A sideways look at economics

In spite of Fathom’s previous note, interest in virtual currencies, of which Bitcoin remains the most prominent, is unabated. It’s almost as though people aren’t listening to us! But no, that cannot be.

So what is going on – how to explain the continued demand for Bitcoin and the high value that it still commands?

Bitcoin transactions are cheap, secure and opaque – difficult to monitor or trace. That makes it attractive to those who would prefer to keep the beady eyes of government, the police and especially tax officials off their financial affairs. It’s also appealing to certain libertarians who like the fact that its existence owes nothing to any sovereign or central bank. And its design is appealing to the technology geek in all of us – it has that cachet of being difficult to understand and to explain, like 1970s prog-rock, or the music of Richard Wagner.

Strange bedfellows: money launderers, libertarians and geeks.

Bitcoin can now be used to purchase vegan, single-origin-bean macchiatos from a man with high-waisted trousers and a peculiar moustache. No doubt the purchaser will spend most of her time blogging against intrusive governments, while secreting her inheritance in a numbered account in Grand Cayman.

For such people, Bitcoin is an increasingly attractive substitute for cash.

We beg to differ.

Much like instant mash (for which there is probably an ironic retro retail outlet somewhere in the Hoxton area), Bitcoin’s valuation is lumpy and inconsistent.

Money is a store of value and a medium of exchange. Thus far, Bitcoin is a highly unreliable store of value, and in the long-term, with no sovereign standing behind it, it is even more questionable. To regard having no sovereign backer (or indeed any other backer) as being better than the alternative, you would have to take an exceptionally dim view of the value of an implicit sovereign guarantee.

Some Chinese people appear to be taking that view – and maybe with good reason.

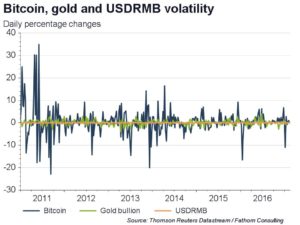

Despite wild gyrations in the value of Bitcoin, Chinese investors have dumped renminbi and increased their exposure to the crypto-currency dramatically.

This is part of a general trend, in which wealthy Chinese have sought assets that are not denominated in renminbi, resulting in dramatic capital outflows from China. The Chinese authorities are seeking to halt or reverse this behaviour.

As of several weeks ago, as a share of total Bitcoin exchanges, renminbi transactions accounted for over 95%! Perhaps we need to amend our stereotypical Bitcoin transaction above – should the purchaser of the macchiato be Chinese? And, thanks in part to that outflow from China, last year, Bitcoin investors were handsomely rewarded. The currency ended the year up 126%.

So long as the renminbi remains under siege, and Bitcoin a viable escape valve, the crypto-currency’s valuation is likely to remain on firm footing. Now might be the time to dust off the old laptop in search of my Bitcoin wallet. Its contents, a single Bitcoin, once of curiosity value alone and given to me for free, is now worth just shy of £1000.

Not so fast. China’s policymakers are already acting, and it is working. The renminbi share of Bitcoin transactions has fallen by more than half in the last two weeks. And the authorities may go further and ban Bitcoin altogether. The high value of Bitcoin might not last for long!