A sideways look at economics

Every four years US presidential candidates debate the relative merits of the North American Free Trade Agreement (NAFTA) – a trilateral trade bloc between Canada, Mexico and the US. With an eye on key swing states, they usually conclude that domestic job losses can be pinned on multinationals exporting production south of the border, and that the US has been on the losing end of the deal. The main point of contention is whether NAFTA is simply bad or the “worst trade deal maybe ever signed anywhere”. The fact that Mexico has been the main beneficiary is taken as a given.

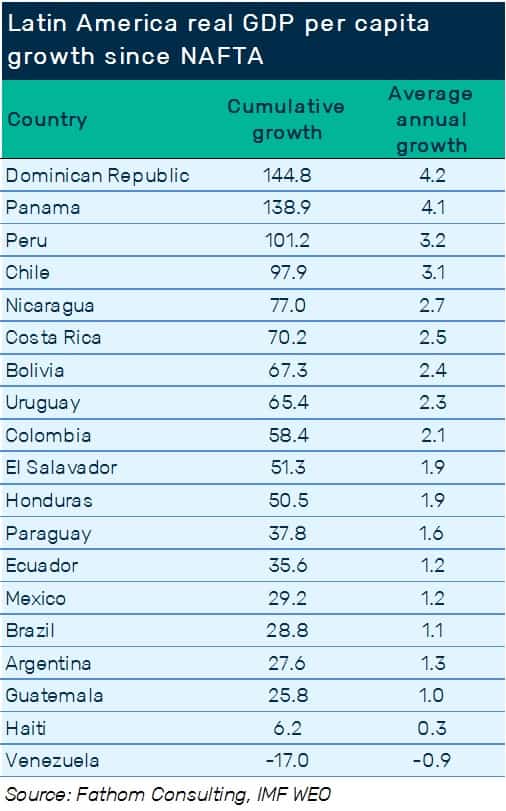

But since 1994, when NAFTA came into force, Mexico’s GDP per capita has increased by just 29.2%. That performance places it 14 out of 19 Latin American economies over that period. Adjusted for the cost of living, Mexico’s GDP per capita, relative to the US, has fallen from 35% to 33%. On other metrics too, developments have not been as positive as may have been expected. Despite some successful maquiladoras, net inflows of Foreign Direct Investment (FDI) into Mexico are unexceptional compared to peers. These totalled 2.9% of GDP in 2015, marking a paltry 0.7 percentage point increase since 1994. Both that level and its absolute change are lower than in regional economies such as Brazil, Chile and Colombia.

What explains Mexico’s relatively mediocre performance despite its proximity and privileged access to the world’s largest economy? It is possible that those headline benefits have acted akin to a ‘resource curse’. This theory states that countries blessed in natural resources will have less incentive to enact meaningful reforms and diversify production. The end result is economic underperformance over a long period. Mexico’s trade links with the US may have discouraged efforts to seek new export markets or move up the value chain.

Today is Cinco de Mayo, perhaps an archetypal US import that has provided uncertain benefits to Mexico. In line with many of Mexico’s exports, it is popular in the US, but garners little attention elsewhere in the world. Recent political developments north of the border have prompted calls for trade diversification, including fast-track talks on an EU-Mexico free trade agreement. Threats to tear up NAFTA may be just the incentive required for Mexico’s policymakers to focus on spearheading pro-growth reforms. For those on this side of the Atlantic that would like to do their bit to help, this author would recommend a cold Modelo over a frosty Corona. Gracias a Fathom es viernes.