A sideways look at economics

Economists like to compare things — UK GDP was 2.2% lower in the first quarter of this year compared to the fourth quarter of last year.

Normal humans like to compare things too — Sally and Tom had a cat, which was fluffier than other cats

A good, helpful, economist will put things into a little more context. For example, knowing that the Q1 print was the largest quarterly contraction since 1979 Q3, provides a little more colour. It’s also relevant that the although the UK’s coronavirus lockdown began in Q1, it was only officially in place for the last week of the quarter. The UK’s Q1 print wasn’t as bad it was in some other places, such as China where the lockdown happened earlier (and GDP contracted by 9.8% QoQ), but the contraction in UK GDP in Q2 will be far greater given that most of the country was locked down for the whole period.

This is still not earth-moving economic analysis, but putting the initial point into a little more perspective makes the information more relevant and interesting.

Equally, the gossip gets better when the juicy details and full context are included:

Sally and Tom really loved that cat, in part due to its fluffiness, but it had some kind of stomach disorder and would repeatedly urinate around the house; they spent thousands of pounds trying to get to the bottom of the problem, including sending it to a cat psychologist, but nothing worked. So they ended up giving the cat away and decided not to have kids.

Putting things into the most relevant context possible is a key skill for a good economist or gossiper. But even the best economists and gossipers still suffer from biases and fears, which affect the way they think about things, analyse things, make decisions and tell stories. Indeed, behavioural economists have shown that we let biases and fears cloud our judgement. Expressed more formally, we frequently engage in non-rational decision-making processes. And the boffs have dissected these biases into different types: framing bias, status quo bias, loss aversion, endowment bias and FOMO.

Interestingly, for many years economists assumed that humans are, on aggregate, rational decision makers. And theories were derived, and policies were set, based on that assumption, which turned out not to be true. We aren’t perfect, and nor should we be, but it’s helpful to keep these things in mind, especially when setting policy and especially in these unusual times. It’s also helpful to realise that policymakers themselves are guilty of these biases, which often means that changes aren’t identified as quickly as they could be, and adaptation is slower than it ought to be.

The issue of framing bias has been illustrated by the Nobel Prize-winning economist Daniel Kahneman and his colleague Amos Tversky, who asked people to make a hypothetical choice and found that the answer varied massively depending on how the question was framed.[1]

A similar, related, concept is that of status quo bias, when we make irrational decisions due to our fear of change. It turns out that we prefer what we already know, the way things are, and that we also prefer to lose by not doing something than to lose by doing something. It’s irrational. We stick with what we know, even when we know it’s wrong.

I sometimes suffer from status quo bias when I’m lying on the sofa and don’t want to move. A better, more useful, example is the UK pension system, where Brits suddenly started saving more after the rules were changed (the default was switched so that people would have to opt out of having a pension deducted from their salary every month if they didn’t want to save, rather than no deductions being the default position). People were, and still are, free to do whatever they want under both scenarios, but they choose to save a lot more now that the default position has changed. Basically, the government tapped into our framing and status quo biases to get us save more, without forcing us to do anything. Nicely played government, nicely played.

For more information on the other forms of biases — endowment, loss aversion, prospect theory and FOMO — I refer you to your nearest search engine. The point is that these lessons can be applied to everyday life (not moving that pile of stuff because it’s been there for a long time), investing (not making the change to your portfolio, even after that bad thing has happened) — the list goes on.

One strand of economic theory that I think suffered from the aforementioned biases can be seen in the arguments that were put forward, at least in advanced economies, against fiscal loosening to address major problems (like climate change). To my way of thinking these arguments were based on political ideology or theories that had become part of the status quo but were no longer fully applicable to the situation today. Fears of runaway inflation, interest rate increases and crowding out of private investment, proved to be unfounded following the large US fiscal stimulus package in 2017. The response of investors to the ‘whatever-it-takes’ approach of policymakers to the COVID-19 pandemic also supports this point.

Huge fiscal stimulus packages have been passed, yet bond yields are at record lows. No sign of inflation on the horizon either. Tax increases on the wealthy are likely to come — the rich are even asking for them. (The top rate of US income tax was around 90% for nearly 20 years after World War II — add that to the framing debate.) Emerging markets are doing QE and getting away with it; bond yields are low, their currencies relatively stable. For now, we seem to be in a new world, and many things are not unfolding in the way that we expected. For example, South Africa’s economy has ground to a halt, its credit rating was recently downgraded to junk, its central bank is doing QE, its government is spending tons of cash on COVID relief, it has just received a $4.3bn bailout from the IMF and yet its bond yields are lower now than they were in 2018.

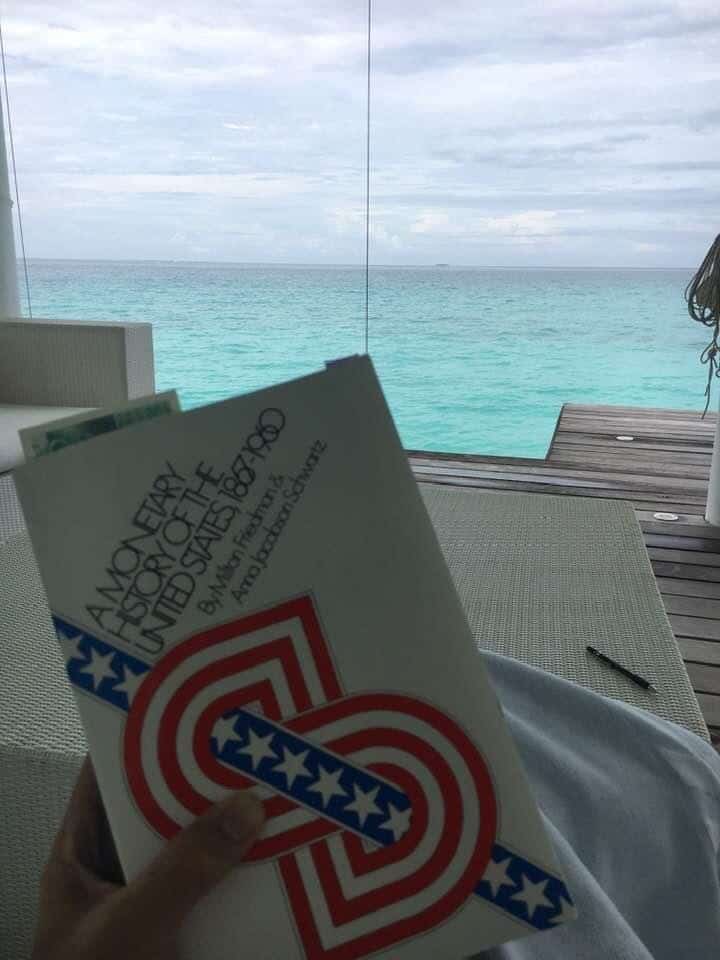

That is not to say that investors aren’t mispricing the risk of default in South Africa. And spending for the sake of it doesn’t make sense, and there are legitimate political and ideological arguments about how much should be allocated to what. Yes, we have yet to see the full consequences of the enormous fiscal and monetary stimulus packages launched in the wake of the pandemic and subsequent lockdowns. There could be some inflation in time, but that would not be the be all or end all —in fact, some inflation might actually be a good thing and policymakers have the tools to rein it in. I’m also not saying throw the baby out with the bathwater — there are still things we can learn from Friedman and some of those lessons are applicable today and have stood the test of time, even if status quo bias is taken out of the equation. (Strangely, I read some of his seminal work when I was in a waterside villa on my honeymoon; even though I wouldn’t describe myself as an orthodox economist. While it may be a very unusual thing to do on a honeymoon, I really enjoyed it.)

Equally, we shouldn’t be bound by beliefs that were established a long time ago just because they were good back then; things change, times change, new information comes to hand. Nor should we let our judgement be clouded by framing things over an inappropriately short time horizon. (Just because we haven’t had inflation for 20 years doesn’t mean that we won’t have any in the next 20 years.)

The signs were there pre-COVID that advanced economies had tools at their disposal to do more to address the problems of the day and that the debate was being clouded due to pre-existing biases and the way things have been framed for so long. The coronavirus response has shown that if the will is there, a way can be found. It’s time to get out of the box, have a look around and think about things. It turns out that some very competent people have already done so and started the debate. We should listen, contribute and deepen those arguments.

[1] The researchers asked respondents to choose between two treatments after 600 people had contracted a fatal disease. Although treatments A and B were the same in both runs of the test, 72% of respondents chose Treatment A when it was framed as saving 200 lives, while just 22% of respondents chose that option when it was framed as 400 people dying. Treatment B had a 33% chance that no one would die and a 66% chance that everybody would die (so the probabilistic outcome was the same).