A sideways look at economics

“No more boom and bust”, was Gordon Brown’s mantra. He served as chancellor of the exchequer following Tony Blair’s landslide victory in 1997, taking over the reins himself as prime minister in 2007. During the Global Financial Crisis of 2008/09, which saw the UK economy contract by close to 6%, Mr Brown added an important qualifier. All he had in fact promised was that there would be “no return to Tory boom and bust”. Economic cycles are generally seen as a ‘bad thing’. Indeed, in the introduction to Lectures on Macroeconomics — required reading for anyone, like me, who studied the subject in the mid-1990s — Olivier Blanchard and Stanley Fischer assert that understanding, and implicitly dampening down the economic cycle should be the primary objective of anyone working in the field. But are we doing the phenomenon a disservice? That is the question I pose, and attempt to answer, in this blog.

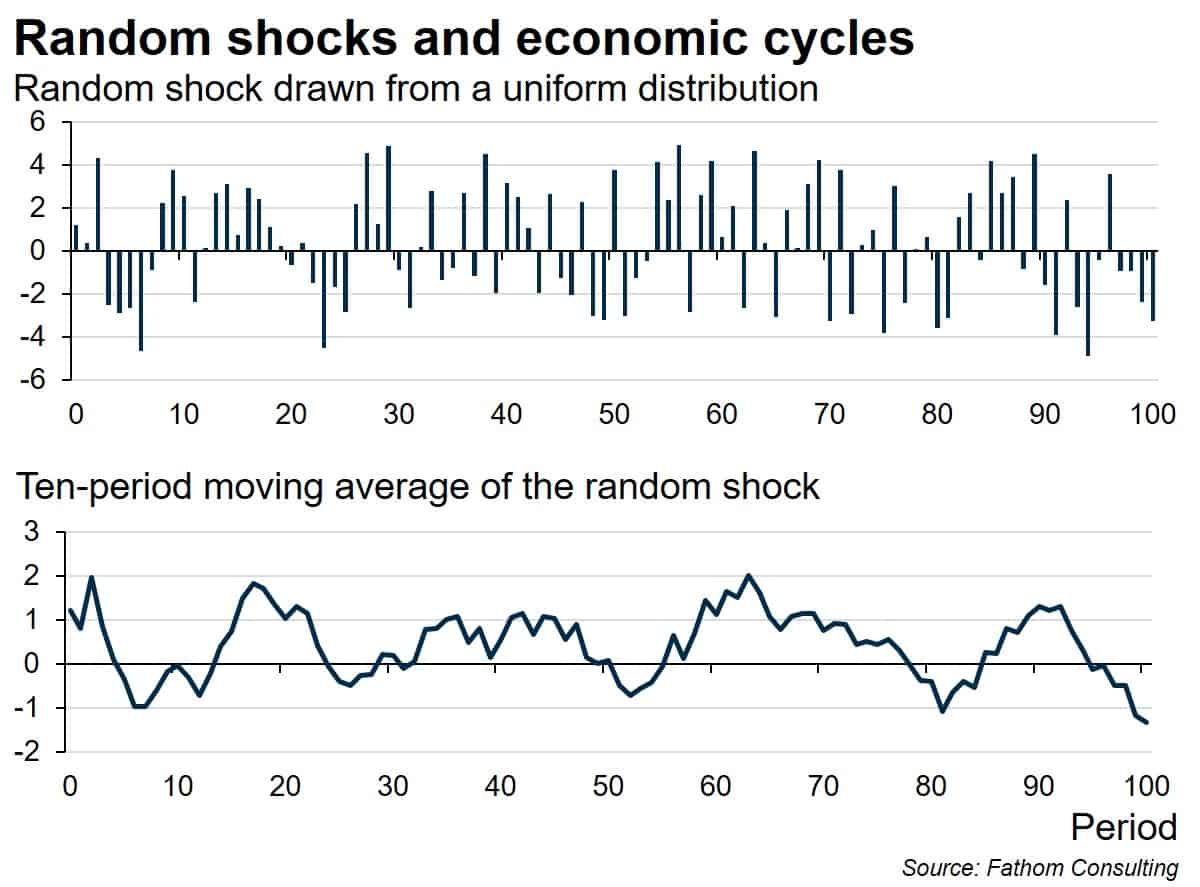

It may come as no surprise to the reader that, despite centuries of study, economists have failed to agree precisely why it is that economic activity tends not to move in a straight line. Some argue that the economic cycle is essentially the consequence of some human failing, whether that is a tendency for risk-averse individuals to save too much in times of uncertainty (the ‘Paradox of Thrift’), or plain old economic mismanagement, particularly with regard to monetary policy. We might call these people Keynesians. Others will tell you that economic cycles can arise even in a world where rational individuals respond optimally to a sequence of economic shocks. Following the work of Nobel laureates Finn Kydland and Edward Prescott, adherents to this view are often known as ‘Real Business Cycle’ theorists. But in truth, they weren’t the first to recognise this. As long ago as the 1930s Russian mathematician Eugen Slutsky observed that, if you plot a simple moving average of a set of random numbers (he used the final digit drawn in a lottery run by the government of the Soviet Union), you can end up with something that looks very much like an economic cycle — a result I have, I think, managed to replicate in my first chart.[1]

Where do I stand on this issue? Well, I sit on the fence. For me, economic cycles are caused in part by random fluctuations about which we can do very little. But human behaviour, which to a degree can be controlled, or at least influenced, almost certainly plays a part too. The period of UK economic history following sterling’s ejection from the Exchange Rate Mechanism of the European Monetary System in September 1992, right up until the Global Financial Crisis of 2008/09, is often referred to as the ‘Great Moderation’. Former Bank of England Governor Mervyn King described it as the ‘NICE decade’, where NICE stood for ‘Non-inflationary, consistently expansionary’. He had a point. From 1992 Q3 until 2008 Q1, the UK economy enjoyed 63 quarters of uninterrupted economic growth, brought to an end by a global financial crisis that, as Gordon Brown reminds us, “started in America”. So that was hardly our fault. There then followed a second period of relative economic stability, derailed by a global pandemic rather than overt economic mismanagement. But is the economic cycle really something to be tamed, or is it something we should embrace?

Fathom has long questioned the merits of the recent period of economic stability, fearing that persistently low interest rates and persistently low inflation breed persistently low growth. In the UK, there is a strikingly close relationship between nominal interest rates, and the corporate failure rate one or two years later — hardly surprising. But what may at first seem more surprising is that there is also a strikingly close relationship between the corporate failure rate and productivity growth over the next several years. Back in the early 1940s, Austrian economist Joseph Schumpeter wrote of the “gales of creative destruction” that were, in his view, essential to the functioning of a capitalist economy. Only by clearing out the dead wood, by allowing less productive firms to fail from time to time, could new, more innovative firms emerge and drive economic growth.

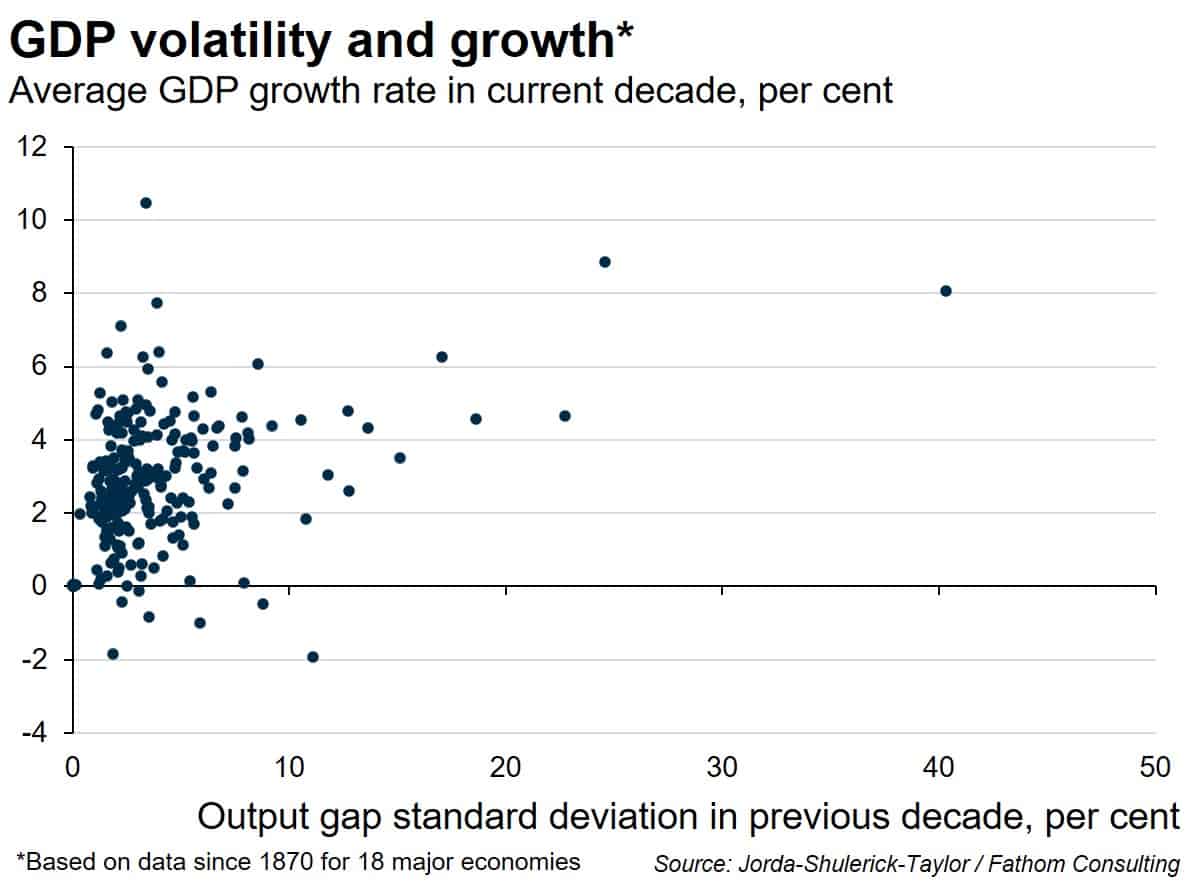

By pursuing economic stability at all costs, we may be sacrificing economic growth. That is not to say that the approach is necessarily wrong, but we should at least be aware that there is probably a trade-off, and a choice to be made. Òscar Jordà, Moritz Schularick and Alan Taylor have made available a fascinating long-run dataset providing key macroeconomic and financial market variables for 18 major economies since 1870. They have used their dataset to demonstrate that, although recessions have become less frequent over time, they have also become larger. In preparing this blog, I have used their dataset to look for linkages between the volatility of output and its average rate of growth. My final chart records the volatility of output, defined as the standard deviation of actual output relative to its trend in a ten-year period, on the horizontal axis, and the average rate of economic growth over the next ten years on the vertical axis. Each dot represents a decade in one of the 18 major economies. By eye, it does appear that there is a relationship between the volatility of output (or the size of the economic cycle) in one decade, and the average rate of economic growth in the following decade. The correlation is far from perfect — there are many other factors that will bear on a country’s average rate of economic growth over a period of time — but it is there.[2]

I will end on a point of philosophy. Imagine that you sit, unborn, behind Rawls’ Veil of Ignorance. Would you rather enter a world where you stand, say, a 5% chance of being unemployed permanently? Or would you rather suffer with certainty spells of unemployment that mean you are without work, on average, for 5% of the time? I would choose the latter. Excessively large booms and busts are, without doubt, to be avoided. But excessive stability — the total absence of any kind of economic cycle — is no panacea.

[1] Economists struggle to predict recessions. I have blogged on this topic before in ‘The Economist who cried wolf?’ This would come as no surprise to Eugen Slutsky, or indeed to many Real Business Cycle theorists.

[2] I have used econometric techniques to confirm that the relationship is statistically significant, and we are not merely capturing the fact that economic booms follow economic busts — the volatility of output is useful in predicting average rates of economic growth in the subsequent decade, over and above any information contained in average rates of growth in the current decade.