A sideways look at economics

Ever heard of the phrase ‘naked wedding’? Until recently, I hadn’t either. But it turns out it’s increasingly popular in China, and it’s not what you first think! Instead, it’s the decision to do away with nearly all of the traditional ‘must-haves’ for a Chinese wedding, such as owning a house, a car, and an expensive wedding ceremony, in favour of a more frugal affair. At odds with China’s well-established customs, this is not always done out of choice, but instead necessity, with China’s increasingly unaffordable property prices playing a key role.

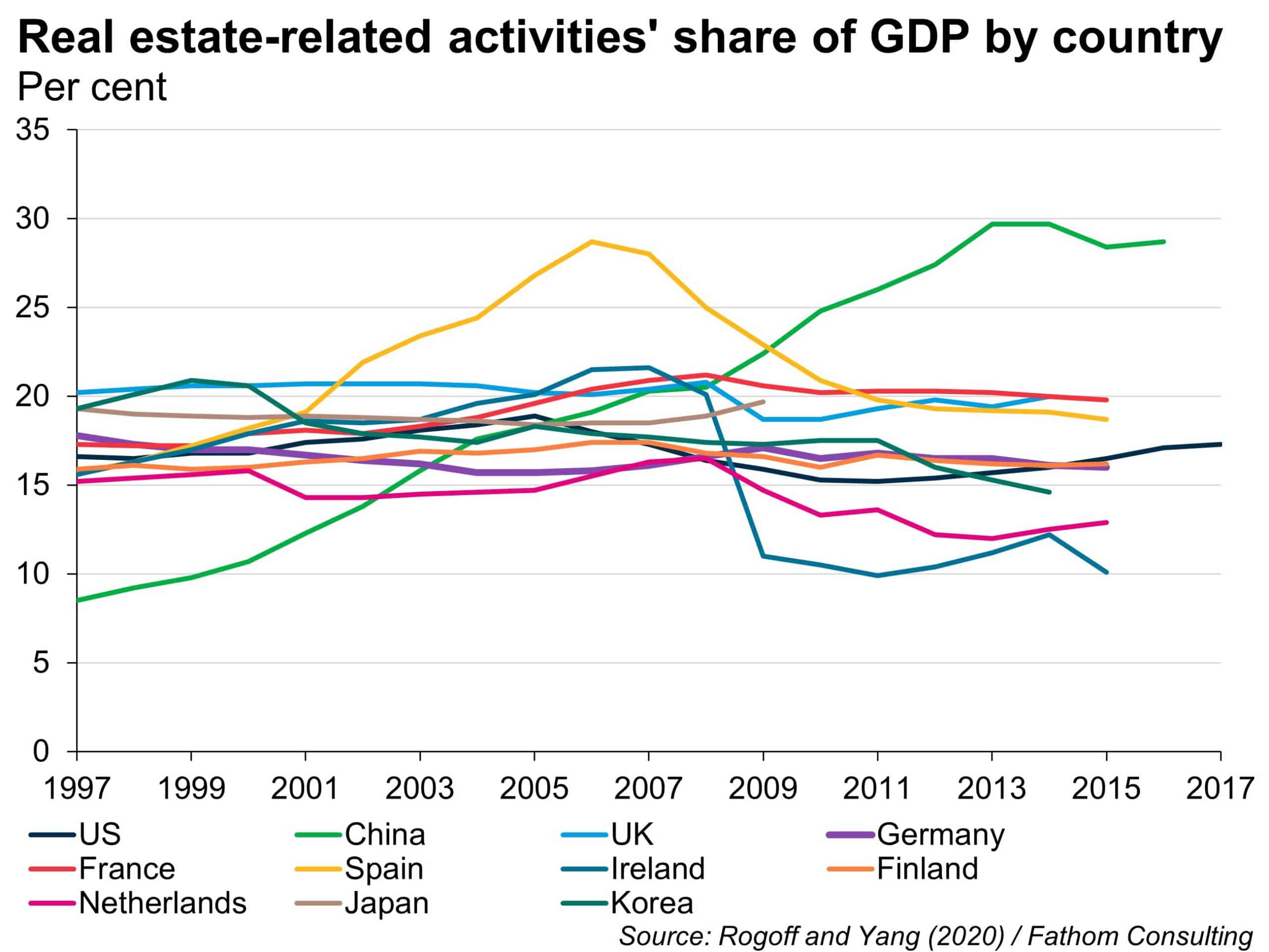

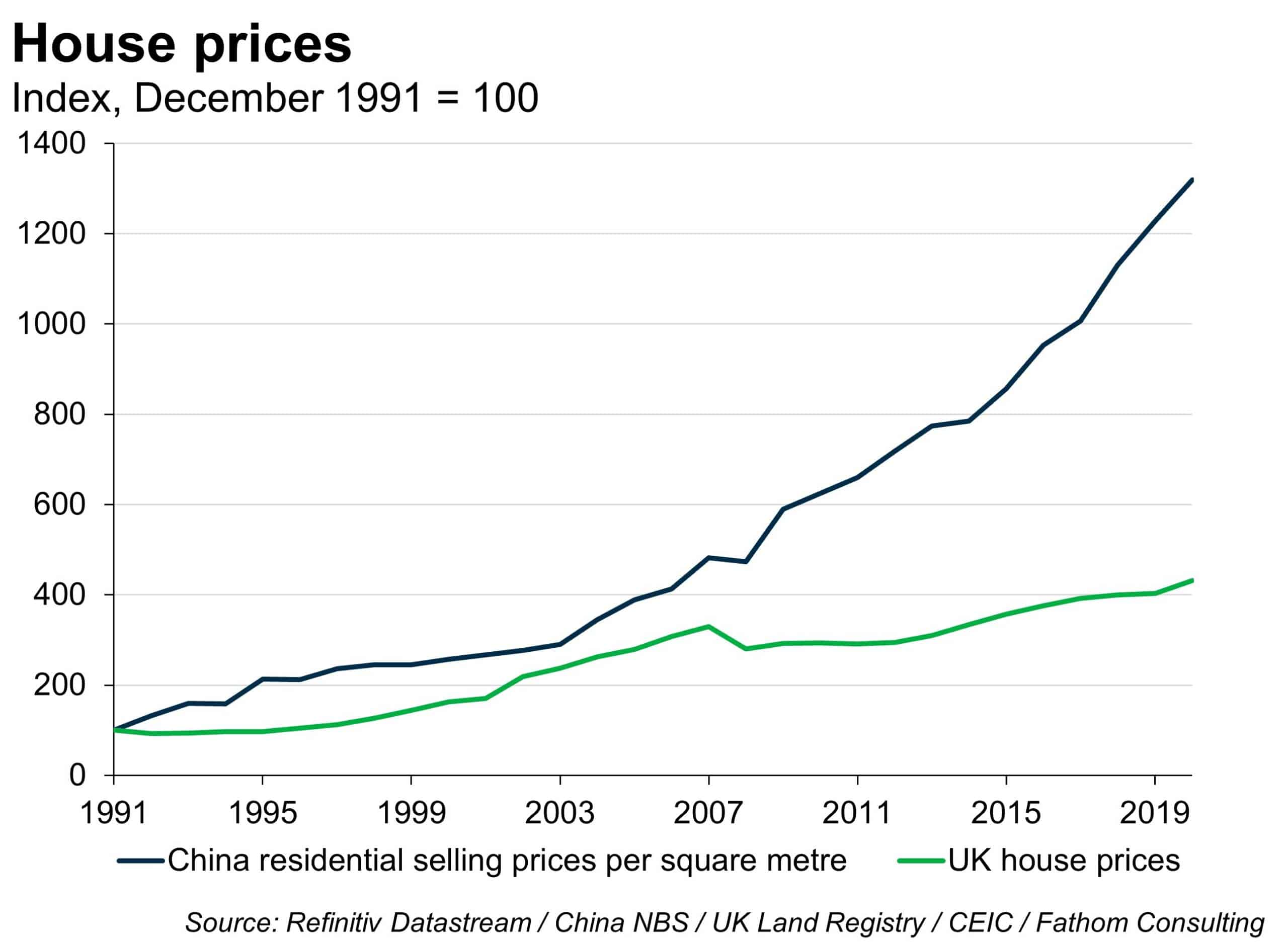

Housing is big business in China. All told, it constitutes up to 30% of GDP (chart below), a reflection of the authorities’ addiction to the housing market. Prices of houses have risen by over 400% since the turn of the century and the national house price-to-income ratio stands at nine,[1] with dizzying ratios evident in major cities.

In Fathom’s latest Global Economics and Markets Outlook, we argue that the authorities are unlikely to be willing to give up their addiction to using housing to boost the economy given the short-term consequences for growth, and we’re already seeing some policy loosening. A clearer insight into the authorities’ future intentions could be revealed by the growth target they set for 2022 and by their actions subsequent to next year’s National Party Congress.

We’re mad about housing and home improvements here in the UK too — in fact, it’s one of our favourite topics during beer o’clock (our CEO is apparently an expert on the life expectancy of boilers). Some of the recent media headlines such as UK house prices rise at fastest pace in 15 years and British housing boom created £3tn ‘unearned’ and ‘unequal’ windfall made me hark back to my days as a UK economist and ponder some of the major differences and similarities between the two housing markets.

One clear contrast is the penchant for building houses. Floor space ‘under construction’ and ‘paused’ construction in China are together estimated to be sufficient to house around 200 million people, while UK policymakers have been frequently criticised for building insufficient housing.

In terms of some major similarities, housing is also vitally important to the UK economy. According to estimates by Rogoff and Yang (2020),[2] the UK has consistently been close to the top of the leader board in terms of the contribution of real estate-related sectors to GDP, with their latest estimate around 20% (chart above).

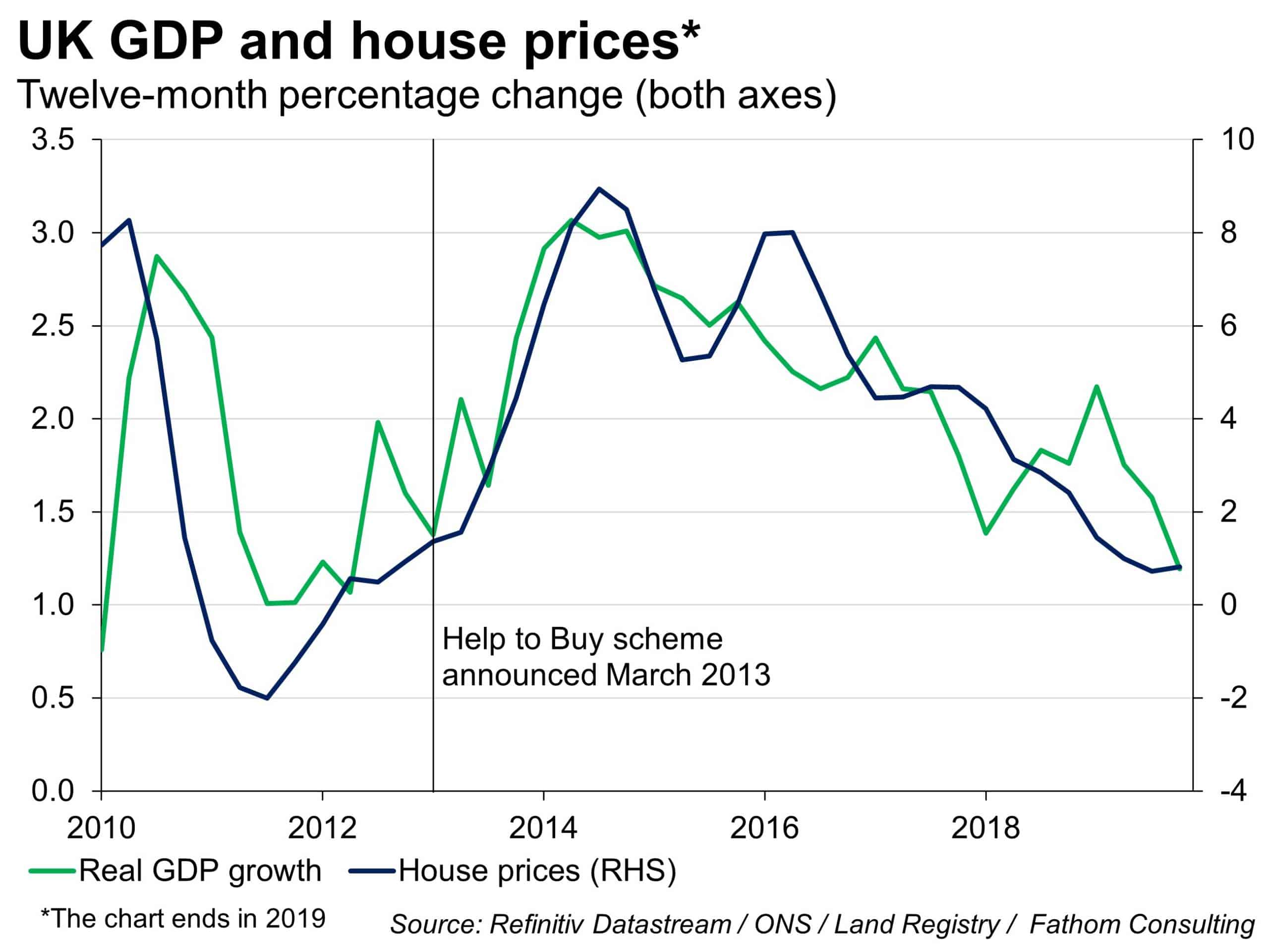

Although we’re not quite in ‘naked wedding’[3] territory here in the UK (and, believe me, I’m very glad for that), housing does matter for household spending and confidence. It’s for this reason that policymakers are reluctant to take away the punch bowl (after all, we know how much the current administration loves a good party). While the independent Monetary Policy Committee hasn’t intentionally stoked house price growth, it has been the consequence of too low for too long interest rates. And when monetary policy isn’t enough, the government always seems to be on hand. (Think Help-to-Buy in 2013, a policy which we once described as having the potential to “guarantee maximum damage to the UK’s long-term growth prospects”.)

As with any addiction, it’s hard to give it up. As property prices continue to rise across the UK, I’m just hoping this doesn’t lead to any ‘naked’ weddings. I suspect my colleagues feel the same — perhaps it’s why they’re all leaving London.

[1] In urban areas.

[3] For more on this phenomenon see China’s housing bares all.