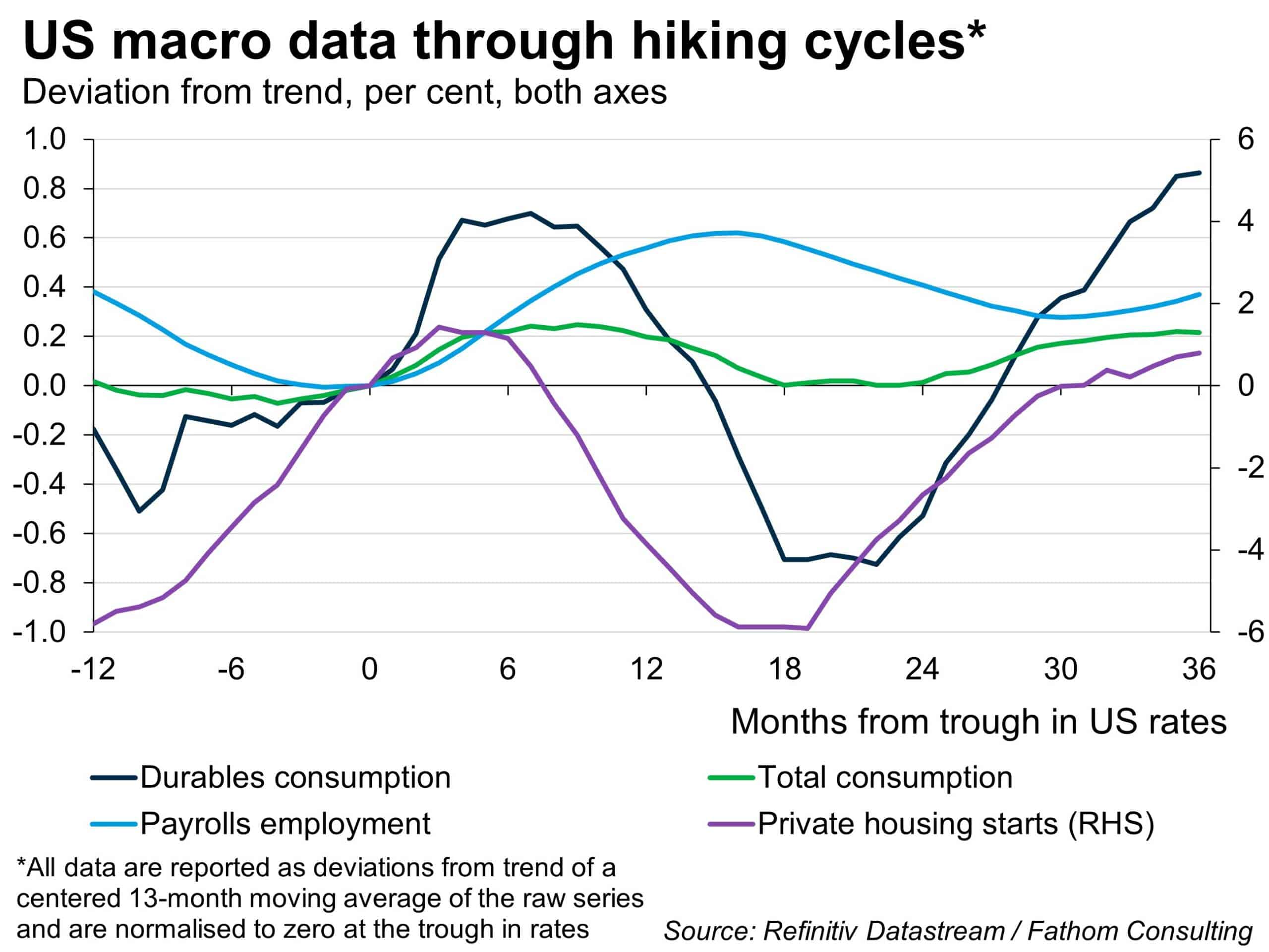

- We trace out the impact of previous Fed tightening cycles

- Private housing starts and durables consumption typically respond to higher interest rates within a few months, with total consumption slowing after a year, and payrolls after a year and a half

- We can be confident that residential construction has reacted, if anything, even more rapidly than usual to what is the second-fastest Fed tightening since at least the 1970s, but the COVID pandemic makes interpreting trends in other series difficult, if not impossible

- Core inflation, to the extent that it is slowing at all, is doing so only gradually in most major economies, while labour markets remain tight in absolute terms

- In these uncertain times the odds of a policy mistake, in either direction, are high

[Please click below to read the full note.]