A sideways look at economics

Healthy debate is strongly encouraged at Fathom. The house view on major economic, geopolitical and financial issues is not determined from the top down; rather, it is the reflection of hours of internal discussion, analysis and research, conducted by the team. A recent note on Chinese equity prices caused quite a stir internally and, as one of our colleagues pointed out, the debate surrounding the story would make for an interesting read. In this week’s TFiF, we provide that behind-the-scenes chat to you (minus the emojis, memes and general tomfoolery that tend to plague Fathom’s Teams chats)…[1]

For those that haven’t read the note in question, it can be found here (free to read). The note’s central call was that the recent rally in Chinese equity prices may have been more froth than anything else and that there was a material risk of a correction. Having dropped an early draft of the note on the discussion channel for Fathom’s economists on Monday, Juan Orts received the following comments:

Juan Orts (JO): Hi all — early fast chart available for review. Kevin Loane you are the official reviewer, but other comments welcome too!

Kevin Loane (KL): Thanks Juan — have left a few comments. It’s impossible to be 100% sure about moves in equity market movements. It seems one thing we can be more confident about from history is that a rally does not guarantee a big acceleration in growth.

Desné Masie (DM): Interesting context is that some people have been talking up China equities since July.

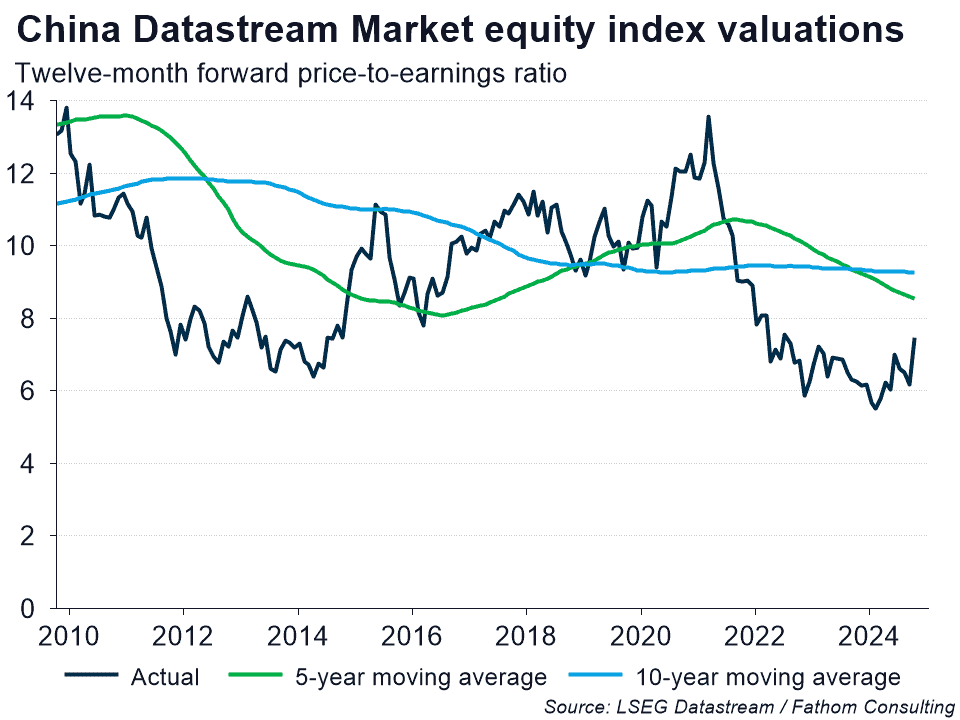

KL: Whoever listened made a lot of money. I was also bullish on Chinese equities because of low valuations — the 12m forward PE ratio is still below 5Y and 10Y moving averages.

JO: In this case, I don’t think the primary reason investors are buying equities right now is low valuations — they have been low for more than two years already as your chart shows. They are buying them primarily because of the stimulus measures announced. Everyone is investing based on the same expectations, so I think once they realise that the story is over they will all pull their money out at the same time, which could cause a quick and sharp fall.

DM: What about the sharp fall over the pandemic? China stayed locked down for way too long, while I agree the froth has to subside, I think some of the gains will persist.

KL: You may be right. Equally, the past two years could have been an aberration and the stimulus is the catalyst to squeeze shorts which was a very crowded trade.

Brian Davidson (BD): My two cents to add on this is that our market calls should be consistent with our econ calls — so if we’re expecting a sell-off in equities, that would normally be associated with weak GDP growth or policy tightening. If that isn’t our central forecast for China, then there needs to be quite a strong case to be bearish on equities (that could be trade-related, investor sentiment for different reasons or whatever).

JO: Thanks Brian. If you have a look at the note, I explain precisely that point: there is typically little relationship between economic growth and equity performance in China.

(Editor: Clearly, and extremely helpfully, Brian is giving his two cents without having read the note).

JO: You can have GDP slowing and equities booming (see for example the rallies of 2015–2017, which happened when growth was slowing). So, I think it is perfectly legitimate to be bearish on the China outlook and bullish on equities on a tactical basis, as long as we clearly explain why, as you point out.

Andrew Harris (AH): One comment from me — since we are also asserting that real activity won’t affect the stock market, are we asserting that Chinese equities are rising on the back of expectations that the government will stimulate the stock market directly? And if that’s the case (and if they’re doing ‘whatever it takes’) then will it also be the case that a subsequent fall in equity prices would be the result of investors realising that this won’t be enough in the end?

JO: Yes, either that investors realise that it won’t be enough OR simply that the rally has run its course once the stimulus ends.

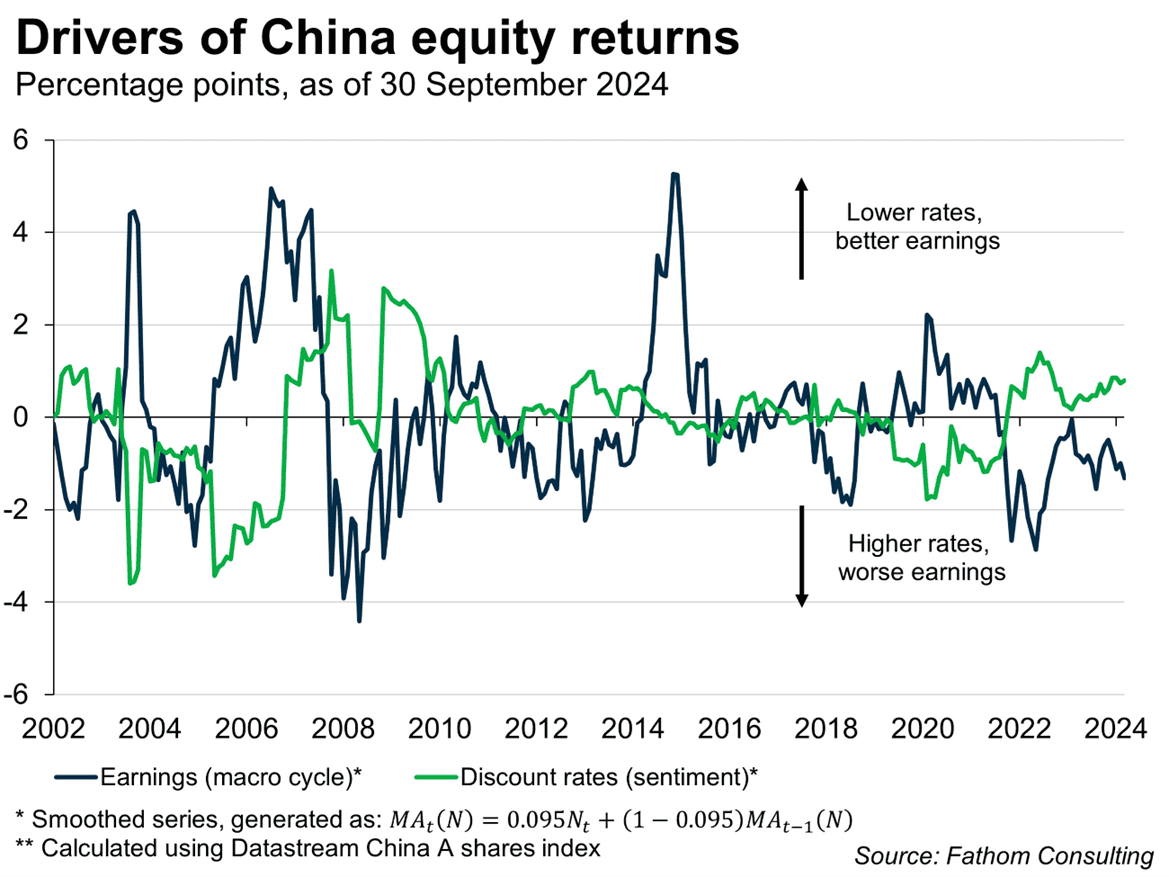

Dimos Andronoudis (DA): One thing that I need to point out is that investment decisions cannot be made on the returns only. It is important to consider the volatility too. From the start of the year Shanghai A-shares delivered a daily Sharpe ratio of 0.06 while the S&P 500 delivered 0.13. Volatility is the problem with Chinese equities: they never sustain their momentum long enough to reduce their risk profile.

AH: Why do you think that is?

DA: One reason is the decomposition of the drivers in equity movements — in China’s case, sentiment and fundamentals rarely contribute in the same direction as each other. In the US, long rallies have both lines positive. To me, China was never investable in 2024 for international retail and institutional investors because of its risk profile — if the fundamentals line does not pick up, then the sentiment line cannot sustain the rally (best case is that continuous pumping of money from the government would keep equities at same levels, or if the ‘put’ is watered down a bit then you would have a decline).

AH: What’s the correlation coefficient between the fundamentals and sentiment lines in China vs the same in the US?

DA: In the US return decomposition the correlation between the two smoothed series is 0.35, while in China it is -0.46.

AH: That’s a fab statistic!

The next morning (i.e., the day after the note was sent), the conversation continued with equities having fallen by the most in a single day since February 2020…

DM: That was fast: China stocks down 7% already.

BD: Must have read Juan’s note. Good call — bravo!

[1]This isn’t the first time we’ve revealed a behind-the-scenes chat at Fathom — for those interested in Kevin and Brian discussing the economics of climate change, please click here.

The terrible idea of price controls

The metaphysics of investing on Friday the 13th