Global Outlook, Winter 2023: The Matterhorn, not Table Mountain

- In our central scenario the US avoids recession, but only because both short- and long-term rates fall faster than expected.

- The near-term path for the US federal funds rate implied by market pricing has shifted significantly since we finalised our forecast last month, and now lies very close to our own.

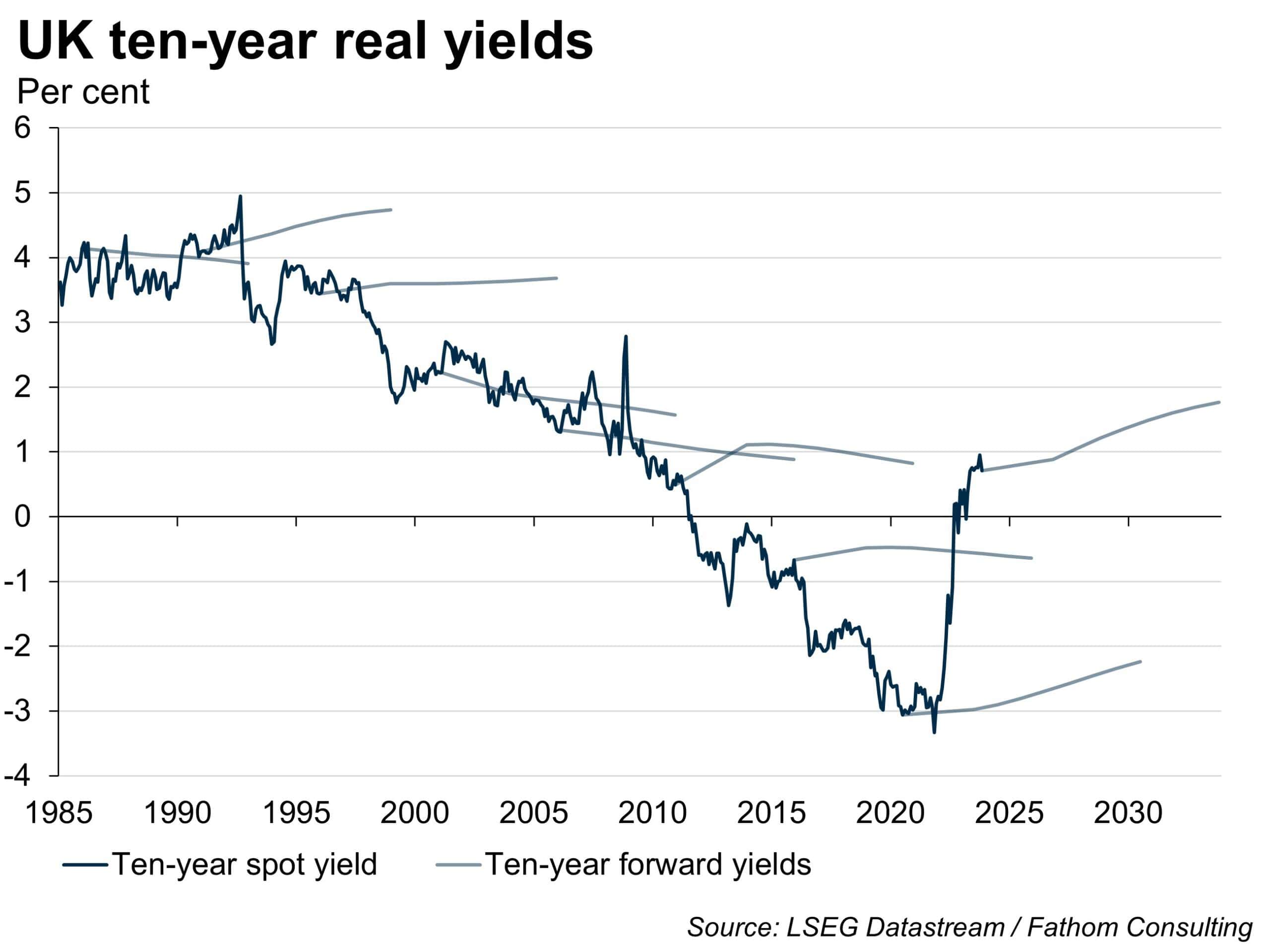

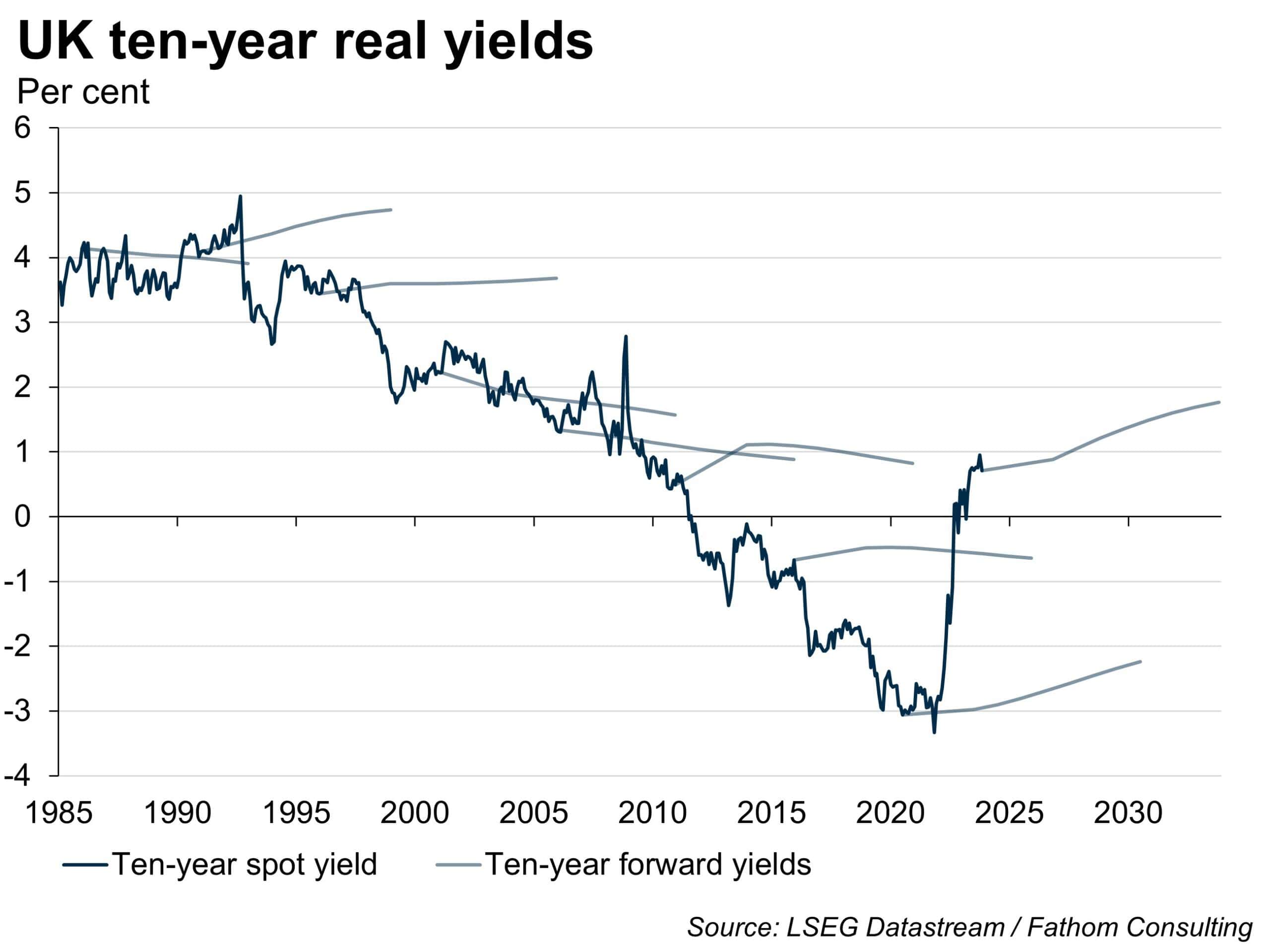

- But the focus of this piece is long-term interest rates, which remain elevated.

- Long-term interest rates turned a corner around the time of Jerome Powell’s decision to stop referring to the pick-up in inflation as ‘transitory’.

- The shift in long-term interest rates reflects greater uncertainty regarding the monetary policy outlook.

- This uncertainty is likely to fade over the coming year or two, causing long-term rates to fall faster than the market is currently pricing in.

- We discuss a number of the risks to this optimistic scenario, including a world where investors lose faith in QE and concern looms regarding large fiscal deficits.