A sideways look at economics

Cricket is more popular than football. Yes, you heard me right. According to the Google Trends review of 2022, ‘England vs India’ was searched for more often than ‘FIFA World Cup’. Indeed, Indian cricket takes up four of the top ten most popular searches! Wordle was top (of course), but not a single economics term is included in the top ten. Disappointing…

If you were to ask me what the key cyclical macroeconomic variables are, then I’d tell you GDP, inflation and policy rates. These are the three principal concepts on which Fathom’s Macro Portfolios (FMPs) are trained. I have my own views on how important each of those concepts are.[1] However, since economists are often accused of living in ivory towers, I thought: why not see what Google says? Here are the results.

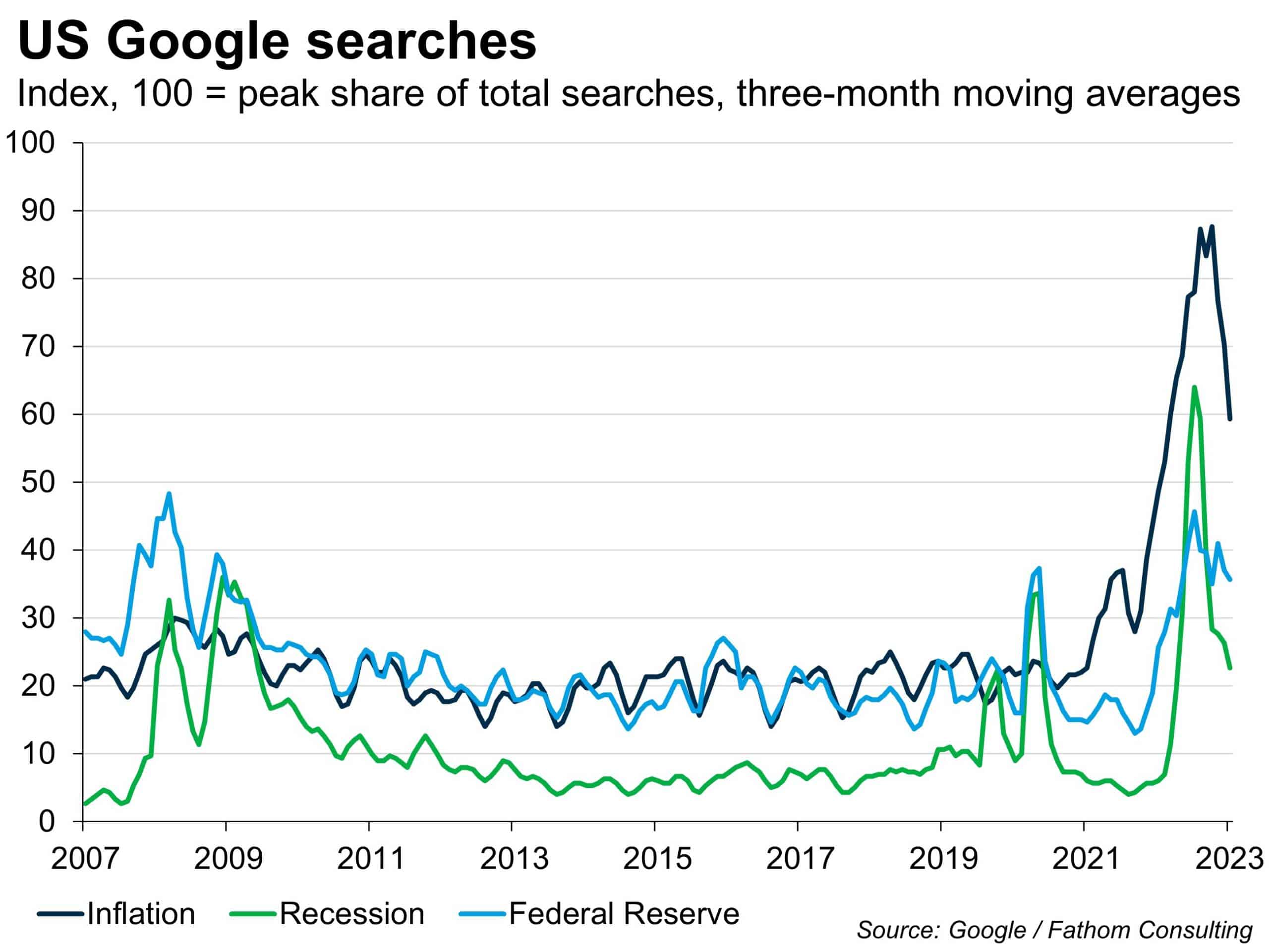

Looking at the chart below, inflation clearly grabbed people’s attention the most. Indeed, its peak search intensity was about three times higher than it ever had been prior to the pandemic. Inflation was high and people noticed. Recession fears lagged interest in inflation by around a year, but searches rose sharply through 2022 and peaked last summer. Interestingly, these concerns were far higher than in the early days of the pandemic or during the global financial crisis. If we do get a recession, then it’ll be the one that everyone saw coming.

There’s been lots of talk recently among economists and investors about a possible Fed pivot. If the Google Trends data are anything to go by then we might be on the verge of the pivot right now. We’ve already seen search interest in inflation drop off (roughly at the same time as actual inflation peaked), and fears of slower growth receding too (a little ahead of the trough in Fathom’s Macro Portfolio for the economic cycle). It now seems like public interest in the Fed is declining too (yes, pun intended), possibly because people no longer expect rate rises.

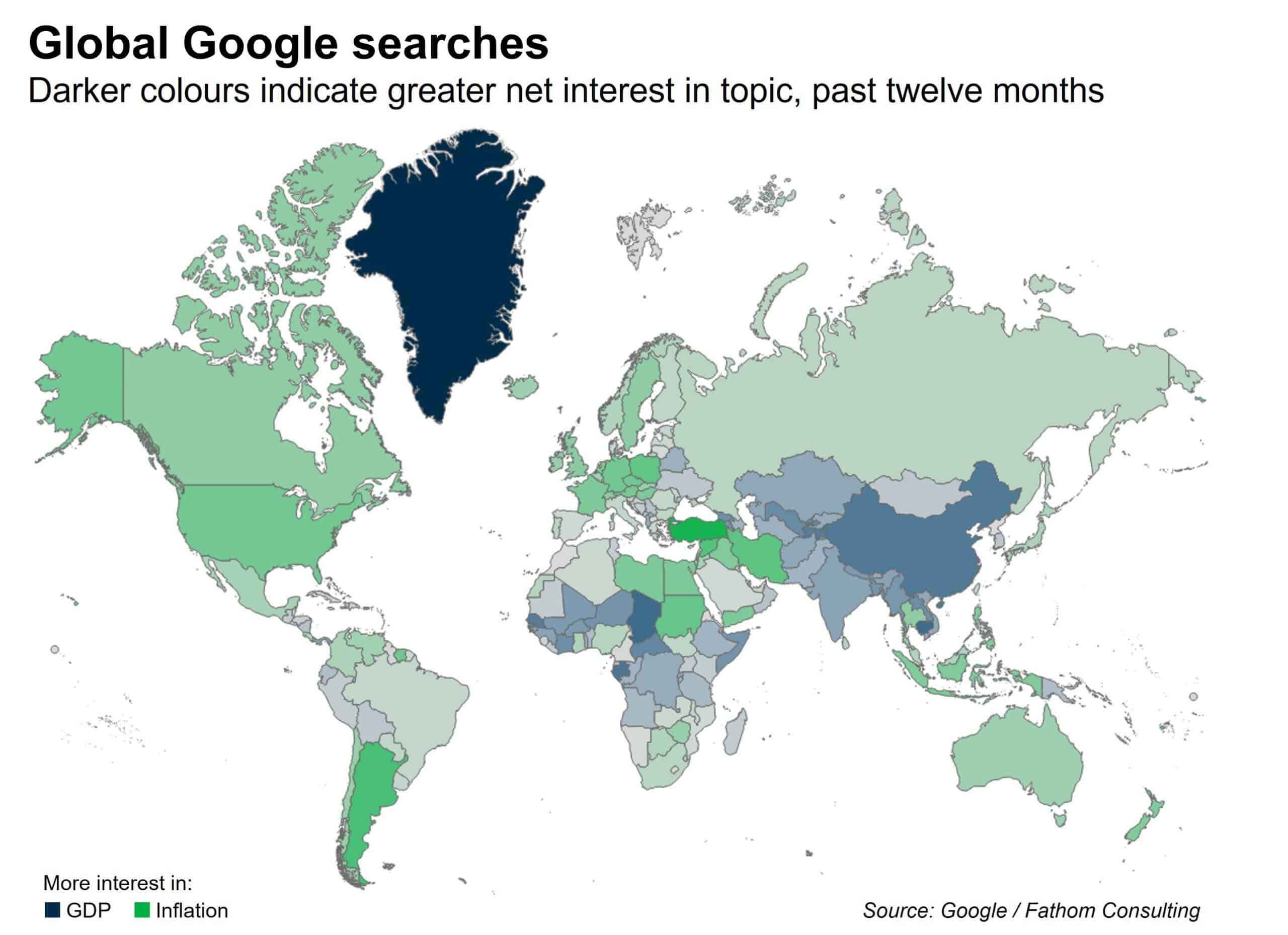

But while all this talk of inflation seems (and is) really important to Googlers in the US, it’s important to remember that there are other concerns in the rest of the world. As the map below suggests, while European and South American search trends appear similar to the US, in large parts of Africa and Asia people are far more concerned about GDP growth than they are about inflation. If you were to redraw the map prior to the current cyclical upturn in inflation, then only three major economies (the US, UK and South Africa) typically showed more interest in growth than inflation. And most of the time, that seems about right — growth is normally harder to generate than inflation is to fight.

In any case, we are currently forecasting that most advanced economies are on the verge of recession and that inflation is likely to continue falling. If, as Fathom expects, these recessions do finally arrive later this year, then I suspect that all those Google searchers who worried about it last year, and then lost interest in ‘recession’, will suddenly start searching for it again. Does this count as ‘seeing it coming’ if you briefly avert your eyes just before actually happens? Possibly…

[1] The answer from me is, of course, “It depends…”

More by this author