A sideways look at economics

It’s Friday and it’s almost the weekend. Here at Fathom, staff often celebrate by coming together to toast the week’s work and to chat about weekend plans and other trivial matters. It’s a great way to relax and I suspect a fair few of our readers will also venture out to the pub for a cheeky pint tonight — there are certainly worse ways to spend a Friday evening.

Such meet-ups are a great tradition and, for many, drinks are a key component regardless of the occasion. As Lily Bollinger (head of that famous house) once put it when asked how she drank her champagne:

“I drink it when I’m happy and when I’m sad.

Sometimes I drink it when I’m alone.

When I have company I consider it obligatory.

I trifle with it if I’m not hungry and drink it when I am.

Otherwise I never touch it — unless I’m thirsty…”

If you subscribe to this view, the demand for champagne is, to invoke the economics jargon, inelastic. That’s to say, it doesn’t vary much with regard to income or to price. This might also apply to alcohol more broadly. Some might drink to get over the loss of a job, while others might do so to celebrate a new one. Does this mean the alcohol industry is recession-proof? If it is, then the consumption of alcohol — and for the rest of this TFiF we focus on beer in particular — ought not to vary over the course of the business cycle.

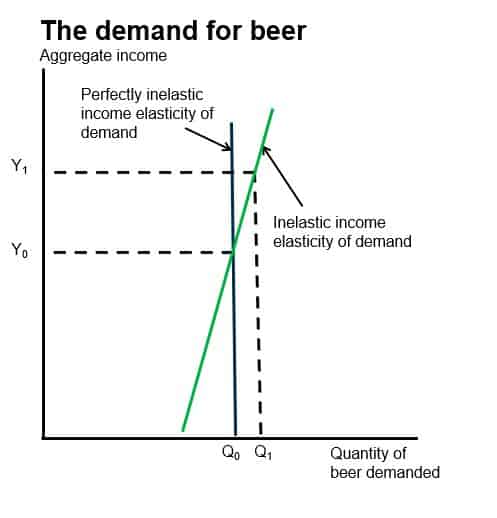

In economics, we can use the concept of income elasticity of demand to assess how the quantity demanded of a good responds to changes in consumer income. If beer were truly invariant to the state of the economy, then it could be described as perfectly inelastic (i.e. it would have an income elasticity of demand equal to zero). As shown in the diagram below, a change in aggregate income would have no impact on the demand for a perfectly inelastic good (blue line). If, however, beer is not a ‘perfectly’ inelastic good but just a ‘very’ inelastic one (as most vices are) then the demand for beer could in fact vary across the cycle and it would not be recession-proof (represented by the green line).

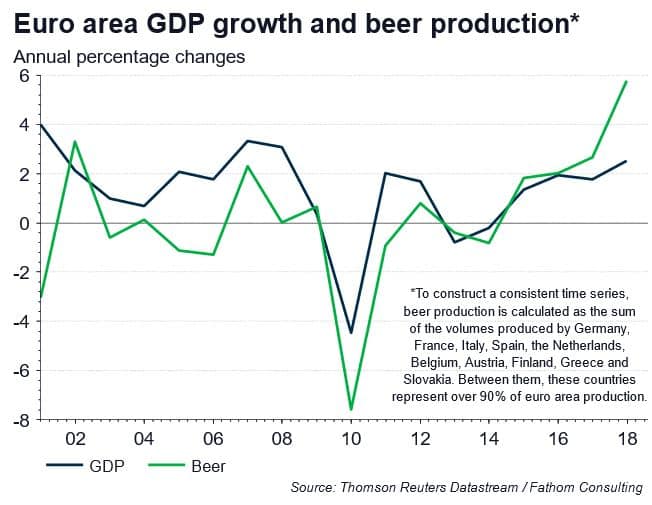

In reality, testing elasticities of demand is a very complex process and one that is plagued by issues of endogeneity.[1] But, even without testing, we can easily see that European beer production varies significantly over time. And what’s more, it is highly correlated with economic growth.

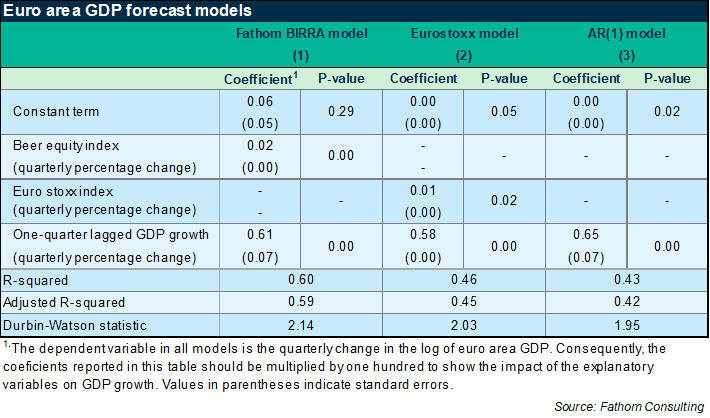

So, is beer just another good for which the demand varies across the economic cycle? Or could it potentially have useful properties for predicting growth? In order to gauge this, we model euro area GDP as a function of lagged GDP growth and an equity market index comprised of major European beer producers. The result of this — Fathom’s Beer IndicatoR of Real Activity (or BIRRA for short[2]) —performs surprisingly well, explaining almost two-thirds of the variation in economic growth and outperforming both a simple AR(1) model and also a similar model where the beer index is replaced by the Eurostoxx 50 index. So, beer seems to make a better predictor of economic growth than the prices of other stocks…

Clearly, we’re not claiming that beer is driving economic growth — to do so would be to confuse correlation with causation (and let’s be honest, absurd). But, the relationship does appear relatively strong. If causality does exist, then more likely than not the relationship works the other way — GDP growth drives beer consumption. In this world, beer consumption tracks the economic cycle, has an income elasticity greater than zero and, surprise surprise, would not be recession-proof.

To be sure of this conclusion, further research would be required (if field experiments are needed, then I’m more than happy to lend a hand). Until then, the precise nature of this relationship remains a mystery and all we can do is add the BIRRA to the list of economic indicators that we monitor.

So, perhaps beer could prove a useful tool for an economist. But, for others it remains just a refreshing beverage. Either way, it’s Friday afternoon. So, kick back, relax, raise a glass and thank Fathom it’s Friday!

[1] Beer and endogeneity – whoever thought those two words could appear in the same sentence!

[2]Purely by chance, birra is also Italian for beer.