A sideways look at economics

Is this the future of art: a twelve-frame animation of a smiling cat, with a biscuit for a body, leaving behind a rainbow as it flies through space?

Well, some people think it is. In February of this year, a digital rendition of the ‘Nyan Cat’ meme sold for almost $600,000. This may come as a surprise, but it’s far from a one-off. In fact, last month, the renowned auction house Christie’s made history selling its first digital artwork, a collage created by artist Beeple, for a groundbreaking $69 million. It’s important to note, however, that some speculate the price was pushed artificially high by those who might benefit from such an eye-watering precedent. If $69 million is the reference point, then paying $1 million for a similar piece is a bargain… right? Regardless, in both of these cases, no physical asset has been exchanged and identical copies of them are still freely available to view across the internet. So why are buyers now flocking to these products, which seemingly lack any scarcity or the ability to claim ownership?

Well, the answer is, thanks to blockchain. This market has only been made possible in recent years because of the applications of that technology, with the first product of this kind appearing in 2017. By requiring transactions to be verified and logged through its global network, blockchain creates the opportunity to prove ownership and authenticity of any asset, whether or not it is a physical one. Hence, what is actually changing hands in these deals is a sort of digital certificate (or token) of ownership in the form of a cryptocurrency called a Non-Fungible Token (NFT).

Fungible assets are those which can be exchanged easily, like swapping five £1 coins for a £5 note. For non-fungible assets this isn’t possible due to their unique properties, such as original art and real estate. In the same way, unlike other cryptocurrencies which are homogenous, NFTs can vary in value depending on the properties of the asset they are tied to, and, through the assignment of ownership, can create scarcity for products which, without it, are practically free.

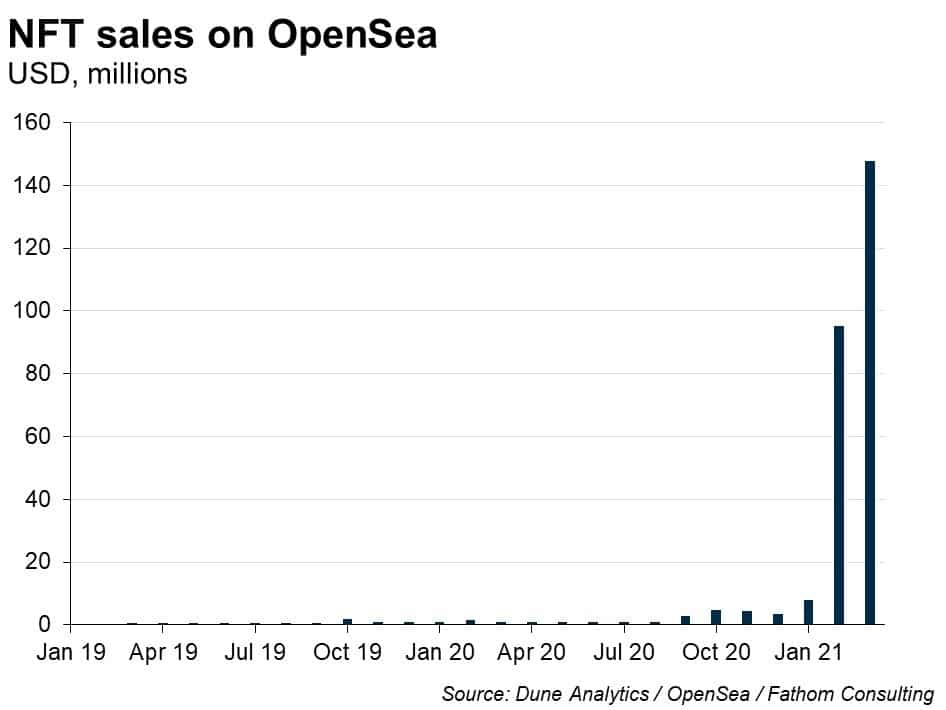

The NFT market has seen explosive growth this year. Sales on OpenSea, which claims to be the biggest NFT trading platform, totalled almost $150 million in March, a jump of over 1700% since January. With big brands starting to get into the market, the range of digital products being sold using NFTs has also been accelerating. The National Basketball Association, for example, has launched a huge marketplace for its users (350,000 at present) to buy and sell millions of ‘collectable’ short video clips from its matches, like virtual trading cards. A 13-second clip of Lebron James dunking, which you can freely view on the site, was on offer, at the time of writing, for a quarter of a million dollars. Probably a rather humbling moment for other players whose clips are going for just $5.

If you think 1700% growth in two months sounds like a bubble, you’re probably not wrong. In fact, Beeple, the artist whose digital art recently sold for $69 million at Christie’s, would agree with you, saying “If it’s not a bubble now, I do believe it probably will be a bubble at some point”. The hype around NFTs has been similar to that experienced by Bitcoin in 2017, before its 65% price crash (or ‘market correction’ depending on who you ask). However, when or if the NFT bubble pops in the coming months, this type of asset does seem to have a long-term future. As I mentioned earlier, the value of an NFT is dependent on the value of the asset it represents, and the value of that asset is in the eye of the beholder. To some, Bitcoin is worthless, but for others (not just money launderers or black market sellers) it has value. Value which has continued to keep it going despite the ‘Great crypto crash’ in 2018. And so, by that logic, just as you might argue ‘Nyan Cat’ is not worth $600,000, I could argue that the picture below, ‘Salvator Mundi’, is not worth the $450 million it sold for in 2017.

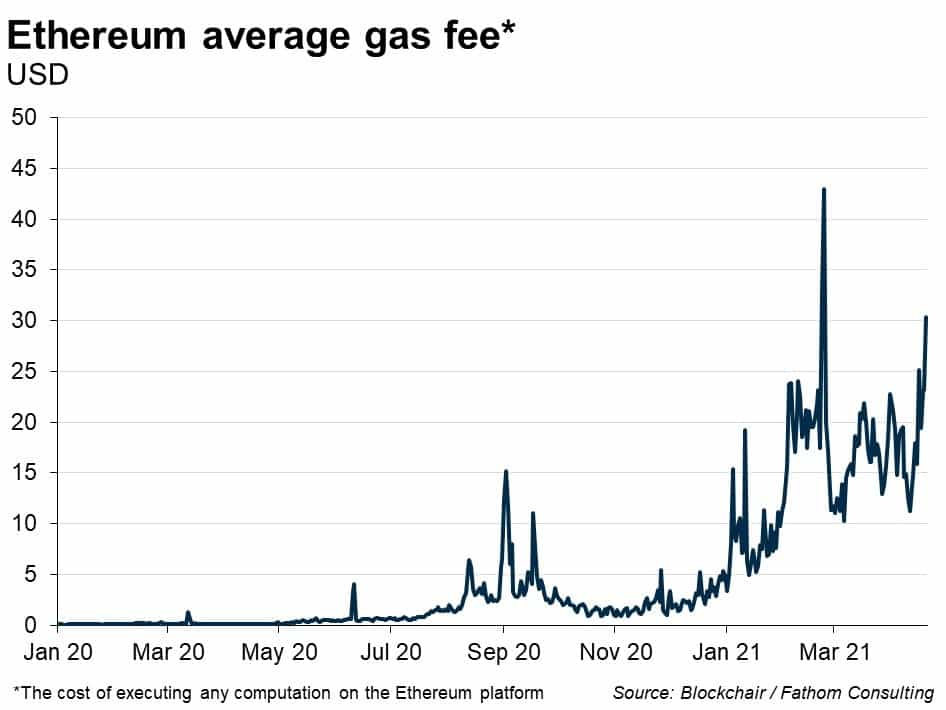

Aside from fears of a bubble, one of the main issues currently facing the NFT market is something called the ‘gas fee’. To run specific operations, such as a transaction, on the Ethereum network (by far the most widely used blockchain for the NFT market), a certain amount of computational power is required to verify and log the action. The cost of using this power is known as the gas fee and it fluctuates throughout the day depending on the demand and supply of computing power on the network at that time. As the popularity of NFTs, and Ethereum as a whole, has grown so has the gas fee. Being relatively complex transactions, the gas fee of transferring NFTs is higher than the average Ethereum transaction. The sale of ‘Nyan Cat’, for example, came with around $80 in gas fees. While in this case this amounted to just a tiny fraction of the final sale price, artists selling similar products will face similar fees regardless of the value of their art. A recent sale on OpenSea, for a ‘Geometry Elon Musk’, went for $2.29, a little underwhelming for the self-proclaimed ‘Techno king of Tesla’. The $118 gas fee for the transaction, however, was not so underwhelming. This disparity is locking many creators out of a marketplace that was designed to give its users more freedom.

A rising gas fee is also reflective of other concerns. As the computing power to maintain the blockchain systems increases so too do their energy requirements. Digiconomist, which provides economic analysis of digital trends, estimates the current annualised energy consumption of Ethereum alone to be greater than the entire country of Bulgaria, with the average carbon footprint of a single transaction being equivalent to watching over 6000 hours of content on YouTube. Close to my weekly average while ‘working’ from home. (Erik, if you’re reading this, this is a joke!) With a growing focus on the impact we have on the environment, blockchain needs to be made much more efficient if its applications are to have global use in the future.

However, this is still a young technology and one that is constantly being improved and developed. Ethereum’s creators even admit the current energy requirements are excessive and development on a much more sustainable version, Ethereum 2.0, has already begun. The increased demand for these services acts as an incentive for it to refine and scale its network. Whether or not you believe cryptocurrencies like Bitcoin will stand the test of time, blockchain technology will. NFTs are just one of many examples of how its application can revolutionise our society and many more ways are yet to come.

Right… That’s the pitch done. Anyone interested in buying some top-quality GIFs? Preferably before the ‘market correction’…