A sideways look at economics

For most of my adult life, my attitude to haircuts has been the following. Get them done as infrequently, as cheaply and as close to home as possible, show the hairdresser a picture of South African cricketer Dale Steyn and say: “Like that, but a little tidier, please. I have an office job.”

Most of the time this strategy has worked out quite well. But as I get older it’s becoming increasingly clear that this laissez faire attitude to haircuts doesn’t really cut it anymore (excuse the pun), especially now that I live and work in Shoreditch, where a haircut costs at least £30 and gets done by a hipster who doesn’t convince me that he knows what he’s doing, but thinks he’s cool because he has a beard, tattoos, and his barber shop has an arcade machine and sells overpriced Hackney-brewed beer. I have reluctantly come to accept that it might be time to take a different approach.

To cut a long story short, this ended up with me standing in a Lithuanian hair salon on New Year’s Eve with my girlfriend’s mum, hairdresser Vitalik and a mobile phone. I can’t understand what is being said (I don’t speak Lithuanian or Russian and they don’t speak English), but I’m getting slightly nervous when I hear Vitalik say Justiin Tiimberlaayke, while staring intently at my head. I mention Dale Steyn, but get no response. I get on the phone to my girlfriend Tatjana who tells me I should relax; Vitalik knows what he’s doing. We hang up and I mention Dale Steyn one more time to no avail.

I’m pleased to report that one hour, two head washes/massages and some immaculate snipping by Vitalik later I’m feeling fantastic. This is the best haircut I’ve had in years. The price: 12 euros.

How can it be that haircuts are so much cheaper, and better, in Lithuania than in Shoreditch? They may be at opposite sides of the European Union, but Shoreditch and Lithuania are still part of the same single market, for now at least. This got me thinking: as an economist I ought to be able to explain why this happens; as a consumer I can benefit from haircut arbitrage; and perhaps there’s a market opportunity too – go long Lithuanian hair salons and short Shoreditch barbers?

Part of the divergence in price must be down to clients of Shoreditch-based barbers associating value to their hairdresser having tattoos and a beard, and being willing to pay for that. They’re also happy to pay a little extra for the arcade machine and to have the option of buying overpriced Hackney-brewed beer should they choose. No such frivolities at Vitalik’s hair salon. The rent in Shoreditch must be a lot higher than in Lithuania, while wages in London are a lot higher too.

As a consequence, the prices of labour-intensive services, like hairdressing, are generally cheaper in Lithuania. The price of goods meanwhile, tends to be more expensive in Lithuania. This is not an entirely unusual situation and the Balassa-Samuelson hypothesis offers an explanation.

A discussion of this hypothesis is beyond the scope of this Friday afternoon blogpost, but the extent that inflation is being kept low by tradable goods in both the UK and Lithuania is of relevance to economists, central bankers and investors alike. Could the price of haircuts shed more light on domestically generated inflationary pressures? And what if central bankers used the price of haircuts as a guide when setting monetary policy?

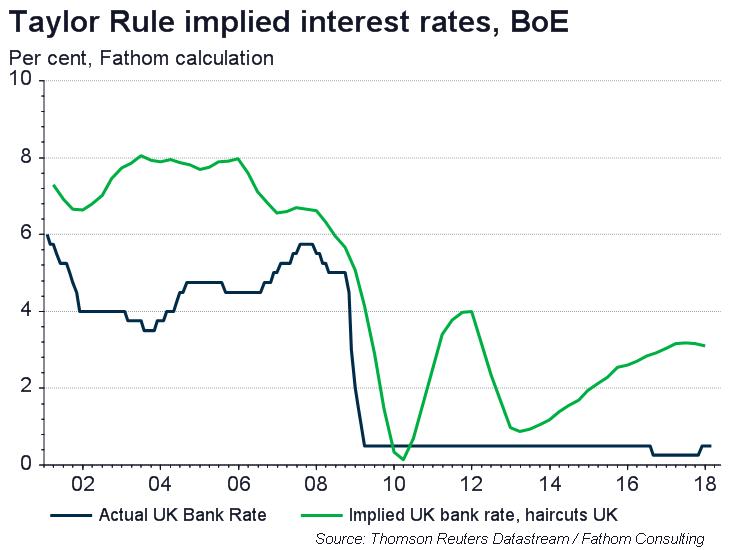

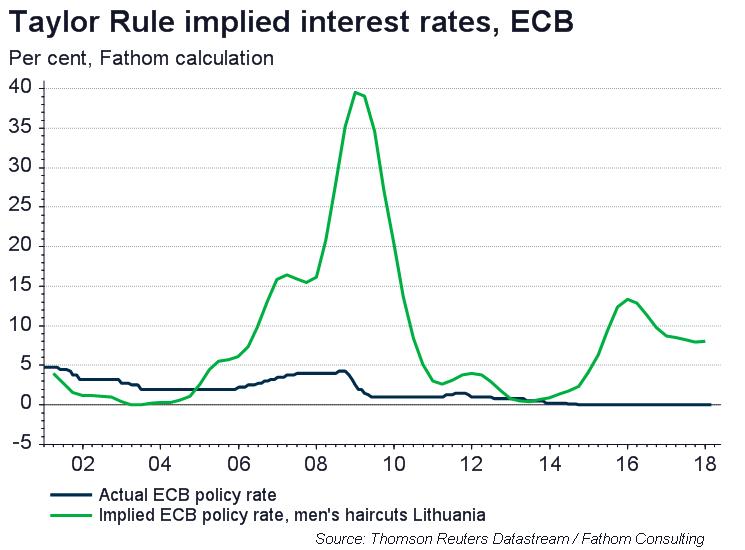

Assuming they did, and the European Central Bank (which sets monetary policy for Lithuania) and the Bank of England targeted a haircut inflation rate of 2 per cent, and set policy based on the Taylor Rule, it emerges that both central banks would be well behind the curve. In the ECB, the Taylor rule-implied policy rate would be 8%, while in the UK, Bank Rate would be 3%.

It turns out that the price of men’s haircuts has risen 21% since Lithuania adopted the euro in January 2015, while the price of haircuts has risen just 6% in the UK over the same period, but haircut inflation is rising.

Of course, the ECB’s monetary policy is unlikely to be set using the price of men’s haircuts in Lithuania anytime soon. After all, men’s haircuts account for just 0.14% of the Lithuanian consumer price basket, and the country itself accounts for less than 0.5% of euro area GDP. Moreover, astute readers will point out that Balassa and Samuelson would argue that services inflation and wages should run hot in Lithuania, until they catch up with the rest of Europe, and that this should be tolerated by the ECB. It’s also true that before Lithuania adopted the euro in 2015, its monetary policy was not set by the ECB. In the UK, meanwhile, Mark Carney and co. are unlikely to be swayed by the price of a haircut in Shoreditch either.

In our upcoming Global Economic and Markets Outlook presentations to clients we won’t be discussing the price of haircuts, but we will be discussing how the outlook for monetary policy in the euro area and UK will be shaped by factors such as globalisation and domestically generated inflationary pressures.