A sideways look at economics

Voters head to the polls this weekend to decide between an incumbent whose popularity has suffered amid high inflation, and an unconventional outsider candidate with weird hair. For Americans unhappy with the probable choices on offer in next year’s election, Argentina shows that it could be worse. Citizens of Latin America’s second largest economy are forced to choose between Sergio Massa, the Minister of Economy in a country with inflation at triple digits, and Javier Milei, an academic economist, who carries a chainsaw to speeches as a visual aid that helps emphasise his commitment to spending cuts. As part of his economic revolution, he also wants to dollarise the economy and eliminate the country’s central bank. On a recent trip to Buenos Aires, a pro-Milei taxi driver told me that the upstart may be ‘un poco loco’ but so is the country’s economic history, with the country having faded from being a jewel in the New World’s crown to becoming a punchline in jokes about sovereign debt.

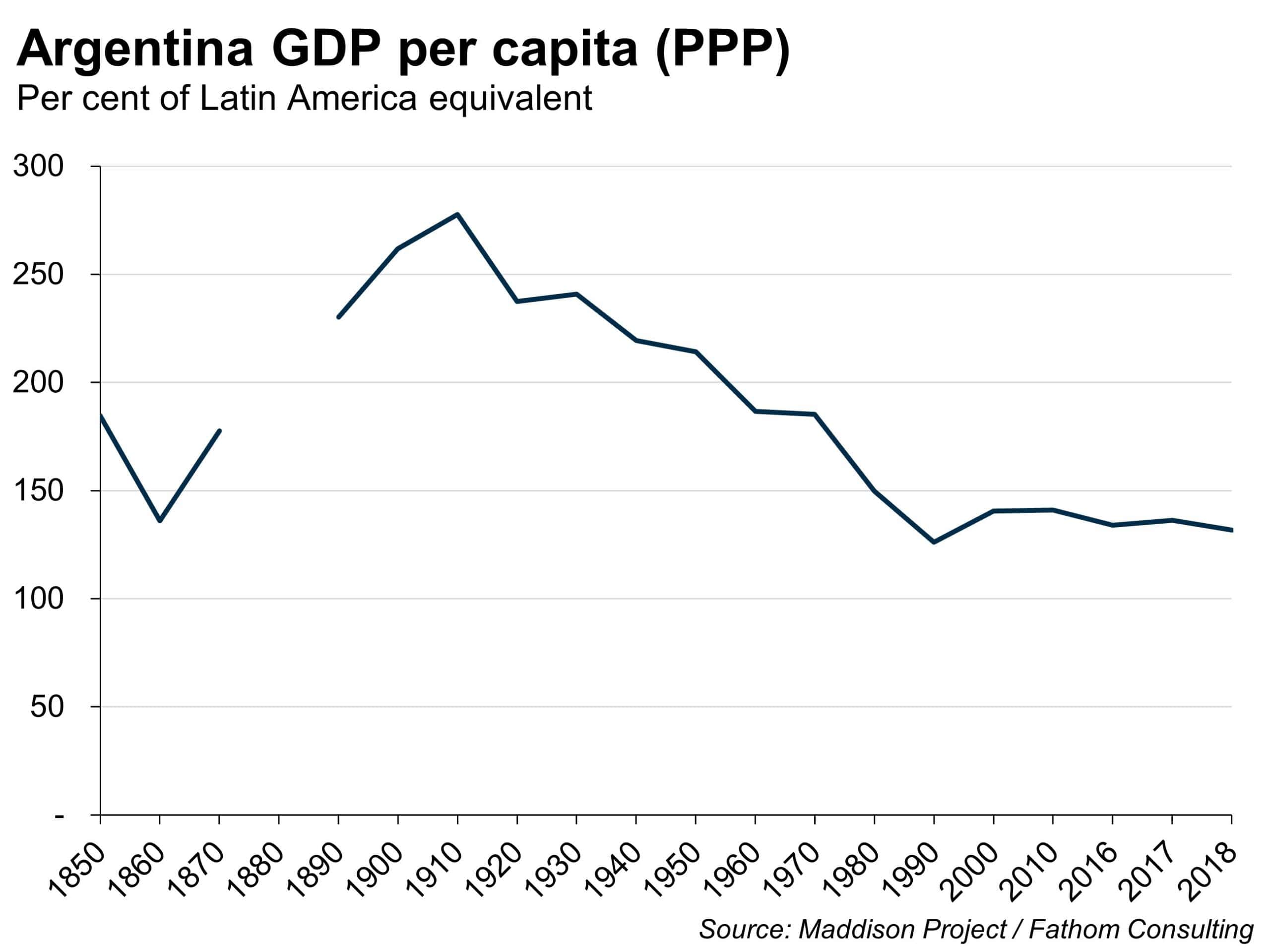

The country was among the richest 120 years ago, as the flat grassland of Las Pampas delivered ideal conditions for cattle to graze on and helped to power a beef-led economic expansion. Inward migration soared, particularly from Italy, amid a large income gap in favour of Argentina. This ‘belle epoque’ for the country meant that at one point the average per capita income (PPP-adjusted) was one and a half times that of ‘the old country’ – over 60% of Argentinians are of Italian descent. As of a few years ago, average income levels were around half of those in Italy. Recent economic performance and, in particular, the large burst of inflation that the country has recently witnessed will probably have made that figure worse. It is no wonder cab drivers are willing to roll the dice on an outsider.

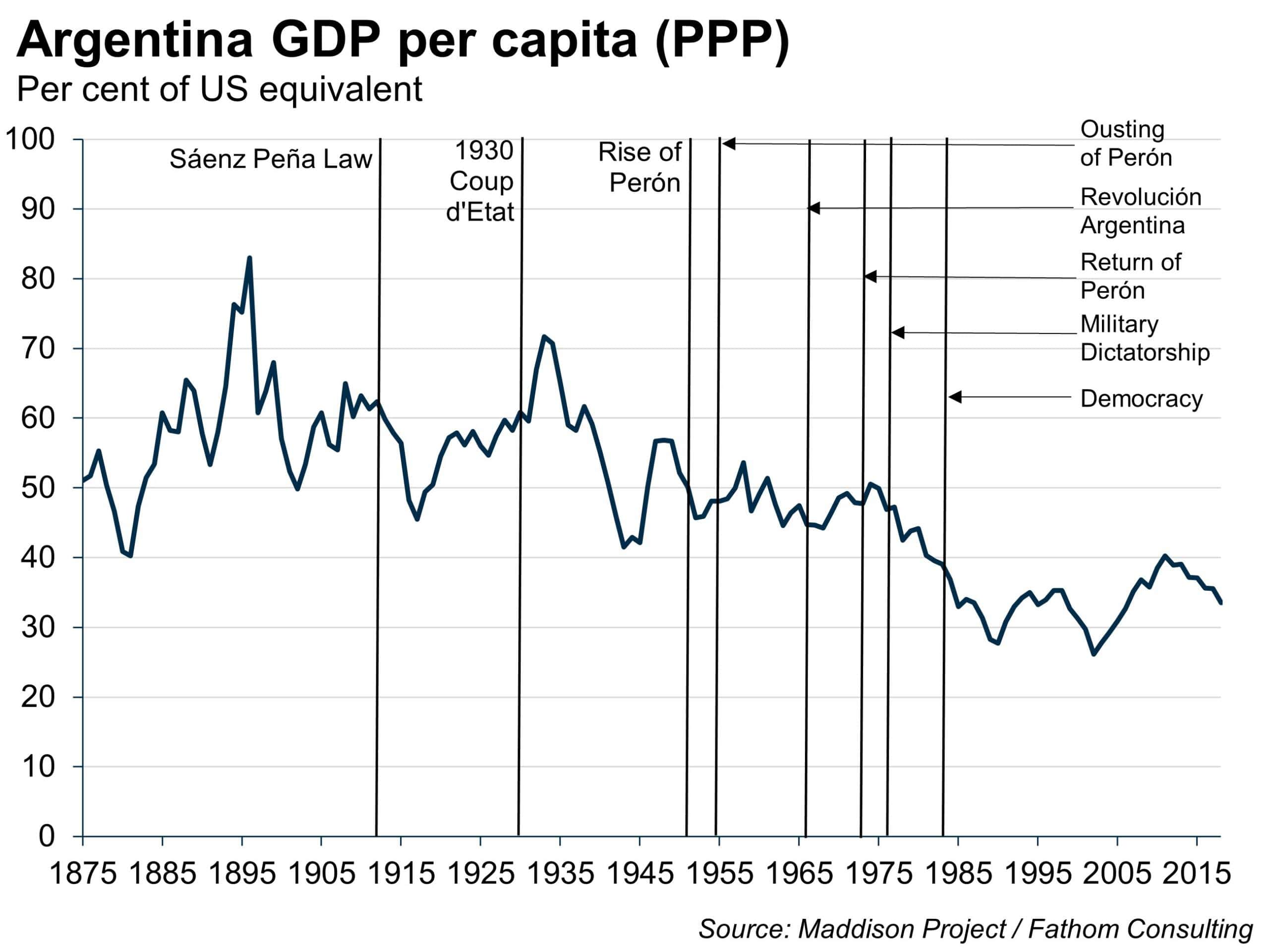

While many Argentinians may compare their living standards to that of their ancestral homeland, it’s not the most scientific benchmarking exercise. It is commonly accepted that institutional failure explains a lot of Argentina’s relative economic reversal. Indeed, using synthetic control group analysis, a recent academic study[1] concluded that with more competent political leadership, the country could have the same GDP per capita as New Zealand. The chart below shows Argentina’s GDP per capita fading alongside some key political outcomes.

Views on Argentina’s economic decline differ significantly depending on the perspective. Compared to the US, Argentina looks like an economic laggard. However, the US is exceptional. In our Global Outlook, Autumn 2023 we showed that G7 economies were increasingly falling behind an ascendant US. Compared to other countries in the region, Argentina is above average, although admittedly it used to be much richer. Some economic fallback was inevitable given the country’s reliance on commodities, including beef. when Argentina was booming. However, the poor record of fiscal management by Argentina’s leaders and their propensity to borrow has made this worse.

It’s up for debate how much potential has been wasted, but it’s beyond reasonable doubt that recent economic policymakers are guilty of incompetence. People in Europe and the US dealing with their first inflation shock should try visiting Argentina for a taste of the real thing. Among the many quirks that 10% monthly price increases have introduced is a multiple exchange-rate regime. The currency’s unofficial ‘blue rate’ is widely observed, with news shows presenting a constant ticker on screen. People check it throughout the day, much like the weather. Checking into a hotel the day after the first round of presidential elections last month, one US dollar had gone from being worth 850 to 950 pesos between me dropping my bags in the room and my return to the front desk. Compared to the turn of the year, one US dollar will get you three times as many pesos. These are numbers that make the Truss administration look like paragons of economic stability.

One small benefit from the rapidly depreciating currency is that it will act as a magnet for foreigners, who wish to experience fútbol, beef and maté at prices that can only be described as incredible. However, the country’s isolated location means that it will likely be difficult to build an economic model around foreign visitors like me – the tourism sector accounts for just 1% of GDP.

Argentina’s economic turmoil is sad to see, and I felt like it was something of a collective blow to a nation of truly patriotic people. The precise economic model they opt for is a matter that only the Argentinian people can decide. My two cents of advice is that dollarisation shouldn’t form part of it, given the reduced flexibility in economic policymaking that it would bring. On the one hand, it might help to limit credit-hungry politicians and, in time, inflation (probably). But, on the other hand, it would come at the cost of a much-reduced ability to respond to exogenous shocks. Implementing it could be viewed as tacit acceptance that the country’s politicians, and by extension electorate, can’t be trusted.

So when it comes to taxi drivers, often an extreme barometer of the national mood, I’d put my personal views closer to a guy called Roberto. During a discussion about football (what else?), Roberto lifted his left sleeve to reveal three tattoos: Boca Juniors, Pink Floyd and Diego Maradona.

[1] https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3242408

More by this author