A sideways look at economics

Macro is back. I cannot remember a time when people I have worked with have collectively nailed so many calls in such a short period of time. Risks we flagged throughout 2021 — about inflation, higher food and commodity prices, geopolitical tensions, market downside and policy risks in the US, UK and China —have all come to pass, often within tiny margins of error.

It’s good to have a positive story to tell. Too often economists are treated either as Cassandras or punch bags: ignored and forgotten when we are right, derided and blamed for the world’s ills when we are wrong. ‘One-handed economists’[1] like us at Fathom are a rare breed: we get paid to stick our necks out so others don’t need to, taking the rap when we’re wrong and making the true fence-sitters look good when we are right.

But let’s put aside the agency problems of economists, and instead consider the general idea that being right is actually easy. You put in the hours, look into every corner, listen to other opinions, weigh up the probabilities, take a final stance and you have a decent chance of being right. When it turns out so, it’s super-gratifying. The hard bit is dealing with being wrong after going through the effort of trying to be right.

This problem is commonly referred to as the ‘sunk cost fallacy’ – when we find it hard to let go of a situation we have invested time and effort in. Classic economic theory says that it should not exist. We should turn the page quickly: let bygones be bygones, and make future decisions on the basis of future expected outcomes alone. Unfortunately, this ideal behaviour is clearly at odds with reality.

Evidence of the sunk cost fallacy at work is literally everywhere we look. Take President Putin — a prime example of someone struggling with cutting his losses. He took a net decision on a set of information which turned out to be too optimistic and plainly wrong. He doesn’t seem inclined to let bygones be bygones, instead doubling down on his original mistake and digging himself deeper into the Ukrainian mud. Take another example – President Xi and his insistence on a draconian zero-COVID policy across China. It seems that tyrants are as susceptible as the rest of us to the sunk cost fallacy, and it’s only the size of their egos that sets them apart.

Or take the world of asset allocation. If my Twitter feed is anything to go by, many crypto investors are licking their wounds after crashing back to earth in the Luna debacle. And yet the same people seem unwilling to reassess their quasi-fanatical beliefs about the crypto outlook, even in the face of broadening trouble (e.g., will Tether be next?).

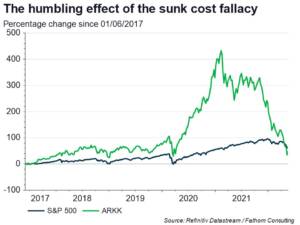

In financial markets, the best traders and forecasters are not necessarily those with the highest success rate, but those with well-calibrated forecasting probabilities and a clear entry and exit game plan. Most investors, however, stick with wins for too long and then don’t sell quick enough. This behaviour has inspired many folkloristic expressions, such as ‘catching a falling knife’, a ‘dead cat bounce’, a ‘whipsaw’, a ‘widow-maker’, a ‘sucker rally’, ‘fool’s gold’ and a ‘one trick pony’. The same bias often leads to investors going from heroes to zeros in a short period of time. Just ask Cathie Wood of ARK Invest, John Paulson and Bill Gross, to name but a few.

This interesting paper proposes that investors avoid realising losses because they dislike admitting, for example, that past purchases were a mistake. However, the authors also suggest that investors who buy mutual funds can avoid this psychological cost by blaming the fund manager instead. In other words, people like Wood may earn their keep not only from their investment skills but also as a whipping boy, taking risks others are unwilling to take and then shouldering the blame. I’d certainly add economists to the list of people providing this extra service.

The most cursory glance at academic journals suggests that the sunk cost fallacy pervades every area of life. Coleman (2009) showed that the more effort a person put into organising an online date, the more likely they were to go through with it — even when offered the chance to switch to a superior date. Rego et al. (2018) showed that people are more willing to stay in an unhappy marriage if they feel considerable money and effort have been invested in it.

What can we do about it? One academic study suggests the answer may be ‘not much’ – the sunk cost fallacy seems to be a very basic instinct hard-wired not just in humans, but in rats and mice too. The authors propose that it arises through two separate processing mechanisms. One uses very recent past experiences (e.g., the amount of effort put into organising an online date) as a simple rule of thumb to decide the merit of sticking to a course of action. The other mechanism builds on a more extended knowledge of past experiences to simulate future outcomes (e.g., choosing to go ahead with the original date or a new superior one).

I mentioned at the start that macro is back. I hope to convince you that it never really goes away. This dual mechanism sounds a lot like the process of habit formation theorised in some macroeconomic models.[2] In these models, the presence of habits makes people act as if they are more risk averse and change course more slowly when confronted with a shock. Drawing a direct parallel between habits and the sunk cost fallacy provides another example of how insights from macroeconomic theory stretch across different social sciences with real-life applications. For example, without macroeconomic insights, we might conclude that the sunk cost fallacy is so hardwired that it might be unavoidable. Yet macroeconomics offers some ideas on how we could at least try to mitigate its impact, and improve our lives.

Getting into the habit of not falling into habits is one such idea. Mixing things up, regularly jolting the usual routines, ought to at least alert us to the worst pitfalls of the sunk cost fallacy. We should think of life as a financial option. Macroeconomic and financial theory teaches us that the value of any option increases with higher volatility. Avoiding falling into too many habits, while increasing our opportunities and risks, should guarantee a richer and more rewarding life — almost irrespective of whether we are ultimately right or wrong.

More from this author:

Ground control to Major Fathom

Eye to I

Dear Aunty Fathom, please can you help?

[1] For the uninitiated, President Truman was credited with saying: “Give me a one-handed economist! All my economists say on the one hand this and on the other hand that”

[2] For the hardcore, unrepentant macroeconomists among you who want to brush up on the theory, habit formation arises from non-separable preferences in the utility function. Check out these slides to know more and gorge on those beautiful Greek letters