Geoeconomic implications of a fractured global economy

What are the risks, and where are the opportunities?

The map of the global economy is slowly being redrawn. As tensions between the US and China increase, countries are being forced to re-evaluate the risk that comes with their economic ties. If divisions deepen into a fracture, economic blocs will solidify; and the flow of global trade will be altered, interrupting supply chains in critical materials and technologies.

This report, Geoeconomic implications of a fractured global economy, commissioned by the Special Competitive Studies Project, predicts the likely alignments of the competing blocs and the implications of such a change.

Interruptions to the supply of strategically important goods will result in temporary shortages and vulnerabilities, but will also present opportunities for new suppliers to step up. This report assesses the challenges that supply chain de-risking presents for the US, identifies the countries that could benefit as new production centres, and estimates the investment in fixed capital that could be required to make this a reality.

Report at a glance

This report considers the implications of a divided global economy, looking particularly at global trade. We use advanced econometric techniques to assess how exporters are likely to align in a fractured world, and analyse a database of more than 1200 products to determine where supply vulnerabilities could arise, how they could be countered and at what cost.

The report finds that:

- Economic dependency, military ties and societal values can go a long way to explain a country’s geopolitical alignment

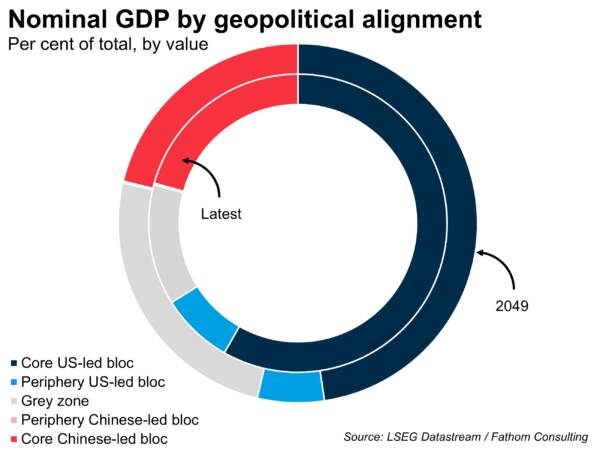

- If countries are grouped according to these fundamental drivers, a US-led bloc would be expected to represent a larger share of global GDP than a Chinese-led bloc out to 2049

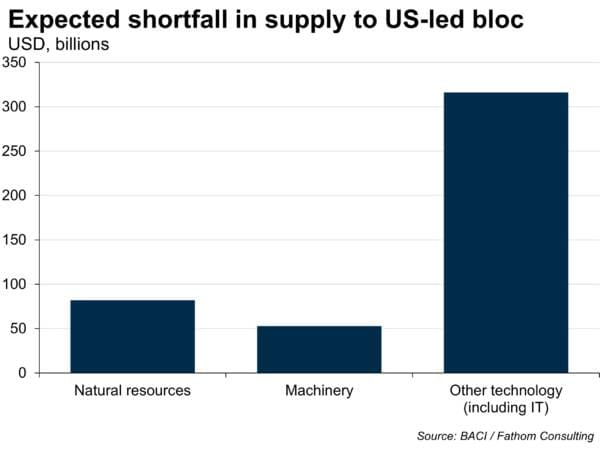

- US supply chains for 29 strategically important products could be at risk in a world in which the global economy fragments

- Just seven countries could collectively increase production to meet half the expected shortfall in these goods — these countries should be a priority for US foreign policy

- Fostering closer ties with key countries could also boost their odds of aligning with the USA — we identify which levers could be the most effective and where

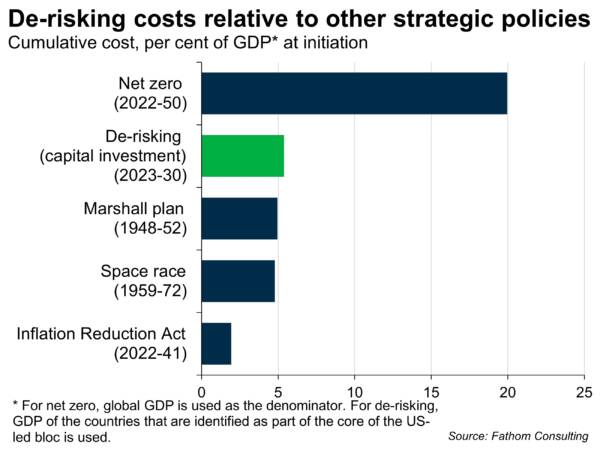

- A fixed capital investment of up to $3 trillion could be required to ramp up production in these countries and meet the US-led bloc’s needs — expressed as a share of GDP, this number would be comparable in size and ambition to the Marshall Plan

- If the US delays a credible commitment to de-risking, costs escalate

Key calls

-

Who will side with whom?

If the global economy fractures into competing economic and geopolitical blocs, our model suggests that 75 countries are likely to side with the US, but only 6 with China. Many low-income countries will be keen to remain non-aligned.

-

What will it cost?

A fixed capital investment of $3 trillion could be required to meet new production needs. This is comparable to total spending on the Marshall Plan or the space race, but is significantly less than the fixed capital investment required to meet net zero.

-

Supply chain vulnerabilities

Fathom’s analysis of more than 1000 trade flows at product level shows the areas where the US and its allies are most likely to experience shortages in a bifurcated world.

-

Potential beneficiaries from de-risking

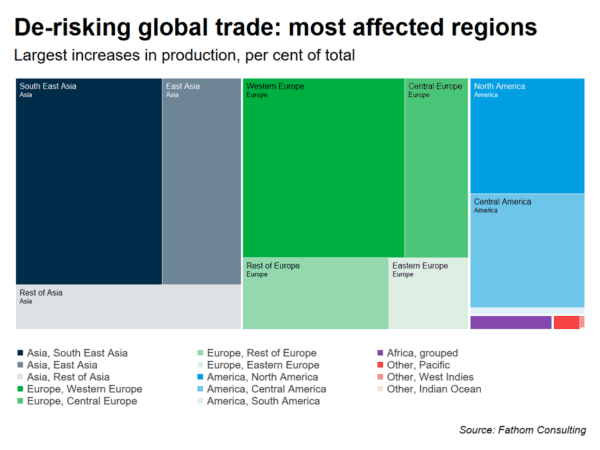

Fathom’s analysis reveals that countries in Europe, North America and parts of southeast Asia are best placed to step in and replace China’s role in global supply chains. This could provide a significant economic boon for some of these countries.

-

Distribution of GDP after de-risking

Countries in the US-led bloc dominate the global economy and are expected to represent a larger share of global GDP than the Chinese-led bloc out to 2049. However, the majority of the world’s population lives in countries likely to form part of the non-aligned grey zone

Insights

Our focus areas

This report touches on issues related to two of our core focuses.

“Many analysts write reports on current supply chain vulnerabilities. Fathom’s work goes further, providing forward-looking insights into global dependencies in the wake of potential future shocks. Their data-driven, sector-level framework helps readers prepare for a post-globalized world.”

Liza Tobin, Senior Director for Economy, SCSP

Meet the team

Erik Britton

Managing Director & CEO

Laura Eaton

Chief Operating Officer

Kevin Loane

Head of Product Development

Andrew Harris

Deputy Chief Economist

Joanna Davies

Head of China Economics & Government Services

To request to read this report, please fill out the form below.