A sideways look at economics

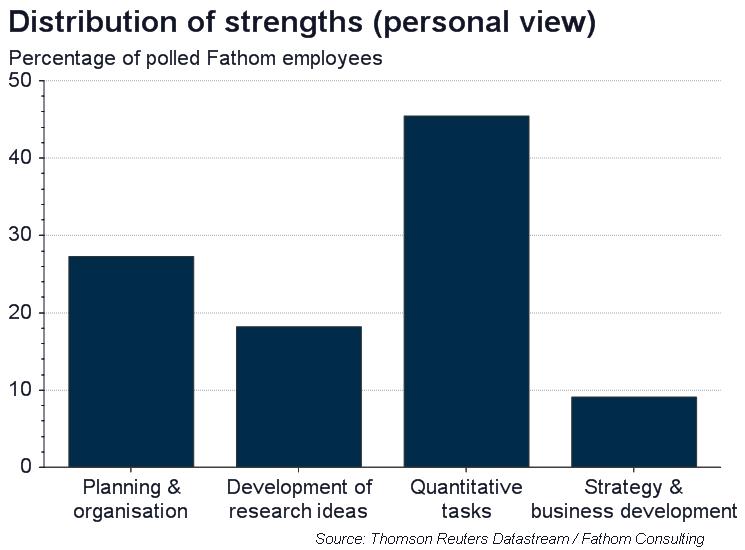

“Tell me what your greatest strength is.” Perhaps I shouldn’t admit this, but I always find this an easier interview question to answer than when I’m asked to name my biggest weakness. That’s the paradox of choice for you! While taking a sideways look at economics over a few beers with colleagues recently, I suggested it might be insightful to compare an individual’s assessment of their own professional forté with that attributed to them by their colleagues. The idea wasn’t to see who’s ‘best’ at any area of work but instead to identify our professional specialities from a list of options. Basically, what’s your comparative advantage in the Fathom world. They hoped I wouldn’t remember this pub chat when my turn on the TFiF rota came around. I did. I’ll come to the result in a moment.

The term ‘comparative advantage’ is back in vogue, with a new generation being frequently reminded that David Ricardo’s 19th-century theory of trade is as relevant today as ever before. Last week, Fathom published a note which offered a new perspective on the debate about President Trump’s tariffs. If you haven’t done so yet, I’d strongly recommend reading it (and certainly not just because it’s written by the Boss). The key takeaway is that there are certain conditions (a sub-optimal world) under which tariffs and other distortions can take us closer to the undistorted, free-trade outcome.

One of these conditions is that a country knows what it’s (comparatively) good at, i.e. what the undistorted pattern of trade would look like. While it’s clear to most that France has a comparative advantage in the production of wine over its northern European neighbours (whatever vineyard owners in Sussex may tell you), in many other cases the source of competitiveness is more difficult to decipher. For instance, what makes Shoreditch and Berlin hubs for fintech start-ups? It’s definitely not because the climate is typically suitable for the sock-free, short trouser look that’s an apparent prerequisite for employment in the sector. Particularly with regard to nascent industries not reliant on natural resources, identifying comparative advantage is challenging, with implications not only for government strategy on trade, but also long-term industrial strategy.

Let’s consider comparative advantage in the context of Fathom. As in any small company, there are times when we need to chip in with whatever needs doing. We all have our area of specialisation though. The unofficial ‘rules of the game’ are that we all work 35 hours per week (ahem…) from Monday to Friday focusing on our specialities, which include economic research, presentation and organisational tasks. We then trade our output with others in the company. The result of this specialisation is that Fathom’s output is greater than the sum of its parts.

What happens when someone starts distorting the rules of the game though? Drawing a (somewhat tenuous) analogy with the China–US dispute, let’s say that our economic researchers start producing their own infographics as opposed to using those designed by our (incomparable) in-house expert? They might even ‘invest’ in this capability by watching a few Youtube tutorials or ‘subsidise’ it by staying late and working weekends. Certainly in my case, my time is better spent on economic theory than visual graphics. If Einstein was correct and “creativity is infectious”, I must have a mighty strong immune system.

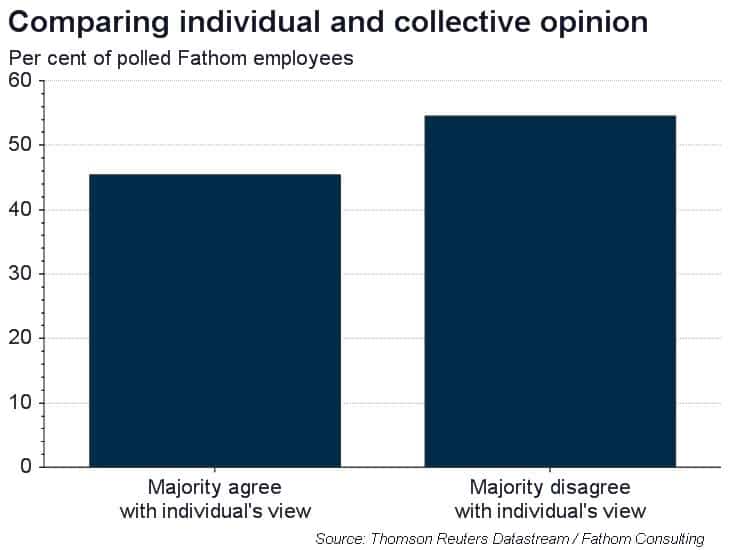

The theory of second best might suggest the optimal response to this type of behaviour is a correcting distortion — the editor could put a ‘quota’ on this output, perhaps by using only every second infographic produced by an economist in Fathom’s client presentations. While in the short run total output would be further depressed, this course of action should dissuade economists from using their time in that manner and perhaps ultimately restore the most efficient outcome. Ideally though, we’d all know from the outset where our comparative advantage lies and use our time correspondingly, removing the need for such corrective actions. You might think that this is a given. Interestingly though, my survey of Fathom colleagues suggests frequent discrepancies between an individual’s view of his/her core competency and how their colleagues see them, with the majority of Fathom employees agreeing with an individual’s assessment of personal strength in only 45% of cases.[1] This suggests a temptation to engage in activities where individuals do not have a comparative advantage.

Clearly these discrepancies don’t provide any confirmation that we’re misallocating our time. There’s no compelling evidence that my colleagues know my strengths better than I do, particularly those I don’t work closely with. More importantly, our all-seeing, all-knowing management acts as the guiding hand of the market, setting work direction and ensuring that the firm’s resources are optimally utilised. What it does perhaps illustrate though, is the challenge of identifying strengths, and hence comparative advantage, in advanced economies that are increasingly focused on producing the intangible,[2] such as macroeconomic consultancy services in Fathom’s case. The share of exports in that particular sector is one indicator, but this may well be driven by government-directed investment or tax incentives. While the supply of high-skilled labour is clearly important to service industries, there are other less obvious factors at play in determining competitiveness at a macro level. In one of the only studies of comparative advantage in the service sector, Chor[3] identifies financial development, the contracting environment and labour market regimes as key determinants of comparative advantage in service sectors.

This difficulty in identifying the drivers of comparative advantage, combined with political pressures, mean that governments may well be investing in industries where their peers hold an irreversible comparative advantage. Free marketeers see such intervention as inhibiting the ability of market forces to direct resources to their most profitable use. Supporters of industrial strategy would say such intervention is necessary to shape the path of economic development. Whatever your view, it’s fair to say that identifying distortions to the first-best equilibrium, and corresponding corrective actions, is increasingly challenging in modern industry. Knowing undistorted trade patterns…Aha!

[1] This is higher than would be achieved had random selection been used.

[2] On average, service trade accounts for 25 per cent of national output in OECD countries.

[3] Davin Chor, ‘Unpacking Sources of Comparative Advantage: A Quantitative Approach’, Journal of International Economics, 82/2 (2010), pp. 152-167.