A sideways look at economics

The term ‘bucket list’ was popularised by a 2000s film of the same name. For those who don’t know, the term is often used to describe a list of things that you intend to complete before you ‘kick the bucket’. I don’t have a bucket list. That said, one thing I’ve always been keen to do is watch a rocket launch. Earlier this summer, I hoped to see this wish fulfilled…

NASA launches most of its rockets from Cape Canaveral on the east coast of Florida. I was staying in Orlando. It’s usually about an hour’s drive between the two. But I wasn’t going at a ‘usual’ time, I was going to see a rocket launch. And not just any rocket launch — I was going to see the inaugural launch of NASA’s Space Launch System (SLS), which is likely to set a new record for being the world’s most powerful rocket. The advice from staff at the Kennedy Space Center was to get there early — 4:00 am to be precise. So up I got at 2:30 am. About half an hour later I was in the taxi and on my way. Four and a half hours later I arrived… About half an hour after that, mission control scrubbed (cancelled) the launch.

The NASA ‘meatball’ at the entrance to the Space Center on launch day

To be fair, I knew there was a high chance of this happening — delays have always been common due to the complexities of space travel. (It’s quite literally rocket science!) But my trip wasn’t a complete bust — the Kennedy Space Center is among the best museums I’ve visited. But, being an economist, I couldn’t help reflecting on the parallels with the work we do at Fathom. Here are a few of my thoughts.

Capital depreciates, sometimes very rapidly

As you walk into the Kennedy Space Center, the first thing you are greeted with is the ‘rocket garden’. It contains unused rockets from the early days of the space programme. Pretty much all of them could have flown if they’d needed to. That said, none of these rockets could launch now. In fact, NASA’s rockets typically have a pretty short shelf-life — the SLS was originally only certified for 12 months from the point that it was first stacked (assembled), while the rocket’s flight termination (self-destruct) system needs replacing every 25 days. Compared to the economy as a whole (where fixed capital is normally assumed to depreciate at a rate of about 5% per year), these are obviously very quick depreciation rates.

NASA’s ‘rocket garden’

Knowledge tends to stick

We’ve forgotten how to go to the moon — if we chose to, we could simply rebuild the Saturn V rocket that last took astronauts there. The reason that we won’t is the unwillingness to bear both the costs and the risks involved in using technology that is more than 70 years old. That’s not to say that the SLS ignores the lessons from previous space programmes — far from it. Indeed, the history of space travel is one of continual evolution with each stage of the progress building on knowledge from previous ventures. First rocket in space, first man, first spacewalk, first rendezvous between two spacecrafts — all of these were steps along the road to Neil Armstrong setting foot on the moon. Knowledge from these experiences will be used in the SLS’s upcoming missions, most visibly in the form of the rocket’s two boosters which are literally taken from the space shuttle programme.

Scale replica of the space shuttle boosters

Knowledge also diffuses

In the sixties, there were only two real competitors in the space race. Nowadays, India and China both have their own space programmes, as does the European Space Agency. But these new players will have learned lessons simply by observing both the US and USSR. In other words, the knowledge of how to ‘do’ spaceflight has diffused. This raises an important point — the diffusion of ideas means that the benefits that an organisation gains from an idea diminish over time, as it is copied by others. Indeed, the convention is to assume that the depreciation rate of ideas is around 20% from a private perspective but 0% from the social perspective. As private companies such as Elon Musk’s SpaceX and Jeff Bezos’s Blue Origin enter the market for spaceflight, that wedge has significant implications for the research and development (R&D) of new ideas. The general assumption in classical economics is that this wedge means that private firms are incentivised to do less R&D than is optimal but there are also curious cases where that does not appear to be true — Tesla, is one such example. The EV manufacturer is far ahead of its rivals and, since 2014, has been willing to share its IP freely with the rest of the world. Why? It’s because it backs itself to continue pushing the frontier at such a pace that rivals can’t keep up, even if they give away the answers!

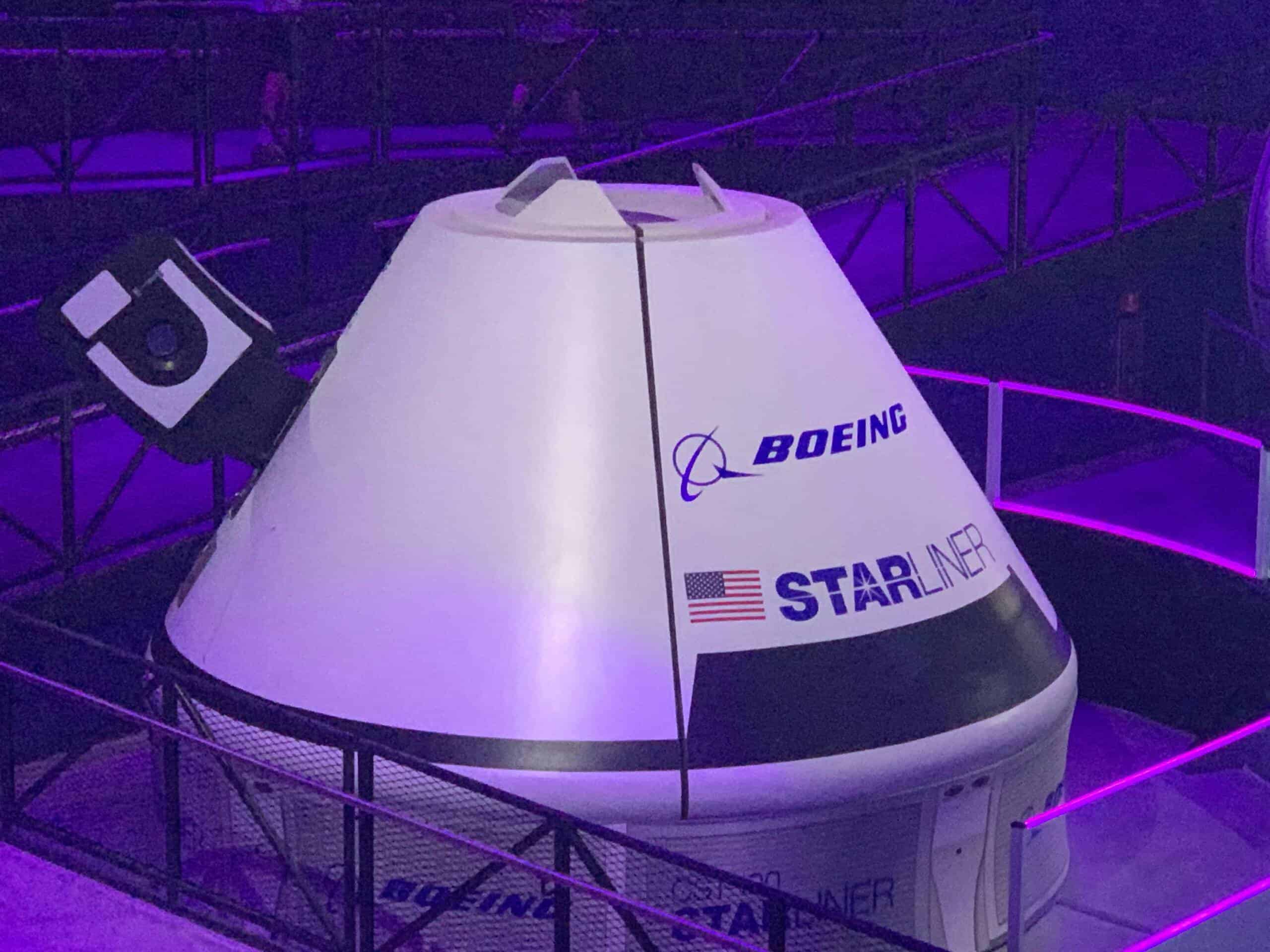

Boeing’s Starliner capsule

Buy a ticket, not a rocket

In recent years, NASA has made big changes to the way it interacts with the private sector. In particular, the space agency has moved away from cost-plus contracts whereby NASA would foot the bill for additional unforeseen costs, effectively shifting the development risks on to the public sector. NASA now engages with companies like SpaceX in a different way, buying seats on rockets as opposed to the intellectual property for them. This has enabled huge cost savings: the cost of resupplying the International Space Station having fallen by more than 60%. This is a good way to do public-private partnerships as it both shifts the risk away from the public sector and reduces risk for private innovators who are guaranteed a market for their products.

A used SpaceX Falcon rocket

Shooting for the stars, land on the moon[1]

Want to know the real reason for JFK’s moon-shot aspirations? Well, he already told you — it’s because it’s hard! By the early 1960s, the USSR had taken the lead in the space race. JFK asked LBJ who asked WvB (Werner von Braun) what should be done about it. As I learned on a recent BBC podcast, von Braun effectively rejected the idea of US-Soviet competition in low-Earth orbit on the basis that you’d always be playing catch-up. He argued that, in an environment of rapidly evolving technology, it would be better to change the game altogether. Circling back to the previous point — how do you beat Tesla if it continues to advance the frontier so quickly? One way is to change the game, perhaps by focusing things like hydrogen-powered vehicles or EVs with replaceable batteries.

An unused Saturn V rocket — to comprehend the size, compare it to the people standing directly beneath it

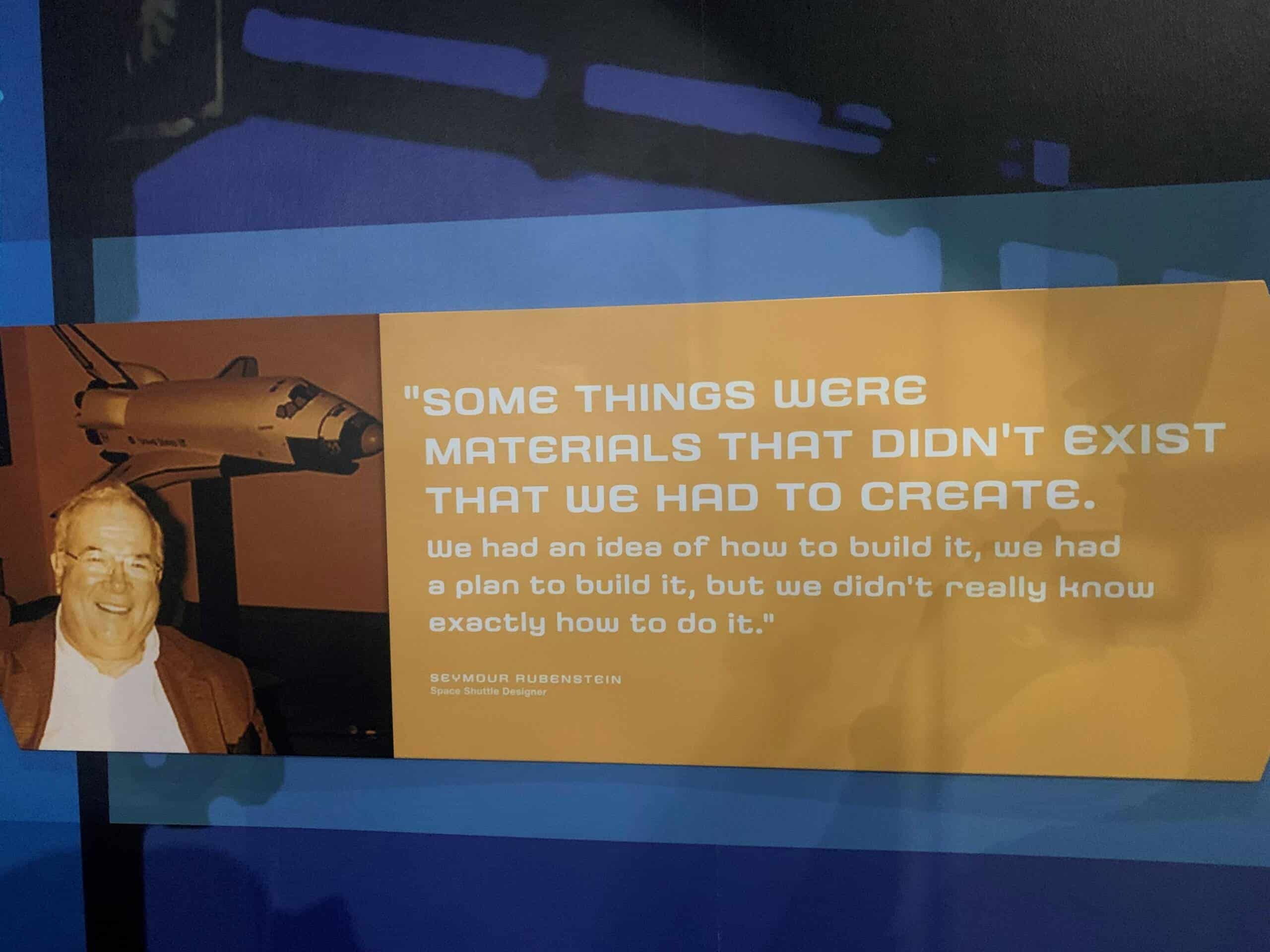

Be bold

During the Apollo missions the average age at mission control was 26. Gene Kranz, the man in charge, was an old man by comparison at 36. Recruitment for the project was driven by two key criteria — they wanted the brightest talent, and they wanted people keen for a challenge, no matter how big. That reminds me a lot of Fathom actually; not only are we also a young company — the median age is 33 — but we’re also keen for a challenge. Indeed, we do what we do, not because it’s easy, but because it’s hard!

Words from one of the space shuttle’s designers

I could go on about NASA’s impact on Silicon Valley (it was the largest buyer of computer chips) or the many technologies that have spun off from the organisation’s work, but perhaps I’ll stop here for now. My trip was fascinating in many ways, even though I wasn’t able to see the rocket launch as hoped. As I said at the start, I’ve always wanted to see a rocket launch — that hasn’t changed…

More by this author:

[1] No, I haven’t got that the wrong way around, everyone else has. In terms of distance, the moon is much, much closer than the nearest star. (Which is a good thing since we’d all be fried otherwise.)