A sideways look at economics

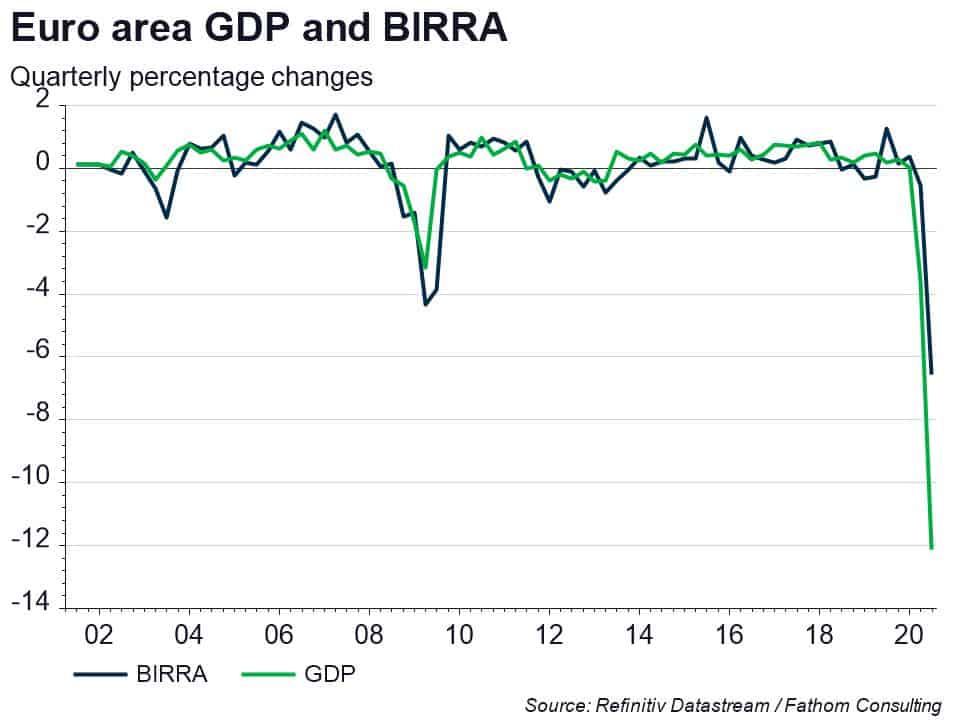

Cheer up, it’s International Beer Day! Two years ago, we first published the BIRRA — the Beer IndicatoR of Real Activity — which showed an apparent relationship between the price of alcohol-related equities and quarterly euro area GDP growth. In the spirit of International Beer Day, and in light of the unprecedented COVID-led global recession, we’ve decided to revisit that analysis to see what, if anything, the BIRRA can tell us about the recovery.

If there’s one thing we can always count upon it’s beer, right? That was our hypothesis back in 2018. As Lily Bollinger once put it, “I drink it when I’m happy and when I’m sad”. This sounds plausible, we thought, and thus expected to find no relationship between beer production and the state of the economy. How wrong we were…

As we noted then, it’s unlikely that beer production is determining economic growth (more likely than not, the causality runs the other way round). Implicitly, this suggests that beer is not entirely inelastic with respect to income (i.e. at least some people cut back when their earnings fall). We can’t explain the closeness of this relationship for certain, not least because my repeated pleas for field experiments to test the theory continue to go unheard by Fathom’s management team. (I can’t imagine why.)

So, how has the BIRRA performed in the latest recession? Well, while it did still outperform a simple PMI-based model in both Q1 and Q2, it failed to fully grasp the depth of the downturn in the first half of the year. There may be several reasons for this:

- Lockdowns haven’t restricted access to beer: Unlike some other goods (e.g. cars) and services (e.g. theatre shows), it’s always (thankfully) been possible to get hold of beer — i.e. supermarkets have substituted for pubs

- These are extreme times: Most economic models that perform well in normal times, struggle in extreme times (and things don’t get much more extreme than 2020)

- The BIRRA was a fluke all along: Since this is only a simple model, it’s entirely possible that there are missing variables or that it’s entirely miss-specified

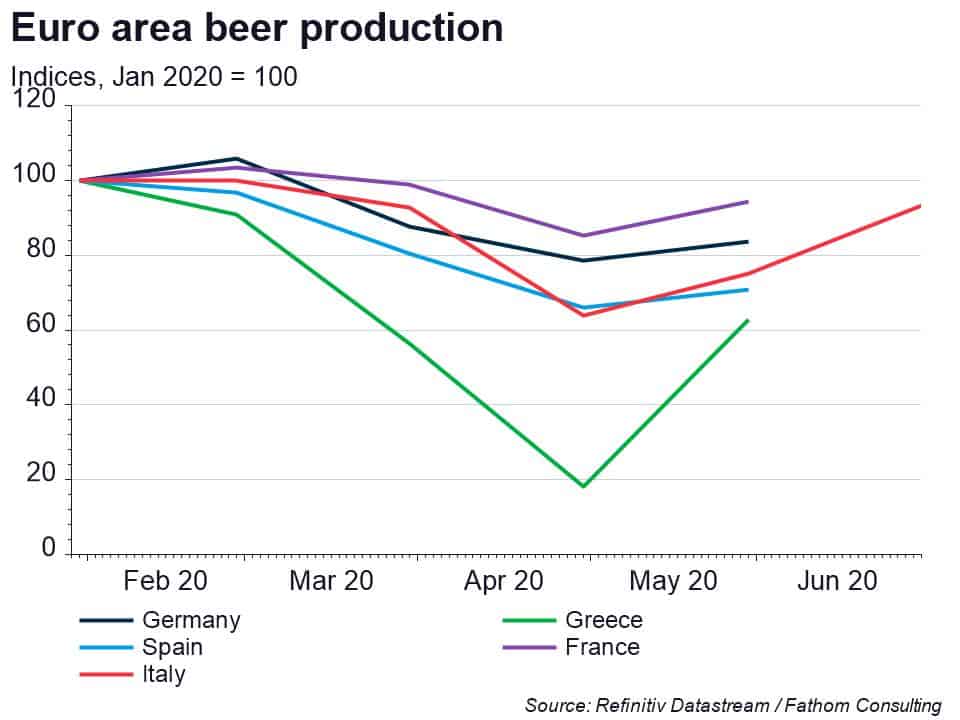

So, what’s the pint (sorry, point) of all this? Well, the BIRRA suggests some evidence of an economic recovery and in some cases (notably, Italy and Greece) the recovery in beer production has V-like characteristics. Of course, we must be careful in misinterpreting a correlation for a causation but nonetheless it’s encouraging to see some green shoots in the latter stages of the second quarter. Anyway, that’s enough about economics. It’s 5 o’clock and it’s International Beer Day so let’s just focus on our beer — cheers!