Headlines

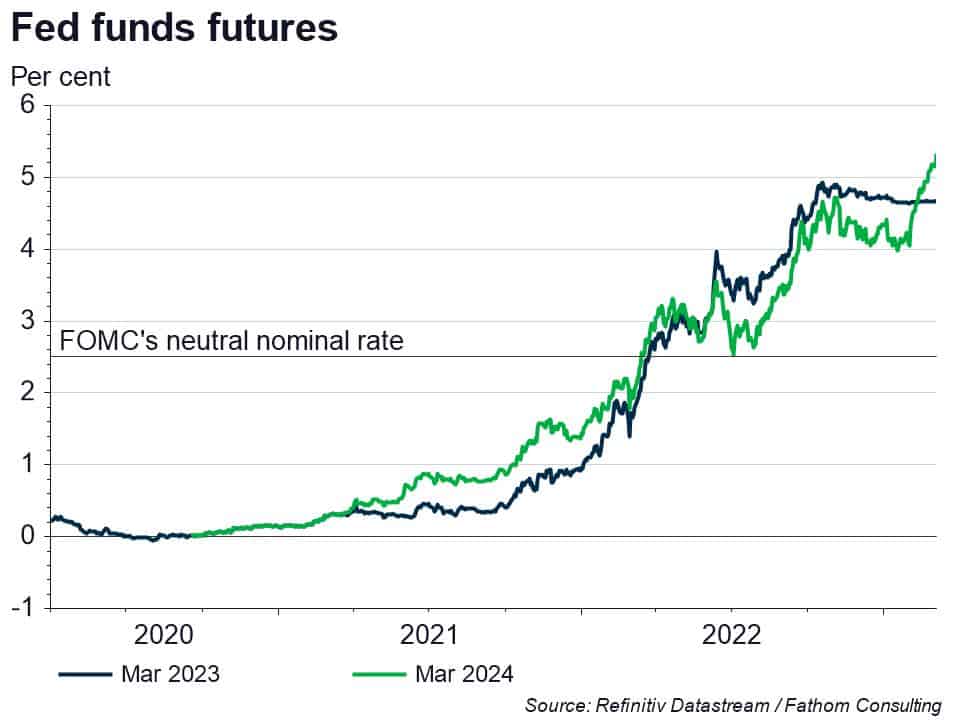

- As economic data continue to surprise on the upside, markets flipflop again from worrying about a recession to fretting about higher rates

- A recession is probably delayed, but is still on the cards as the rebound in post-lockdown China has peaked

- The real estate sector holds the key to tracking the long and variable lags of the impact of tighter rates on the real economy

- Drops in real prices in key real estate markets and weaker housing demand in the US present clear fault lines that should be taken seriously

[Please click below to read the full note.]