A sideways look at economics

Data released this morning pointed to easing manufacturing and mining activity in South Africa, and erased hopes of a sustained bounceback following better-than-expected second quarter GDP figures. Africa’s most industrialised economy has long faced a range of economic ills, from low educational attainment and persistently high unemployment through to world-leading levels of inequality.

Worryingly, economic performance is getting worse. Since the current President, Jacob Zuma, was elected to office in 2009, GDP growth has averaged 1.7% versus a 4.4% average over the prior seven years; government debt has increased from 30% to 50% as a share of GDP; and the rand has declined by 75% against the US dollar. Bill Clinton’s 1992 election campaign strategist famously pointed to the primacy of the pocketbook when it came to voters’ choices: It’s the economy, stupid. But investors betting on a growth-boosting change in government may be disappointed.

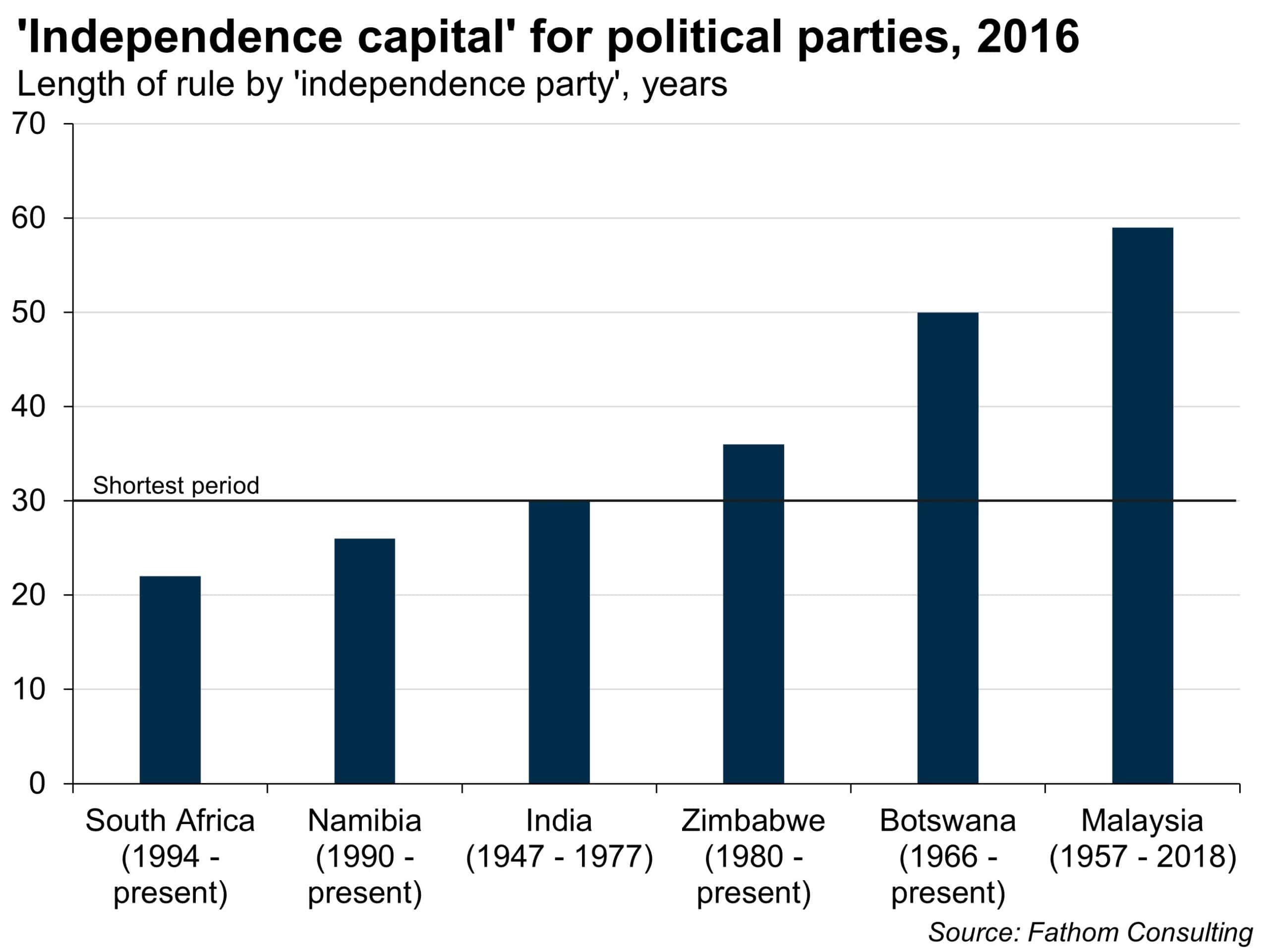

Mr Zuma’s African National Congress (ANC) led South Africa to independence, and that is perhaps the greatest advantage a political party can enjoy. In the countries we looked at, where independence was followed by democracy, the ‘independence party’ remained in power for at least 30 years before being voted out.

Recent poor municipal election results notwithstanding, the ANC appears to have at least eight years of independence capital remaining. That fact may help explain some of Mr Zuma’s more colourful decisions, such as ‘dabbing’ at political rallies and spending USD20 million of taxpayers’ money renovating his private residence. What’s good for the party is unlikely to be good for investors. And South African assets risk underperforming.