A sideways look at economics

Smallest violin in the world alert: delayed planning and pent-up demand from other would-be travellers meant that I faced a potentially eyewatering cost to spend a week by the Mediterranean. With flights to Italy coming in at $1000, car rental at $2000 and Airbnb at $3000, I opted instead for a staycation in London. This #firstworldproblem is one example of substitution. At the moment, the price of almost everything is rising, but some prices are rising by more than others. So while it would be pretty hard to avoid a generalised increase in the cost of living, it’s possible to adjust your consumption to dodge some of the most pronounced price hikes. Here’s my take on where to divert spending and where to double down.

Foreign vacations (out) / staycations (in)

Presumably, you are paying or have paid a lot for the privilege of living in your home. Why not take some time to enjoy it and the place it’s located? Not only will this save you an enormous amount on the cost of travel and accommodation, but it will also negate the (increasing) risk of delays and lost bags. This substitution will help you avoid swarms of stressed passengers. The way this summer has gone, odds are you won’t even have to sacrifice on sunshine. The price of home repairs has increased rapidly (parts and labour). So why not save on the latter by going to your local hardware store before getting stuck into some YouTube DIY videos?

Cars (out) / bicycles (in)

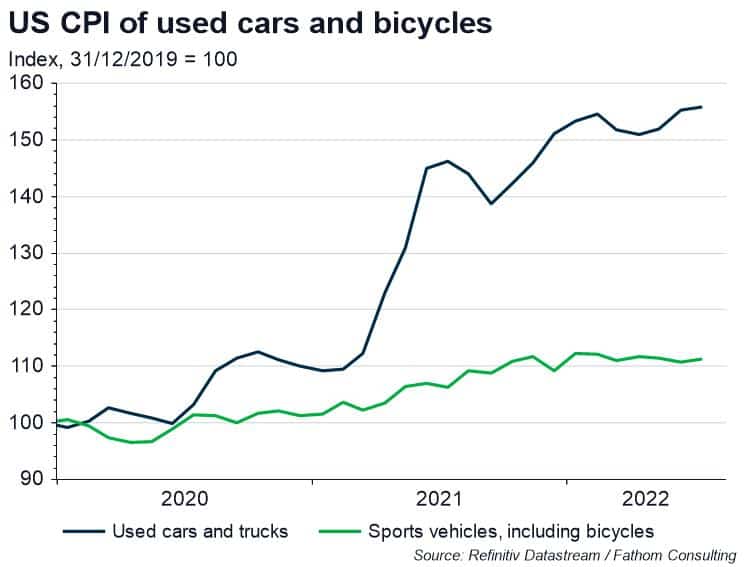

A lot of weird things have happened over the past couple of years, but one of the strangest (from an economics perspective) has been the rapid spike in used car prices. In the US, the annual inflation rate of used cars and trucks peaked at almost 40% earlier this year. Used cars are not often thought of as good stores of value, never mind appreciating assets. In any case, this rapid increase is a good reason to avoid the motor vehicle, particularly if you live in a big city. So instead of buying a car, why not buy a bike? Sure, the price of two-wheelers has also increased, but by a lot less. Moreover, they are much cheaper to run. In my case, I’m hoping the substitution of bike rides for car rides will help to hasten the disinflationary process – around my waist at least.

Food delivery (out) / restaurants (in)

Speaking of which, the number of people on the road delivering food seems to grow day by day. Look, I get it: pressing a few buttons, and getting your comfort food delivered to your front door is pretty awesome (shoutout to Wingos in DC). But it is an undeniable luxury. Times are tough and the price of delivery apps keeps rising. Between the service charge, the delivery fee, local taxes and tip, the cost sure adds up. For my next substitution, use your new bike to go get those wings yourself. Even better, cook at home. When in the mood for a treat, go to a restaurant. Not only will the food taste better than when it’s delivered, but the atmosphere will be better, too. And not having to do the dishes? Priceless.

Putting it in cash (out) / BTFD* (in)

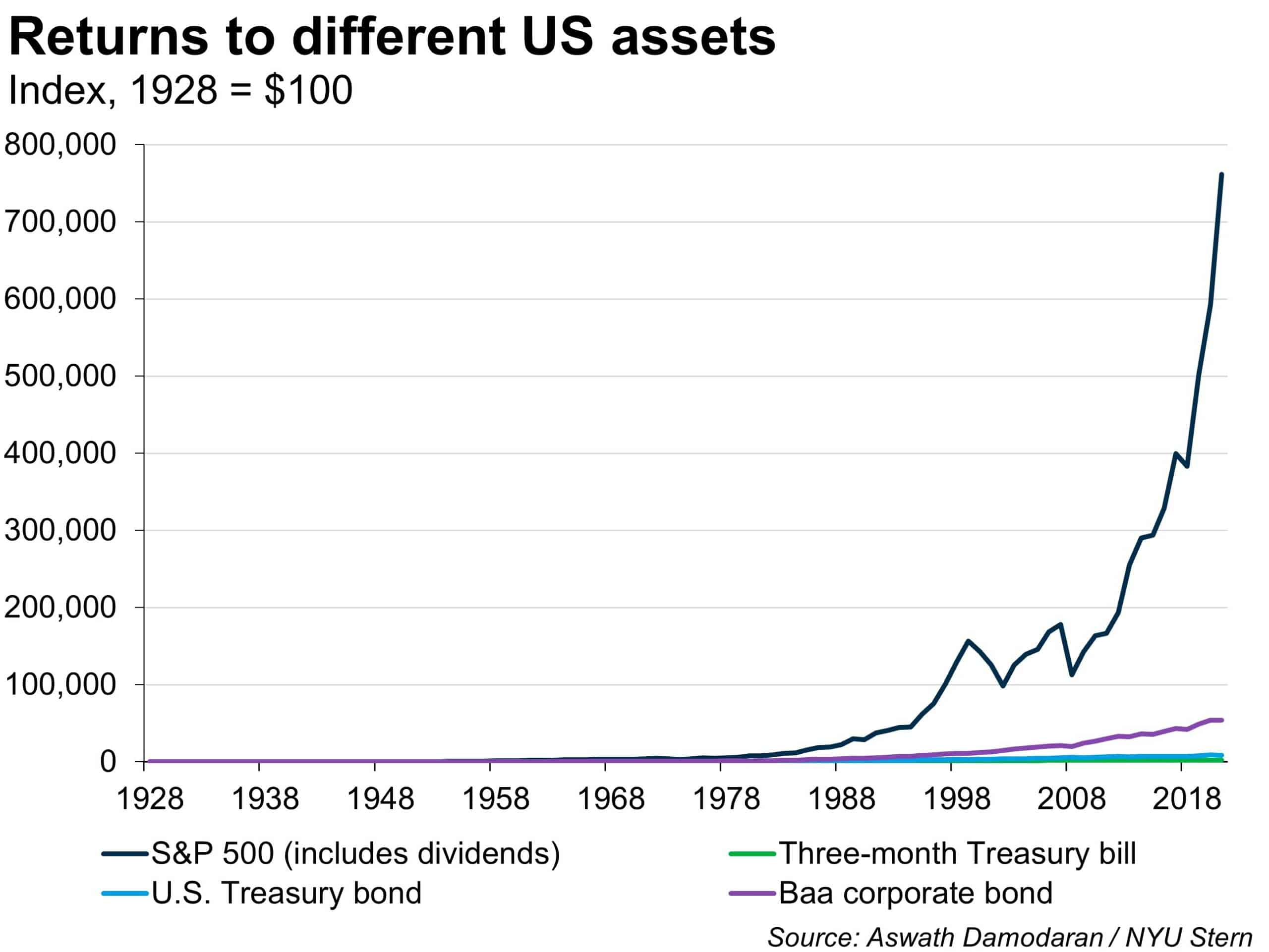

With inflation high, money concerns become more acute. This is amplified when people’s net worth drops due to falling asset prices. In casual conversation, complaints about gas prices are closely followed by laments about declining equities. With stonks down (some by a lot), and interest rates finally offering more than zero (in nominal terms), people may be tempted to try a substitution of their own devising and keep their money in cash. I take the other side on this, putting additional funds into stonks, the price of which thirteen-year-olds on Reddit assure me ‘always go up’. To be fair, the kids have a point. Over long periods, the returns to money invested in an equity index are far, far superior to those invested in bonds or cash. If you’re a long-term investor who doesn’t face near-term liquidity constraints, go ahead and keep buying stonks (whether they have dipped or not)![1]

[1] Not official investment advice. We will present a comprehensive assessment of the economic outlook and relative opportunities in asset markets in our forthcoming Global Outlook, Autumn 2022).

More by this author