A sideways look at economics

We live in difficult times, with our economies under pressure, inflation high, and ongoing wars pushing up the number of refugees. Amid all these stresses, people are losing faith in political institutions — democracy itself is under challenge from populism. My aim in this blog is to refresh our memory about why democracy is good if one sticks with it. Unpicking this hefty topic could take hours of discussion (not to mention a constant supply of beverages and snacks), the equivalent of which can only be found in ancient Athenian symposia or Fathom’s Think and Drink Club[1]. However, I have an alternative suggestion for measuring the value of democracy, which doesn’t require hours of debate. It is more superficial, yet extrapolative enough to make a contribution. Is more democracy associated with better outcomes for the equity market?

To answer that question, let’s start with a definition of democracy. Unfortunately, Solon — the founder of the first democracy — didn’t dish one out, although we know that his constitutional reforms had a positive economic impact. Since widespread democratisation began in the early 19th century, political scientists and economists have gradually defined the meaning of democracy. Schumpeter (1942) describes it as a political system in which rulers are elected by the people, in regular and competitive elections. Rivera-Batiz (2002) summarises it as a system whose characteristics include checks and balances for the administrative power, a constitutional process that is defined and protected, free and uncensored media, clear and effective legislature and judiciary, and limited terms of office for political leaders, as well as transparency, openness, and democratic participation. To all these qualities I would add that democracies create an environment inviting to investors in search of prospects, with secured rights and low risks of expropriation by the government. In theory, this should mean a positive association between the level of democratisation and stock returns. Strange to say, this (to me, highly meaningful) hypothesis has not been investigated extensively [2] — until now.

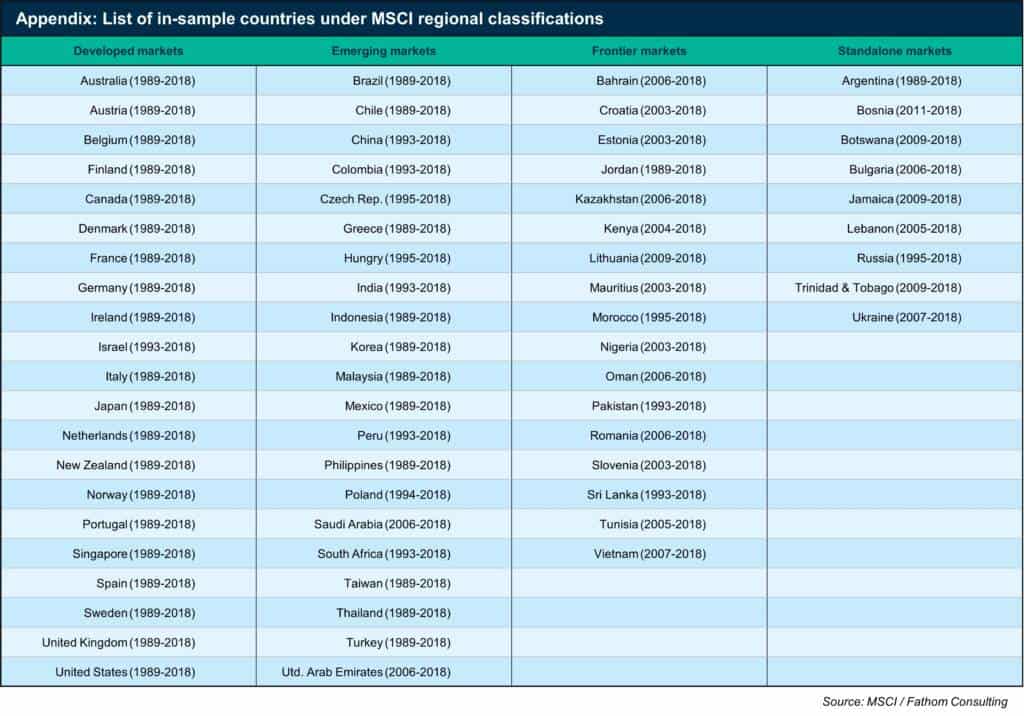

The investigation requires a variable capable of measuring the degree of democracy. Luckily, the Center for Systematic Peace’s POLITY variable achieves that, by providing an annual score ranging from -10 to +10 to indicate stronger or weaker displays of the democratic characteristics outlined above.[3] I paired these scores with countries with a Morgan Stanley Capital International (MSCI) index denominated in USD, and ended up with an unbalanced panel of 68 countries with POLITY scores between 1989 and 2018 — the list is in the table below.[4] Then, I split the sample in three: a) an autocracy group, with country-years of POLITY ranging from -10 to -5; b) a balanced group, with country-years of POLITY ranging from -3 to +3; and c) a democracy group, for country-years of POLITY ranging from +4 to +10. If my hypothesis is correct, strong democracies should be delivering higher returns to equity investors than autocracies.

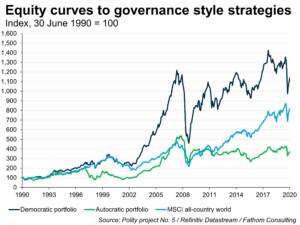

Indeed, investing $100 in the equally-weighted portfolio of the democratic group at the end of June 1990 would have returned $1,139 by the end of June 2020. For the counterpart autocratic portfolio, the figure stands at $372. For comparison, the MSCI all-country portfolio returns $819 in the same period. Needless to say, more tests are required to establish the drivers of returns, but the difference is large enough for the chart to showcase what strong democracy offers in the long term — and to undermine the argument that autocracy is a superior system because it plans ahead. Advocates of Stephen Ross’s neoclassical finance, like me, will infer that an environment that boosts the equity market will also have boosted the economy beforehand, making the arguments in favour of democracy even more appealing.

A cynic might point to the large drawdowns during the 30-year period, arguing that democracy creates bubbles and inefficiencies that ultimately take a toll on people. By that token, autocracies should be the ‘right’ choice for those seeking diversification and better risk-adjusted returns. But are they? In fact, the autocratic portfolio exhibits similar drawdowns, in relative terms, at the same time as the other two portfolios.

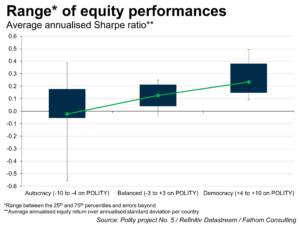

What about risk-adjusted return? The range of the risk-adjusted performances, gauged by the Sharpe ratio (return gained or lost per unit of added volatility), delivers a clear winner — and it is not autocracies. During the 30-year period, democracies on average compensate with 23% more return for each percentage point of added volatility. On the contrary, autocracies charge 2% of return for each percentage point of added volatility! There is a range of risk-reward profiles per group, as the chart shows, but the overarching conclusion is that Sharpe ratios tend to increase with democracy levels.

So how has this exercise contributed to the democracy debate? Our non-exhaustive set of asset-pricing tests indicated a positive association between the degree of democracy and country-wise returns. If the equity market can be regarded as a free vote on a country’s prospects, then democratic countries clearly outvote autocratic. Of course, many would argue that such market-based evidence is a tenuous representation of the reality faced by democratically or autocratically led societies. Still, it is a useful representation. The democratic portfolio succeeds in representing the ultimate characteristic of a democracy: the fact that it is a never-ending and ever-evolving experiment that allows ideas and innovations to emerge, creating bubbles and inefficiencies but also rectifying them over time. Democracy finds a way to move onwards and upwards, as the democratic portfolio does above. If one sticks with it, the benefits are large, even when considering the risks underpinning any experiment.

[1] Once a month, Fathom holds its Think and Drink Club: a social event based at Vagabond Wine Bar in Monument with the aim of exploring ideas and encouraging attendees to engage in interesting conversations, expand their networks and build connections. The next time we meet is from 6pm on Thursday 17th November. For further details, please contact Leara Gabay [ leara.gabay@fathom-consulting.com ]

[2] One notable study that does examine this hypothesis is by Lehkonen and Heimonen (2015). They document a positive relationship between stock returns and democracy levels, but they do so only for emerging markets between 2000 and 2012.

[3] The POLITY 5 project first derives a democracy indicator, measured on a scale ranging from zero to ten, by gauging the ability of citizens to express their political preferences, the extent to which civil liberties are guaranteed, and the existence of constraints on the power of executive. An autocracy variable is also measured on a zero to ten scale, focusing on competitiveness and regulation of political participation, procedures for executive recruitment, and the constraints imposed upon political leaders. The overall POLITY score is derived by deducting the autocracy score from the democracy score.

[4] The process connects an annual metric related to a general and elusive concept, the degree of democracy, with monthly equity returns. The metric for any given year t is linked with equity returns from July year t+1 to June year t+2. The six-month gap between returns and the end of the year which the metric pertains to, ensures that the market assimilates the information and arrives at a similar conclusion to the metric. This linking process is followed for each country and year, as POLITY ratios become available.

More by this author:

The story of a cultural reserve currency

Strawberries are not the only juicy prospects at Wimbledon

Congress mulls ban on CEO narcissism