A sideways look at economics

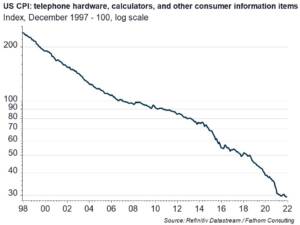

Over the years, as Apple has cemented its hold on the mobile phone market, the price of the iPhone has increased dramatically. Back in 2007, when Apple was still competing fiercely with BlackBerry, a device would’ve set you back around $500 — while the iPhone 13 Pro Max was priced around the $1100 mark on its release in 2021. And yet this doubling in prices can’t be observed in measured CPI, with US data showing a 70% fall in the price of ‘telephone hardware, calculators, and other consumer information items’ [1] over this period. How can this be so?

Well, let’s start by getting philosophical. Some of you may have heard of the Ship of Theseus thought experiment. According to legend, the ship in which Theseus returned after his slaying of the Minotaur was preserved in an Athenian museum. Over time, it decayed and, as it did, each of its constituent parts was replaced until, eventually, no original pieces remained. At this point, debate broke out among Greek philosophers — was this the same ship that Theseus had sailed in or not?

How does this relate to the iPhone? Well, consider this: how many of the parts used for the original iPhone are still being used in the latest versions? In other words, much like the ship of Theseus, can we say the iPhone is still the same product that Steve Jobs first launched 15 years ago?

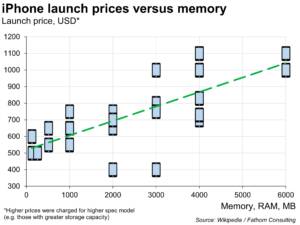

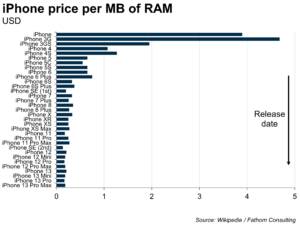

One of the ways the phone has changed radically is the increase of its random-access memory (RAM). For a given processor, or CPU, more RAM will generally give you a faster phone. The two charts below show how increases in iPhone prices have been more than matched by increases in RAM. Those familiar with Moore’s law[2] won’t be surprised to hear that the price per MB of iPhone RAM has fallen by about 95%. In other words, even though its price has doubled, the quality of the iPhone — as measured by RAM — has increased by considerably more than its price.

Economists calculating price indices try to compare like-for-like, and so attempt to strip out differences in quality (think of someone replacing their Fiat with a Ferrari and calling that inflation, and you’ll see why). Quality-adjusted prices are often computed through use of ‘hedonic regressions’. These regressions effectively model the price of a product (for example a phone) as a function of its various properties (memory, screen size, camera quality, etc.). With this approach, it is possible to construct a price index that tracks a certain quality of product over time.

Statistics agencies now use hedonic regressions to create the price index for smartphones and finds that prices have fallen dramatically over time. Apple would presumably use a similar justification for the rapid increase in the nominal price of a handset. Implicitly, this approach is consistent with viewing each new iPhone model as a separate product and adjusting for that. From the perspective of calculating inflation, this is probably the correct way to go about things.

Is there another side to the story? Maybe. Let’s consider things from a cost-of-living perspective. If you assert that a phone is a necessity, and if you believe that only an iPhone really counts, then maybe there’s an argument that current entry-level iPhones are the equivalent to original product (Theseus’s ship, in other words, is still alive). But here’s the thing: the second-generation iPhone SE is currently the cheapest handset available from Apple. It’s priced at $399, $100 less than the device launched 15 years ago. So, as hard as it may be to believe, iPhones have fallen in price, however you look at it.

[1] US inflation data are published by the Bureau of Labour Statistics. It does not report the price of mobiles as a separate index but does state that they have a weight of approximately 50% within the category of telephone hardware, calculators, and other consumer information items.

[2] Moore’s Law, which is really more of a rule of thumb, states that the number of transistors on a microchip roughly tends to double every two years.