- China’s lockdowns to meet its ‘dynamic zero-COVID’ policy mean the world’s second largest economy is likely to contract in Q2

- The developed economies (DMs) experienced a V-shaped recovery from the pandemic, but are now enduring inflation at multi-decade highs

- Consumer confidence has collapsed as a result, and is now at levels that have almost always resulted in recession

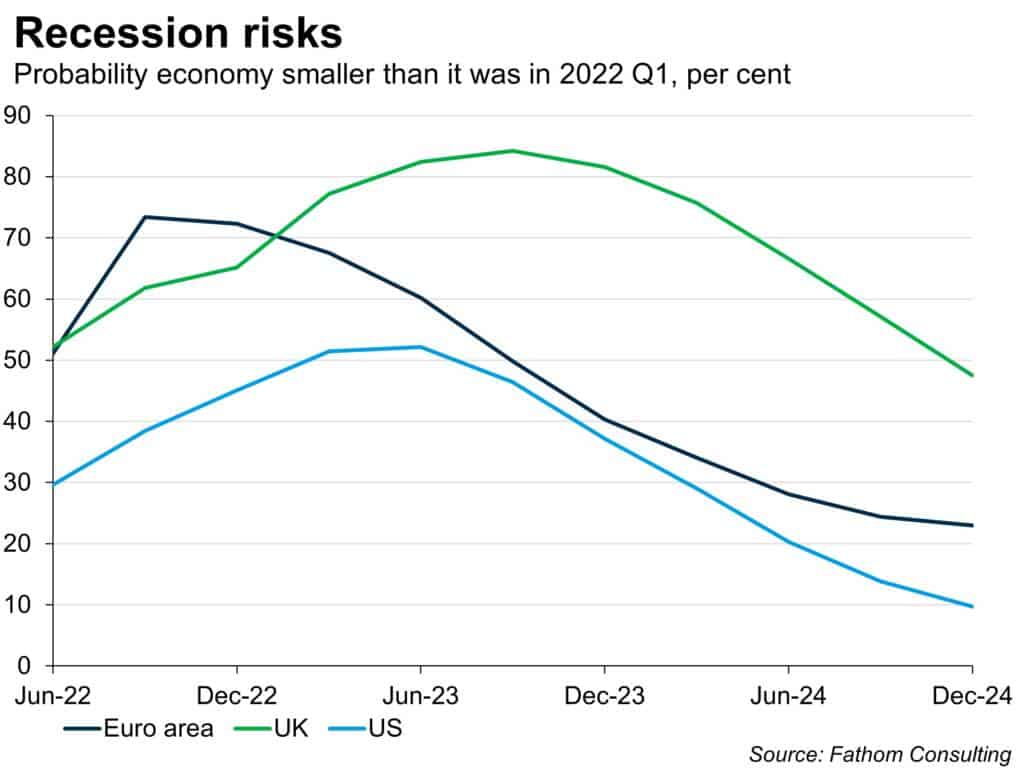

- We see a broadly evens chance that the euro area is already in recession

- If the EU avoids a contraction in Q2, it will almost certainly be pain deferred rather than pain avoided, with a recession overwhelmingly likely in the coming 12 months

- The US, with a larger stock of excess savings and resilient to European natural gas prices, is the DM economy best placed to avoid recession

- Risk assets have performed poorly, and we maintain our underweight position due to recession risks which could reduce earnings

- We continue to look for signs of a Fed pivot, however, which could boost sentiment and liquidity in the US, perhaps aiding risk assets in the second half of the year

[Please click below to read the full note.]