A sideways look at economics

England reached the final of a major football tournament for the first time in 55 years on Wednesday night. Standing in the way of bringing it home on Sunday are the Italians, who have seen and done it all before. An England win would be epic and fun (if you are English, and not Italian like my colleague Andrea Zazzarelli), but could it have any more measurable economic benefits? Some of these, such as inspiring young people to take up exercise, are hard to measure and the results are likely to be felt over years. However, there may be short-term economic benefits such as higher sales of beer, football memorabilia and other things, resulting from a general feelgood factor and boost to consumer confidence.

The literature on the economic benefits of sporting success appears to be surprisingly thin and I did not find any studies pointing to hard evidence of changes to sales or economic activity. One of the few related studies concluded that sporting success had a positive effect on the workplace, which could boost productivity: most men and women said that their team winning had an impact on their approach to work; 47% of women and 40% of men said that sporting success lifted their mood and made them more productive; just 3% said that it was distracting and made them less productive; a fifth of men said it increases their motivation at work compared to 12% of women.[1] This sounds positive, but let’s be honest, if you are English and England win, how productive is your day going to be on Monday?

There have been a number of news articles and reports in recent days discussing the possible economic boost of a Euro 2020 victory (yes, its Euro 2020 even though its being played in 2021). Deutsche Bank reckon that England’s run to the final will bring an additional £90m to the economy – but that’s not necessarily winning it and a £90m boost to an economy of more than £2 trillion isn’t very much in the grand scheme of things.[2] The BBC quotes Chancellor Rishi Sunak who expects to see a “bounce” in consumer confidence after the tournament, along with pub and shop managers who are expecting a boost in sales.[3] Ian King of Sky News is less optimistic, however, noting that a lot of spending (such as on new TVs or sofas) is done before a tournament, and that buying feelgood memorabilia replaces spending on other items.[4]

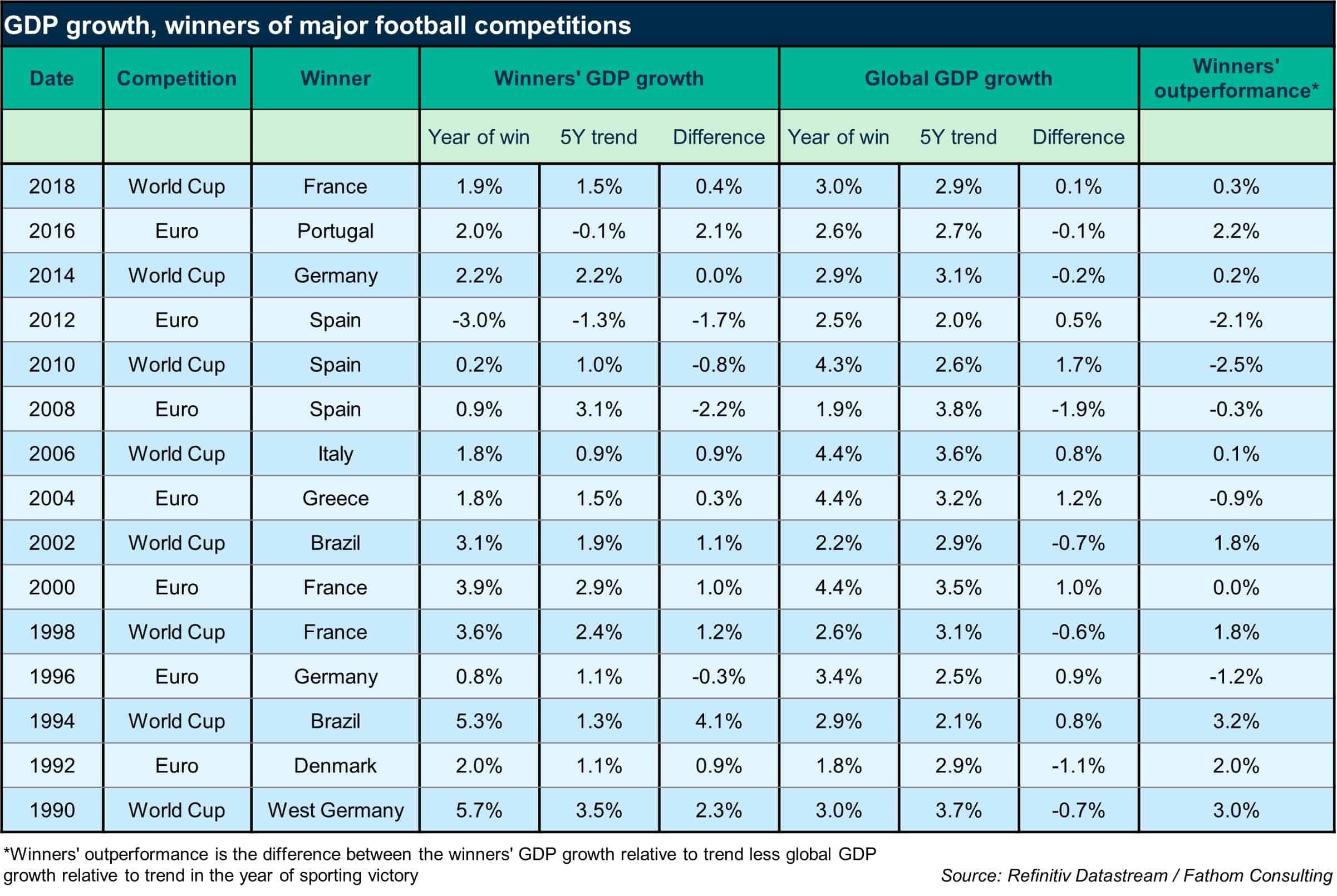

With this limited evidence, and a range of different views, I thought I might look at the data myself to see what I could find. To do this and thanks to the help of my colleague George, we have identified the winning nation in each of the football World Cups and European Championships since 1990 and checked how the economy of the winning nation fared in the year of victory. It would be great to have a longer series of observations and indeed to have a series of quarterly observations, although some data collection challenges proved prohibitive. (At least for a Friday blog post – for a longer, commissioned study we would find a way!) Nevertheless, the annual data reveal some interesting, albeit not fully conclusive results.

A couple of adjustments were necessary: first, to compare the winners’ GDP growth in the year of winning to trend; and second, to strip out any global cyclical factors which might explain this difference. With these two points in mind, the last column is the key column in the table below, which shows the difference between the winners GDP growth in year of victory relative to that country’s trend less global GDP growth in that year relative to the trend in global GDP; a positive number means that the victors’ GDP growth relative to trend in the year of victory was greater than the same thing at the global level. A large number of strongly positive numbers in that column would support the hypothesis that football victories boost GDP growth.

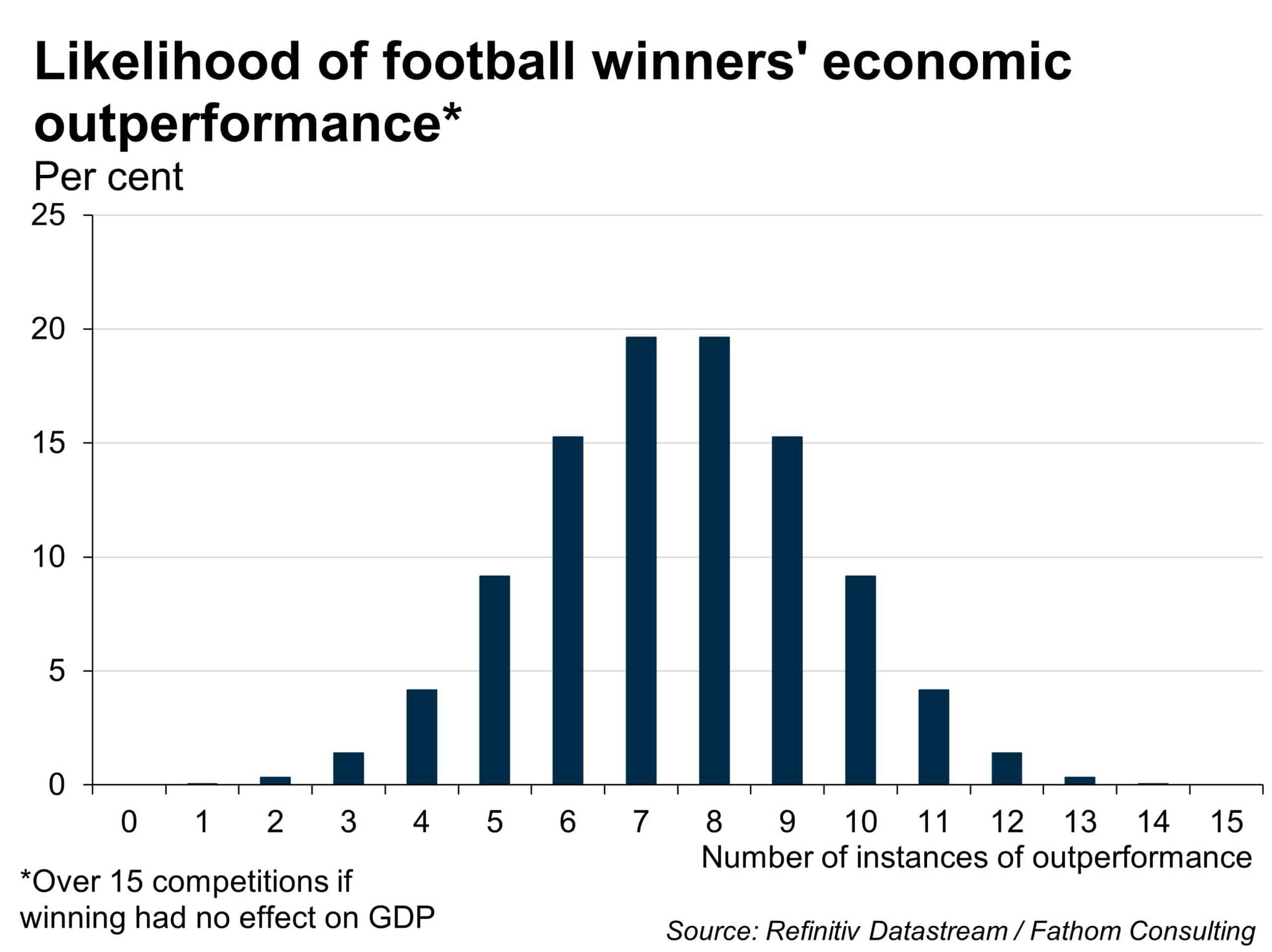

The fact that the winners’ GDP growth in years of victory relative to trend was higher than that of global GDP growth on 10 out of 15 occasions is suggestive that football success might have an effect; if it didn’t have any effect then it would be fair to expect this number to be positive just 50% of the time. If you flipped a coin 15 times, the probability of ten or more heads would be just 15% according to Omni Calculator.[5]

But this is not conclusive evidence that football victories boost GDP, for a few reasons. One is the small sample size. Another is that the magnitudes of outperformance have been dropped and the numbers binarised, resulting in lost information. One way we might get around this is to do a t-test, where the null hypothesis is that sporting success doesn’t have a positive effect, and in which we compare the average outperformance of years of footballing victory to the average outperformance of the average country in any given year and adjust this by the standard deviation of this outperformance. To reject the null we would need to a t-stat of close to two, but in fact it is just 0.3, meaning that we cannot reject the null hypothesis that footballing wins do not have an effect on GDP. In fact, it isn’t even close. That is not to say that it doesn’t, but that we just do not have enough clear evidence from these data that they do.

Also, many things will affect a country’s growth in any given year other than football, even once global trends have been stripped out. For example, Portugal’s economy grew by 2.0% in 2016, the year they won the Euros, which was much higher than Portugal’s five-year moving average (while global growth in that year was 0.1% below its five-year average), resulting in an outperformance vis-à-vis the global economy of 2.2%. But such large outperformance was due to a broader European recovery after several years of economic problems. By contrast, the Spanish economy underperformed the global economy in 2008, 2010 and 2012 for Spain-specific and non-football-related reasons. The football win might have had a positive effect, but it wasn’t enough to offset the other factors that pushed GDP growth down. A comprehensive and robust study would control for these factors in some way (although this would be difficult and this is a blog, not a comprehensive or robust study).

If anything, the challenges described here show that there are a variety of ways to treat data and to look at statistics and methods to analyse things, in order to address the questions at hand. It also highlights the issues that economists face, especially when we are constrained by limited observations and data spread out over long periods, and when we are trying to explain the effect on something as complex as GDP. It is worth remembering that while GDP is considered to be a measure of welfare and utility, it isn’t a perfect measure of such things. Winning the Euros would almost certainly add to the average utility of a nation, but looking for this in GDP kind of misses the point.

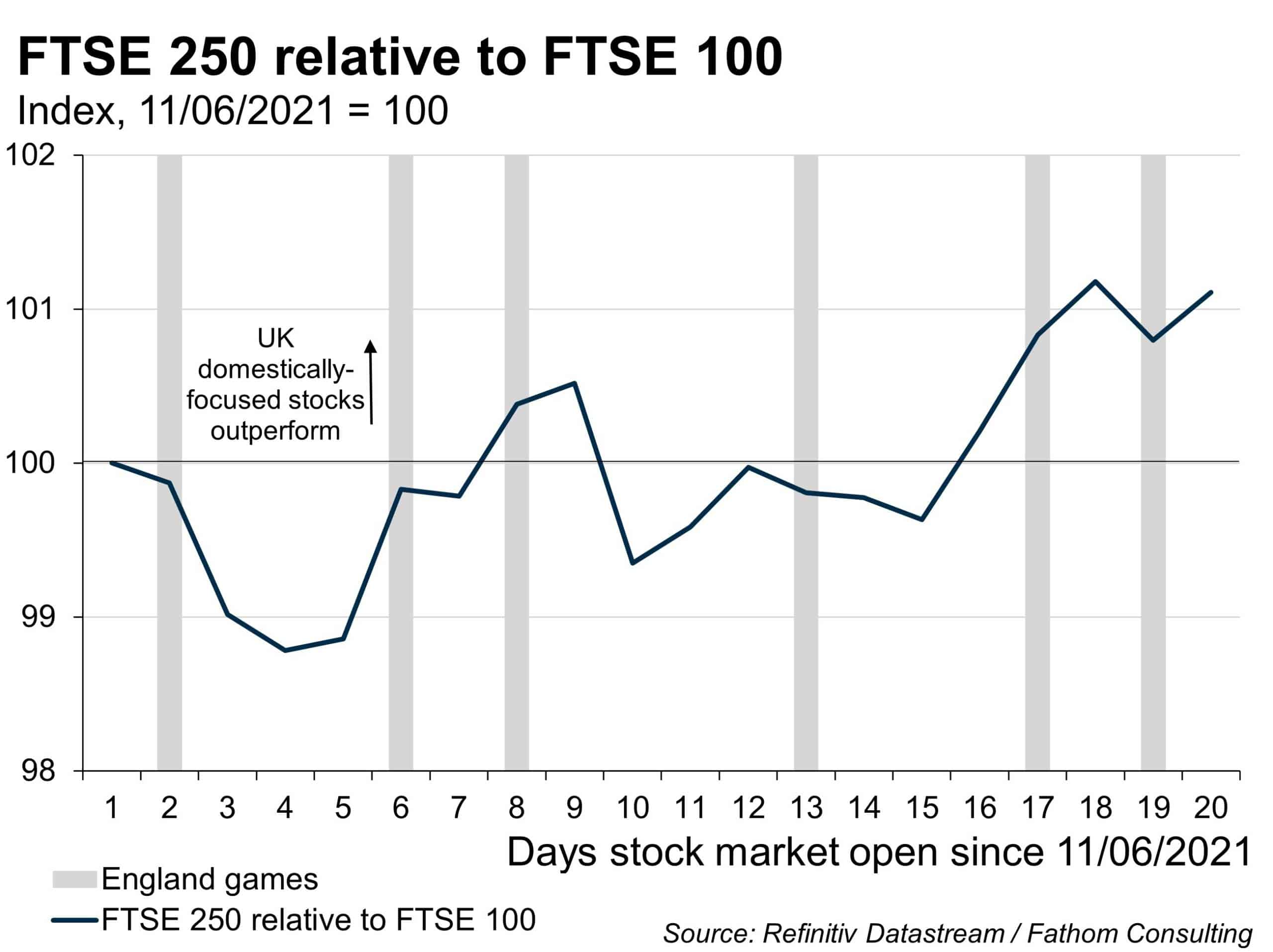

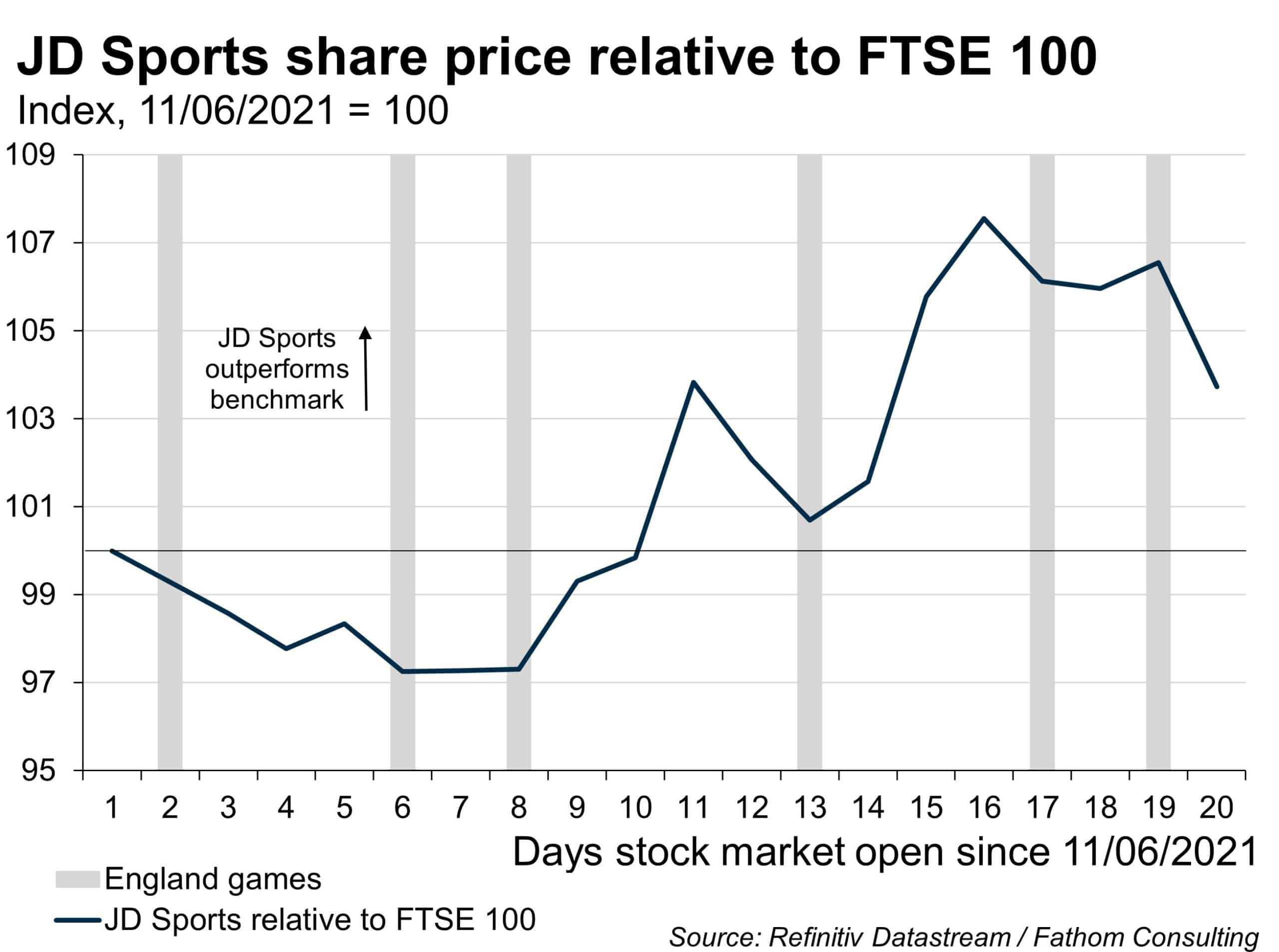

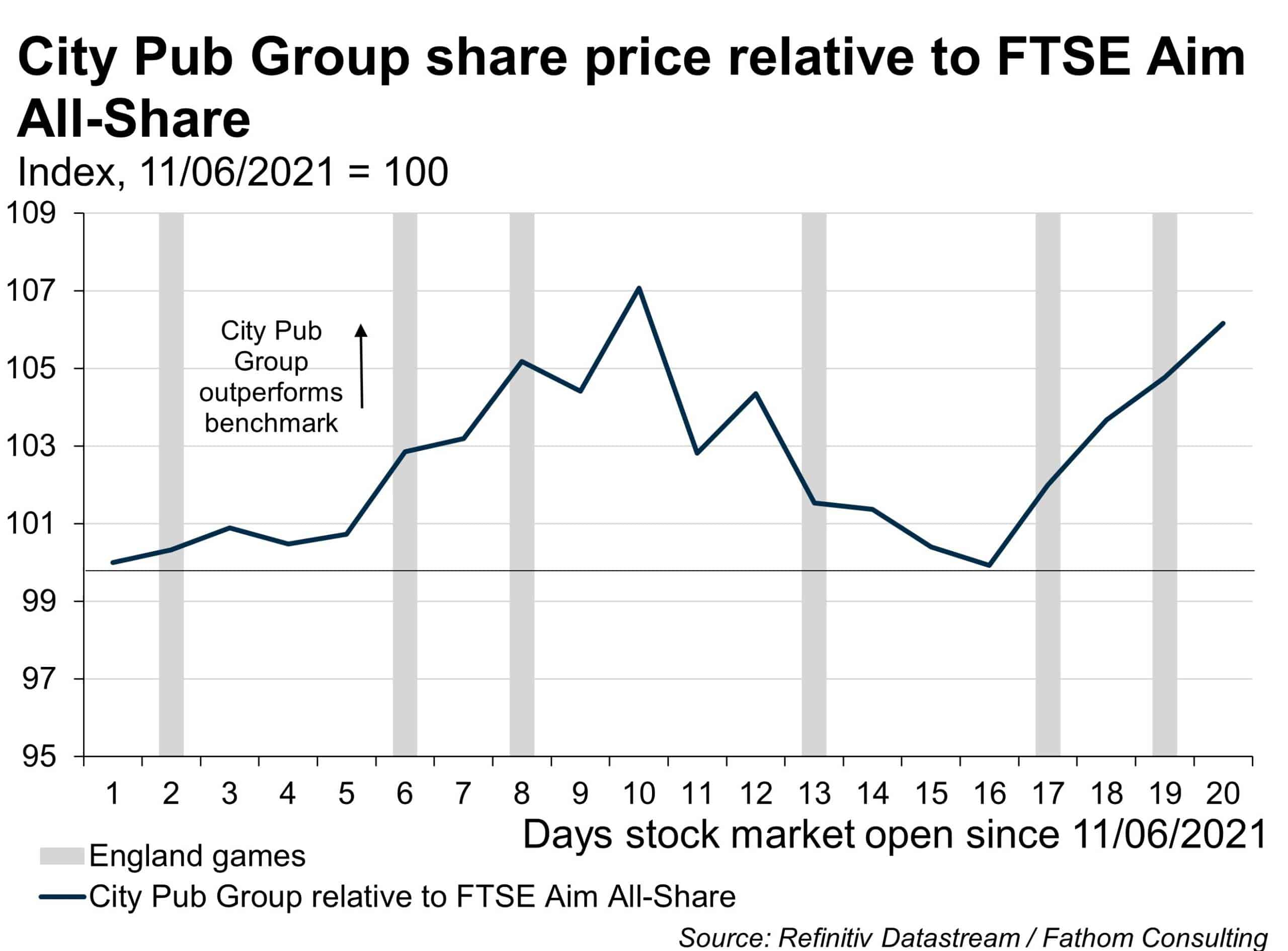

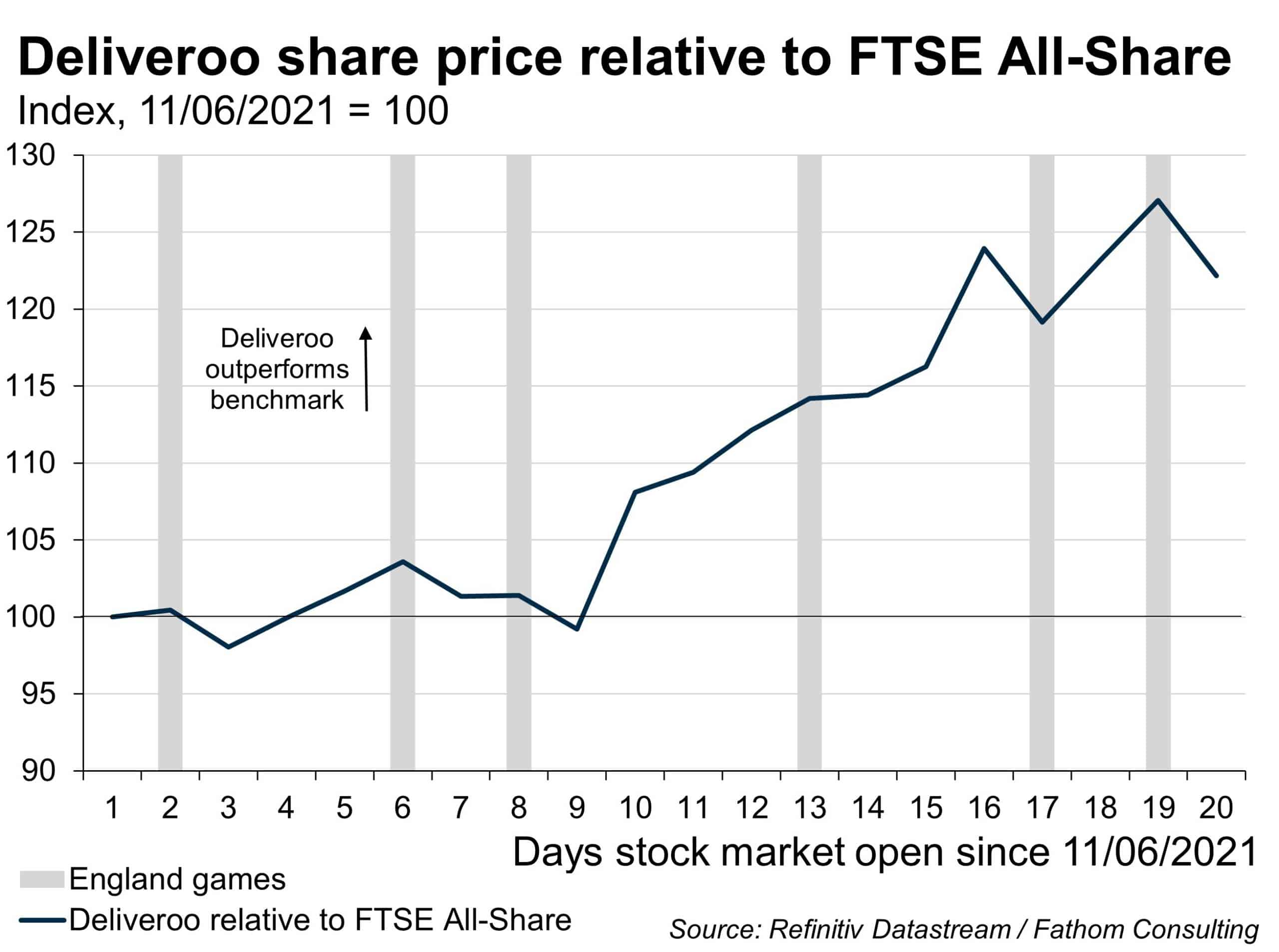

Investors’ expectations about the extent to which an England win might boost GDP could be reflected in the stock market, but there is little evidence to support that either, with the domestically-focused FTSE 250 only very marginally outperforming the FTSE 100 since the tournament began. It is hard to identify particular stocks that might benefit from an England win: beer consumption might be a little higher if England score and more beer is thrown into the air, but presumably people will drink just as much on Sunday even if England lose. We may have identified a few however: JD Sports (a retailer of England shirts and memorabilia) has outperformed slightly since the tournament begun, as has the City Pub Group. Deliveroo has done particularly well, although it is hard to see people continuing to order more takeaways if England win once the tournament is over. The bottom line, really: stop worrying about the economy or stock market, and enjoy the game on Sunday!

[1] http://www.sirc.org/publik/sport_and_the_workplace.shtml

[2] https://uk.news.yahoo.com/uefa-euro-2020-england-denmark-three-lions-final-italy-deutsche-bank-rishi-sunak-uk-economy-wembley-101319443.html?guccounter=1

[3] https://www.bbc.co.uk/news/business-57746627

[4] https://news.sky.com/story/euro-2020-why-talk-of-economic-benefits-from-englands-euro-2020-run-is-wide-of-the-post-12351626

[5] https://www.omnicalculator.com/statistics/coin-flip-probability